Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

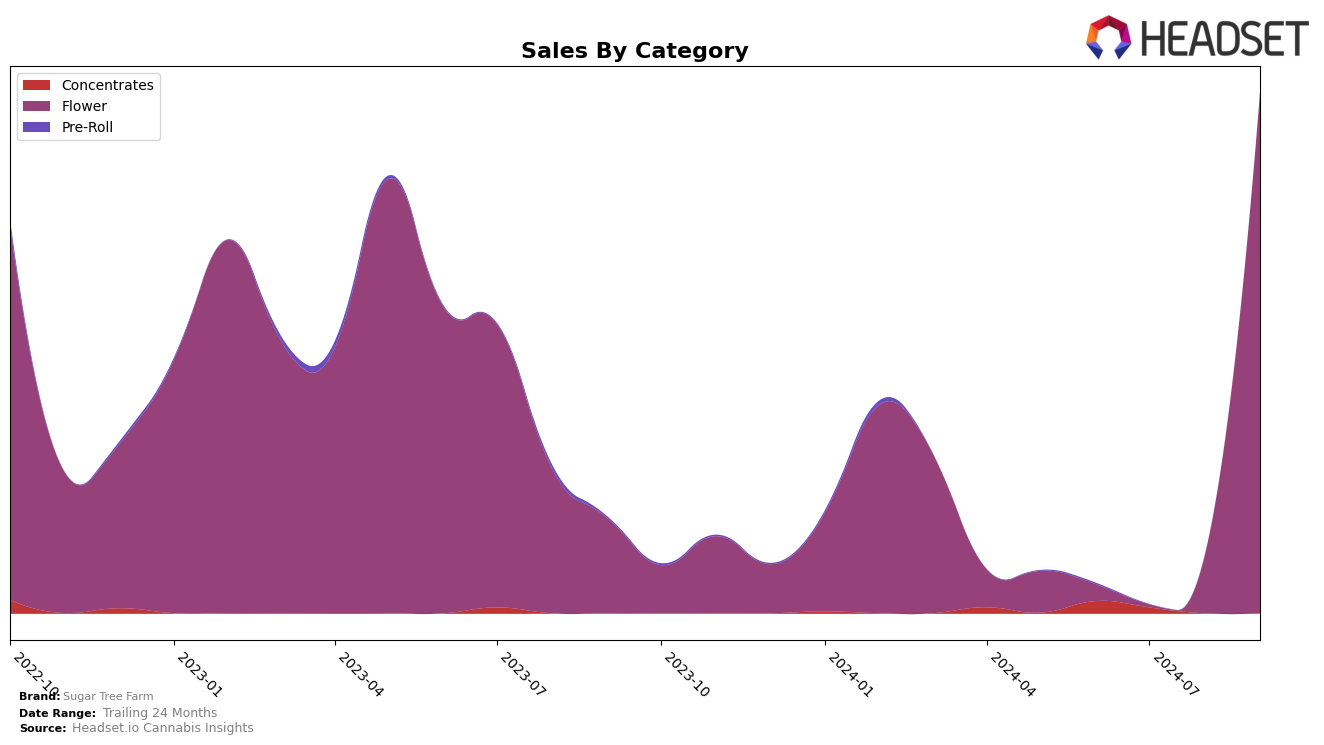

In the state of Oregon, Sugar Tree Farm has shown a notable emergence in the Flower category by securing the 24th rank in September 2024. This marks their first appearance in the top 30 for this category and state, suggesting a positive trend in their market penetration and consumer acceptance. The absence of ranking in the preceding months of June, July, and August indicates that their recent entry into the top ranks is a significant achievement, potentially driven by strategic changes or new product introductions. Such movement highlights Sugar Tree Farm's growing influence in the Oregon cannabis market, especially in the competitive Flower category.

While the exact sales figures for the other months are not disclosed, the available data shows that Sugar Tree Farm's sales in September reached $260,706 in Oregon. This figure provides a glimpse into their market performance, suggesting a strong finish to the third quarter. The lack of ranking in prior months could either point to a prior lack of presence or a rapid recent growth, a topic worthy of further exploration. Understanding the strategies behind their September success could offer insights into their potential future trajectory and competitive positioning within the state's cannabis industry.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Sugar Tree Farm experienced a notable shift in its market position from June to September 2024. Despite not ranking in the top 20 during these months, a comparison with competitors reveals significant insights. PDX Organics showed a fluctuating rank, peaking at 23rd in August, while Excolo made a remarkable leap from 81st in July to 22nd in September, indicating a strong upward trend. Evan's Creek Farms and Lofty also demonstrated competitive resilience, with ranks stabilizing in the mid-20s by September. These dynamics suggest that while Sugar Tree Farm was not in the top 20, the market remains highly competitive with brands like Excolo making significant gains, potentially impacting Sugar Tree Farm's sales trajectory and necessitating strategic adjustments to regain market share.

Notable Products

In September 2024, the top-performing product for Sugar Tree Farm was Gorilla Snacks (3.5g) in the Flower category, achieving the number one rank with sales of 4765 units. Ice Cream Cake (1g) maintained its consistent performance, holding the second position for three consecutive months, with a notable increase in sales to 837 units. Gorilla Snacks (28g) debuted at the third position, showing strong entry into the rankings with 744 units sold. Trinity Mimosa (28g) and Jungle Sunset (28g) followed in fourth and fifth places respectively, marking their first appearance in the top five for the year. This month marked a significant shift in the product rankings, with several new entries taking the lead compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.