Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

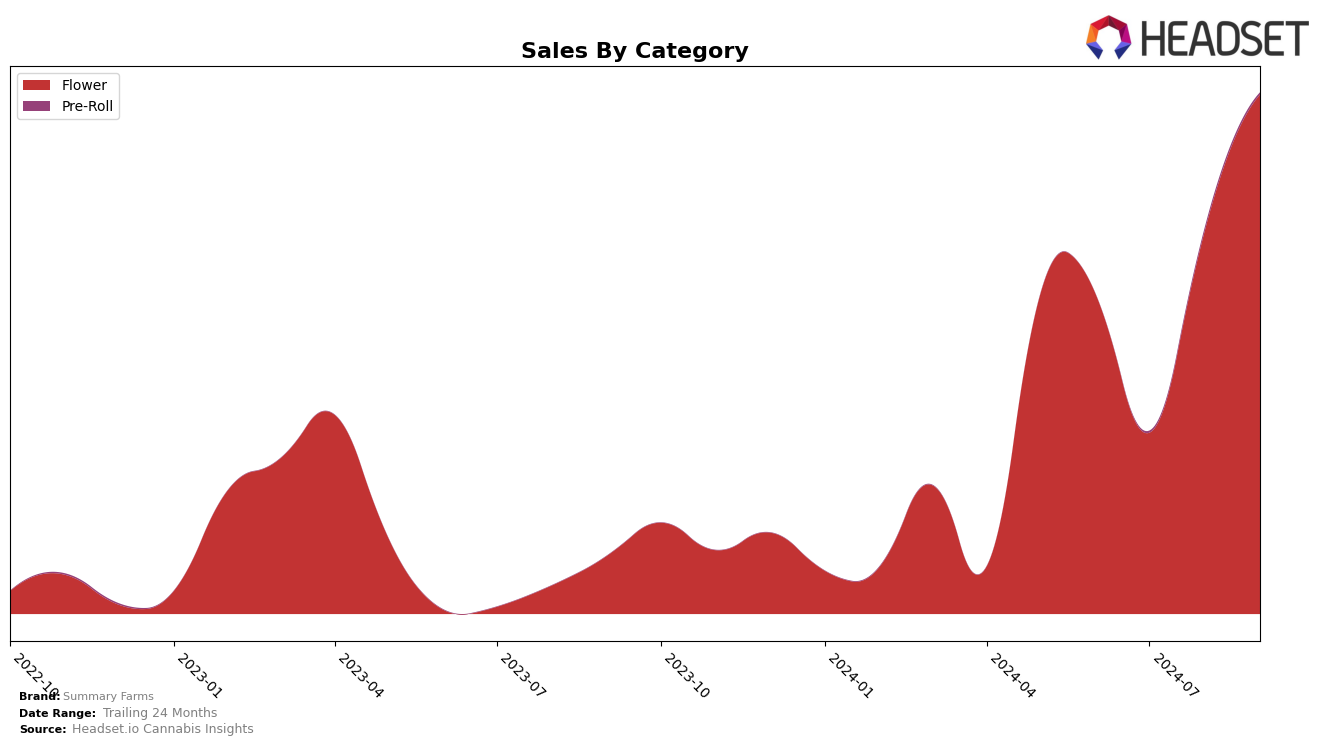

Summary Farms has shown a notable improvement in its performance within the Flower category in Oregon. Starting from June 2024, where they were ranked outside the top 30, the brand made a significant leap to the 18th position by September 2024. This upward trajectory suggests a strong recovery and an effective strategy in capturing market share. The increase in sales from June to September underscores this growth, with September sales reaching a substantial figure. However, the fluctuation in rankings between June and August indicates some volatility, which may be attributed to competitive pressures or seasonal factors in the market.

Interestingly, the brand's absence from the top 30 rankings in June and July could be viewed as a setback or an opportunity for further analysis. This absence highlights the competitive nature of the Flower category in Oregon, where Summary Farms had to navigate challenges to re-establish its presence. The rapid climb back into the rankings by August and further improvement in September could suggest strategic shifts or successful marketing initiatives. While the brand's performance in Oregon is promising, it would be insightful to compare this with their performance in other states or categories to better understand their overall market positioning and potential areas for growth.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Summary Farms has shown a remarkable upward trajectory in recent months. After a challenging start in July 2024, where they fell out of the top 20, Summary Farms made a significant comeback by September, climbing to the 18th position. This resurgence is notable when compared to competitors like Oregon Roots, which maintained a relatively stable presence within the top 20, and Frontier Farms, which also experienced fluctuations but ended September ranked 19th. Meanwhile, TH3 Farms demonstrated a volatile pattern, yet managed to secure the 17th spot by September. The sales trends indicate that Summary Farms' strategic adjustments have effectively boosted their market position, suggesting a promising growth trajectory in the Oregon flower market.

Notable Products

In September 2024, the top-performing product from Summary Farms was Papaya (1g) in the Flower category, which achieved the number one rank with sales amounting to $6,114. Papaya (Bulk) maintained its position at rank two, indicating consistent demand. Apple Fritter (1g) rose to the third position from fourth in August, showing an upward trend in popularity. NYC Piff S2 #3 (1g) entered the top ranks, debuting at fourth place, while Garanimals (1g), which was first in August, dropped to fifth. This shift in rankings highlights a dynamic change in consumer preferences towards Papaya products in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.