Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

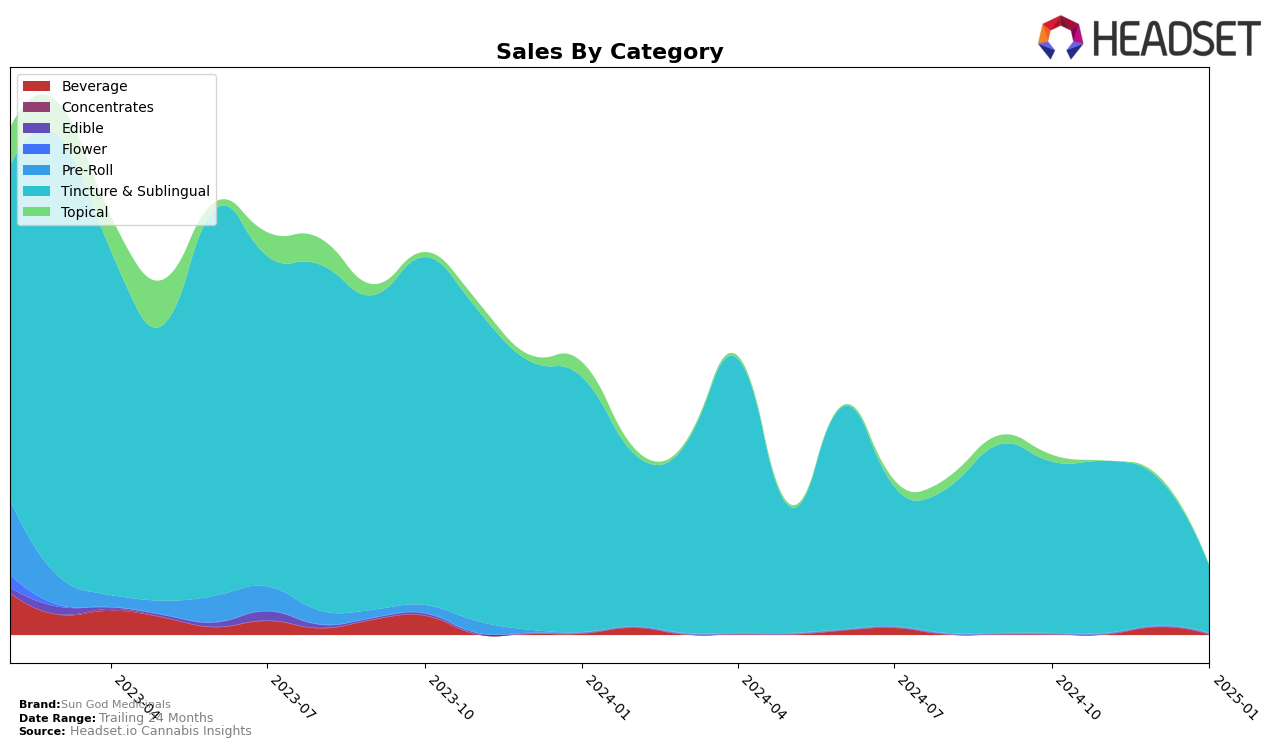

Sun God Medicinals has demonstrated a notable presence in the Tincture & Sublingual category within Oregon. The brand improved its ranking from 14th in October 2024 to 12th in November 2024, indicating a positive trend in consumer reception and market penetration. However, it's worth noting that the brand did not maintain a top 30 position in December 2024 and January 2025, which may suggest challenges in sustaining its momentum or increased competition in the market. The sales figures for October and November show a slight increase, but the absence of rankings in the subsequent months highlights a potential area for strategic focus.

The fluctuations in Sun God Medicinals' performance across the months provide an interesting case study in brand dynamics within the cannabis industry. While the initial upward movement in Oregon was promising, the drop-off in rankings could indicate a need for the brand to reassess its strategies to regain and sustain its market position. This pattern of performance might be reflective of broader market trends or specific brand challenges, offering valuable insights for stakeholders looking to navigate the competitive landscape of cannabis products. Further analysis could delve into factors such as consumer preferences, competitive actions, and market conditions that may have influenced these rankings.

Competitive Landscape

In the Oregon Tincture & Sublingual category, Sun God Medicinals has experienced notable fluctuations in its market position, which could impact its sales trajectory. In October 2024, the brand was ranked 14th, and it improved to 12th in November 2024, maintaining this position through December 2024. However, by January 2025, Sun God Medicinals was no longer in the top 20, indicating a potential decline in market presence. Comparatively, Medicine Farm showed a similar ranking pattern, starting outside the top 20 in October 2024, then climbing to 14th in December 2024, before also dropping out of the top 20 by January 2025. Meanwhile, Dr. Jolly's experienced a more stable performance, beginning at 5th place in October 2024, then gradually declining to 11th by December 2024, and also dropping out of the top 20 by January 2025. This competitive landscape suggests that while Sun God Medicinals initially gained ground, it faces significant challenges in maintaining its position against competitors like Dr. Jolly's, which, despite its decline, still managed higher sales figures in the months observed.

Notable Products

In January 2025, the top product from Sun God Medicinals was Ra Hemp - CBD Green Dragon Tincture (1000mg CBD, 30ml), maintaining its number one rank despite a decrease in sales to 50 units. Ra Cannabis - Sativa MCT Tincture (500mg THC, 1oz) climbed to the second position, with notable sales of 33 units, showing a consistent rise from its previous fifth and third positions in October and November 2024. Ra Hemp - Indica Tincture (500mg THC, 1oz) secured the third spot, experiencing a resurgence in sales from previous months. The Ra cannabis - CBD/THC 1:1 Indica Tincture (300mg CBD, 300mg THC, 30ml, 1oz) dropped to fourth, indicating a decline in its sales momentum. Lastly, the Ra Hemp - CBD/THC/CBG 1:1:1 Green Dragon Tincture (1000mg CBD, 1000mg THC, 1000mg CBG, 30ml, 1oz) held steady at fourth, despite fluctuating sales figures in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.