Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

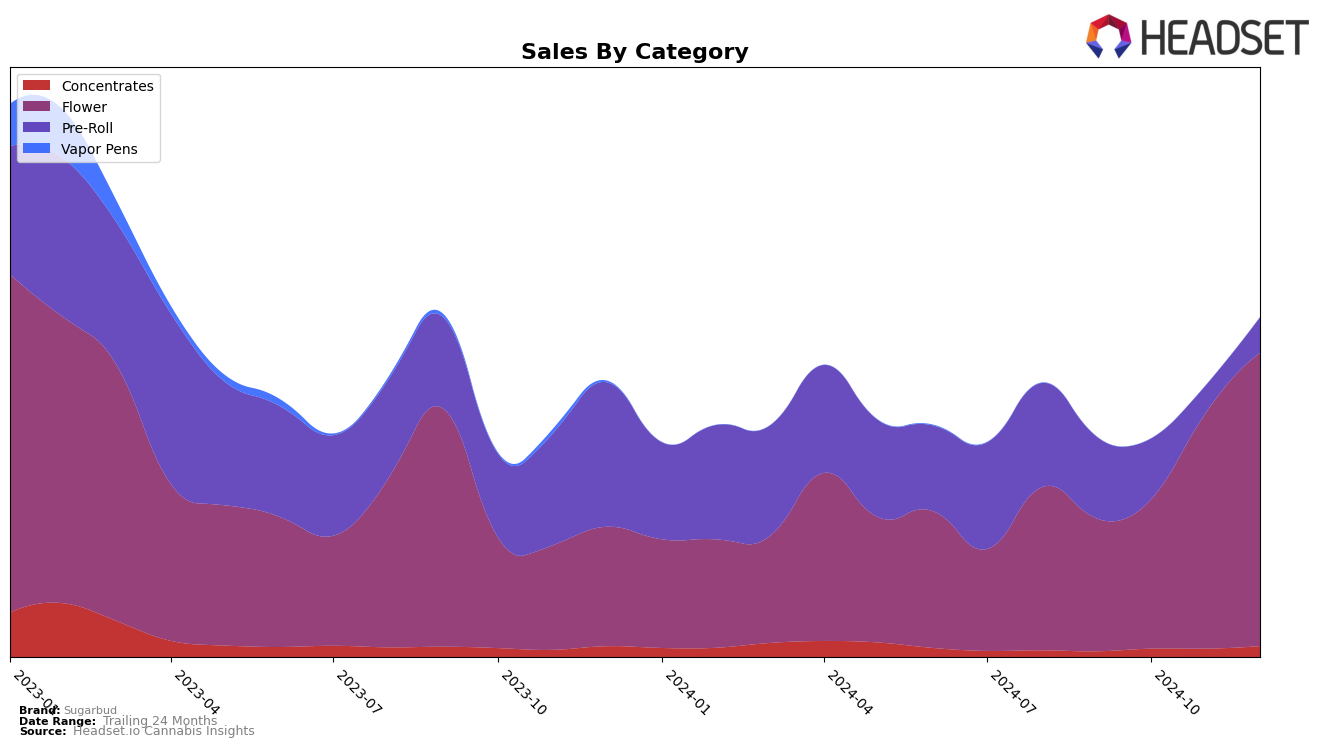

Sugarbud's performance in the Oregon market shows notable trends across different categories. In the Flower category, Sugarbud has demonstrated a significant upward trajectory, starting at rank 77 in September 2024 and climbing to rank 30 by December 2024. This movement into the top 30 indicates a strengthening position in the competitive Flower market, suggesting increased consumer preference or successful marketing strategies. Conversely, in the Pre-Roll category, Sugarbud's rankings have fluctuated, beginning at rank 46 in September, dropping to 80 in November, and then slightly recovering to 65 in December. This volatility could highlight challenges in maintaining a consistent market presence or competition from other brands.

The absence of Sugarbud in the top 30 rankings for multiple months in the Pre-Roll category suggests that they are struggling to capture significant market share in this segment within Oregon. Despite this, the brand's overall sales in the Flower category indicate a strong performance, with a noticeable increase from October to December 2024. This suggests that while there are challenges in certain categories, Sugarbud is successfully leveraging its strengths in others, particularly in the Flower category, which may be a strategic focus for the brand moving forward. The data provides a glimpse into Sugarbud’s positioning and potential areas for growth or improvement in the coming months.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Sugarbud has demonstrated a notable upward trajectory in brand rank over the last few months of 2024. Starting at rank 77 in September, Sugarbud has impressively climbed to rank 30 by December, indicating a significant improvement in market positioning. This upward trend is contrasted with competitors such as Verdant Leaf Farms, which experienced a decline from rank 47 in September to 53 in December, and Excolo, which fluctuated but ended slightly better at rank 29. Meanwhile, Drewby Doobie / Epic Flower showed a similar positive trend, improving from rank 54 to 34. NUGZ FARM - Oregon experienced a volatile ranking, peaking at 18 in November but dropping to 28 in December. Sugarbud's consistent sales growth, reflected in its ascending rank, suggests a strengthening brand presence and potential for continued market share gains in Oregon's competitive flower category.

Notable Products

In December 2024, Sugarbud's top-performing product was Grapehead (Bulk) in the Flower category, maintaining its first-place ranking from November with notable sales of 4,894 units. Lemon Royale (Bulk), also in the Flower category, secured the second position, consistent with its rank from November, showing a strong performance with increased sales figures. Beach Wedding (Bulk) made an impressive entry into the rankings, debuting at third place in December. Diesel Poison (Bulk) held steady in the fourth position, unchanged from November. Animal Face Pre-Roll (0.5g) entered the top five for the first time, ranking fifth in December, indicating a growing interest in pre-roll products from Sugarbud.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.