Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

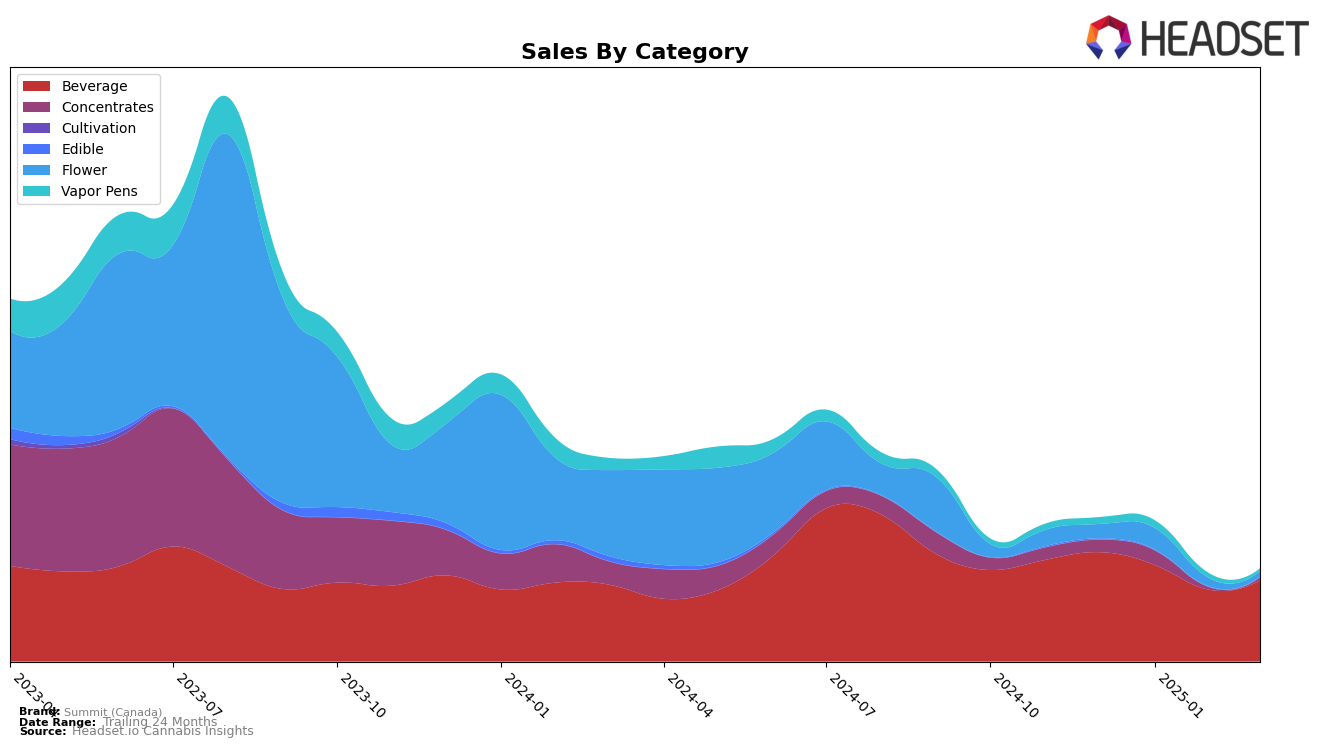

Summit (Canada) has shown a consistent performance in the beverage category across several Canadian provinces. In Alberta, the brand maintained a steady rank of ninth place from December 2024 through March 2025. This consistency suggests a stable market presence and consumer base. However, sales figures did see a dip from December to February, before experiencing a slight rebound in March. In British Columbia, Summit (Canada) experienced a slight drop in ranking from ninth to tenth place in February 2025, maintaining this position into March. Despite this minor decline in rank, the brand's sales saw a modest recovery in March, indicating potential resilience in the market.

In Ontario, Summit (Canada) saw some fluctuations in its beverage category ranking, moving from 21st in December 2024 to 20th in January 2025, before dropping back to 22nd in February and returning to 21st in March. This indicates a competitive market environment with some challenges in maintaining a higher rank. Meanwhile, in the U.S. state of Colorado, Summit (Canada) entered the flower category rankings in January 2025 at 87th place but was not ranked in the top 30 in the subsequent months, suggesting that their presence in this category and market is still developing. The absence from the top 30 in Colorado's flower category underscores the potential challenges Summit faces in expanding its market share in this particular segment.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Summit (Canada) has experienced a slight decline in rank from December 2024 to March 2025, moving from 9th to 10th position. This shift is notable as it coincides with the rise of TeaPot, which has climbed from 15th to 7th place over the same period, indicating a strong upward trajectory in sales. Additionally, Collective Project has maintained a consistent lead over Summit (Canada), holding steady at 8th and 9th positions. Meanwhile, Green Monke has shown significant improvement, moving from 19th to 11th place, suggesting a potential threat if this trend continues. Summit (Canada)'s sales have seen a decrease, which may be contributing to its drop in rank, highlighting the need for strategic adjustments to regain competitive positioning in this dynamic market.

Notable Products

In March 2025, the top-performing product for Summit (Canada) was the Iced Tea Lemonade (10mg THC, 355ml) in the Beverage category, maintaining its first-place ranking from previous months with sales of 6,958 units. Following closely, the Peach Iced Tea (10mg THC, 355ml) also held its consistent second-place position. The Wild Cherry Lime Sparkling Beverage (10mg THC, 355ml) secured the third spot, unchanged from February, while the Rocket Berry Sparkling Drink (10mg THC, 355ml) remained fourth, having previously dropped from third in December 2024. Notably, Trop Cherry (Bulk) in the Flower category sustained its fifth-place ranking since its introduction in February 2025. These rankings reflect a stable performance for Summit (Canada) products, with minor fluctuations observed in the Beverage category over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.