Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

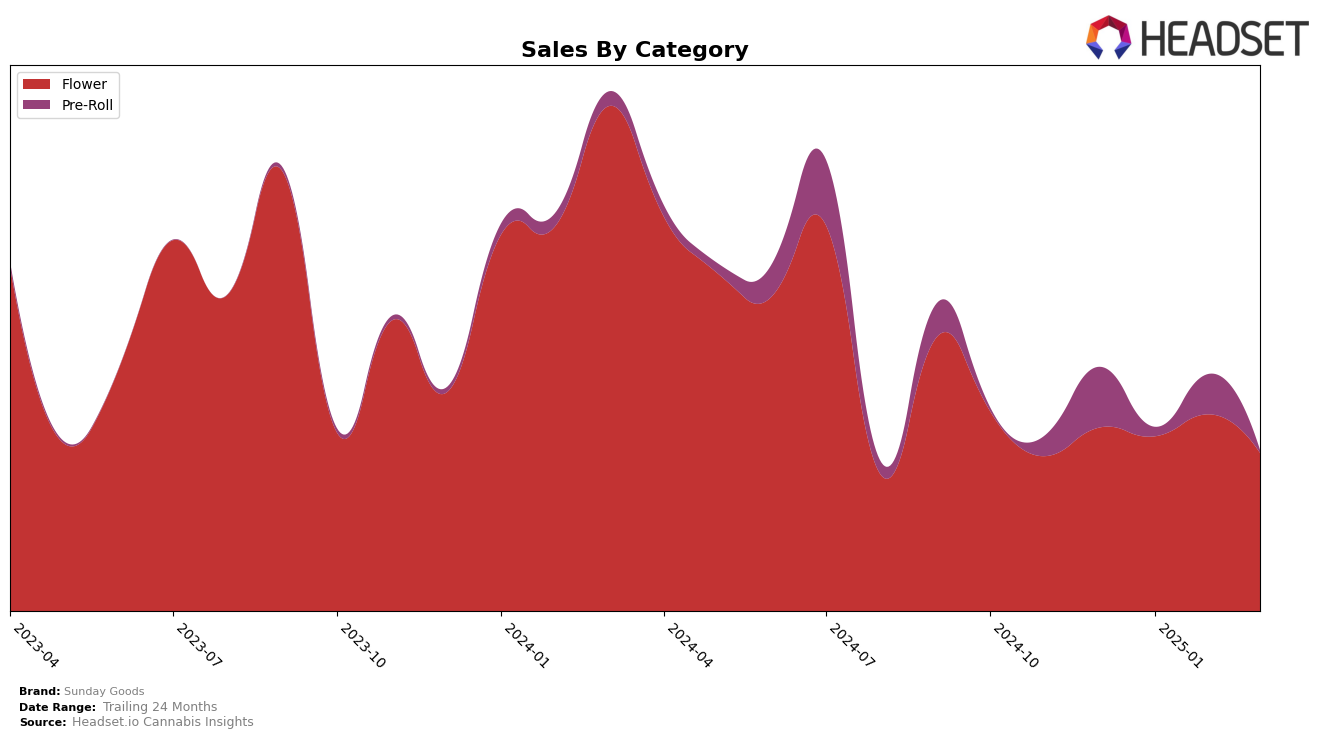

In Arizona, Sunday Goods has shown varied performance across different cannabis categories. Within the Flower category, the brand maintained a steady presence in the top 20, with a slight dip from 14th place in December 2024 to 17th place by March 2025. Despite the fluctuations in ranking, there was a notable increase in sales from January to February 2025, indicating a temporary boost in consumer demand. Conversely, in the Pre-Roll category, Sunday Goods experienced a significant drop in rankings, falling from 11th place in December 2024 to being outside the top 30 by March 2025. This decline suggests challenges in maintaining market share or possibly increased competition within the category.

The absence of Sunday Goods in the top 30 for the Pre-Roll category in March 2025 in Arizona is particularly noteworthy. This could signal a strategic shift or a need for the brand to reassess its market approach in that segment. While the Flower category has shown resilience, the Pre-Roll category's performance highlights potential areas for improvement. These movements across categories and rankings suggest that Sunday Goods may need to focus on strengthening its presence and appeal in the Pre-Roll market to regain its competitive edge. The data provides a glimpse into the brand's performance, leaving room for further analysis and insights into their strategic maneuvers in the cannabis market.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Sunday Goods has experienced fluctuations in its market position, notably maintaining a rank between 14th and 17th from December 2024 to March 2025. Despite a slight dip in sales from December to March, Sunday Goods has managed to stay ahead of brands like Sublime, which did not break into the top 20 until March 2025. However, Sunday Goods faces stiff competition from brands such as Fade Co. and Aeriz. Notably, Aeriz made a significant leap from 23rd in December to 11th in February, surpassing Sunday Goods in rank and sales during that period. Additionally, Green Leef Pharms showed remarkable growth, climbing from 65th in December to 14th in February, indicating a dynamic shift in consumer preferences that Sunday Goods must navigate to maintain and improve its market position.

Notable Products

In March 2025, the top-performing product for Sunday Goods was Royal Wedding (3.5g) in the Flower category, achieving the number one rank with sales of 4,617 units. Lemon Brulee #420 (3.5g) followed closely, securing the second rank, while Sour Leopard (3.5g) took the third position. Notably, Tropsanto #90 (3.5g) experienced a drop from first place in January to fourth place in March. Blue Dream (3.5g) entered the top five, ranking fifth in March. This shift in rankings from previous months highlights a dynamic change in consumer preferences within Sunday Goods' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.