Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

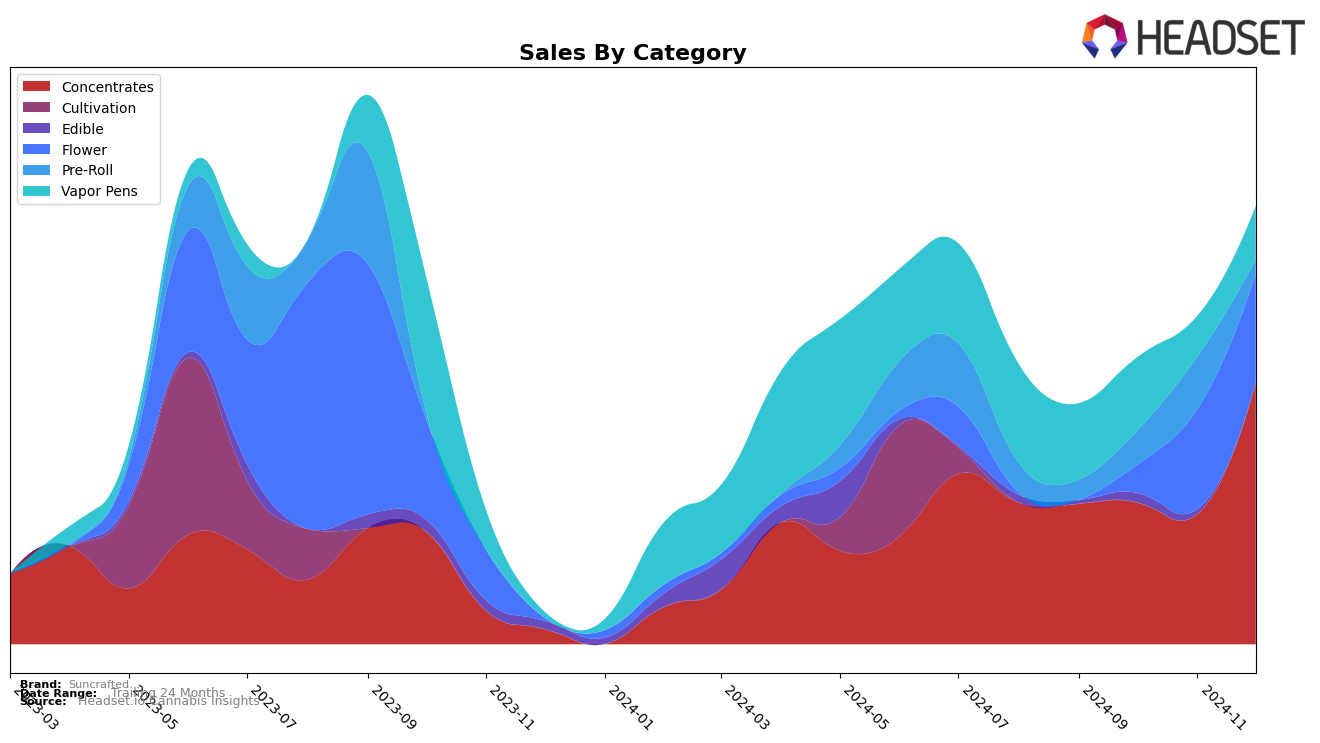

Suncrafted has shown interesting dynamics in the Massachusetts market, particularly in the Concentrates category. While the brand did not make it into the top 30 rankings in September, October, and November 2024, it made a significant leap to rank 24th in December. This upward movement suggests a strong finish to the year, indicating either an effective marketing push or a seasonal demand spike. The sales figures corroborate this trend, with December sales more than doubling from the previous months, highlighting a potential growth trajectory that could continue into the new year.

In the broader context of state performance, Suncrafted's absence from the top 30 in earlier months might have been a point of concern, but the December breakthrough in Massachusetts is a positive signal. This shift could reflect strategic adjustments or successful product launches that resonated with consumers. The fact that they were not in the top 30 for three consecutive months before December underscores the competitive nature of the market and the challenges faced by brands trying to establish a foothold. Observing how Suncrafted builds on this momentum in the coming months will be crucial for understanding their long-term positioning in the market.

Competitive Landscape

In the Massachusetts concentrates market, Suncrafted has shown a remarkable recovery in December 2024, climbing to the 24th rank from consistently being outside the top 40 in the previous months. This significant leap in rank is accompanied by a notable increase in sales, suggesting a successful strategy or product launch that resonated with consumers. In contrast, Natural Selections has been steadily improving its position, moving from the 37th to the 26th rank over the same period, indicating growing consumer interest. Meanwhile, SAUSE has maintained a strong presence, hovering around the 21st to 22nd rank, which suggests stable consumer loyalty. Superflux experienced fluctuations, peaking at 14th in October before dropping to 21st in December, indicating potential volatility in their market strategy or consumer base. Remedi also faced challenges, dropping from 16th to 25th, which may reflect a need for strategic adjustments. Suncrafted's recent surge positions it as a brand to watch, potentially disrupting the current market dynamics if the upward trend continues.

Notable Products

In December 2024, the top-performing product for Suncrafted was 1992 OG Kush (3.5g) in the Flower category, achieving the highest rank with notable sales of 516 units. GG4 (3.5g), also in the Flower category, secured the second spot, showcasing strong sales performance. Superboof Live Rosin (1g) in the Concentrates category climbed to the third position, improving from its fifth rank in September 2024. Wedding Cake Live Rosin (1g) followed in fourth place, while Apple Fritter Live Rosin (1g) rounded out the top five, both maintaining steady sales figures. This month saw a significant rise for concentrates like Superboof Live Rosin, indicating a shift in consumer preference towards these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.