Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

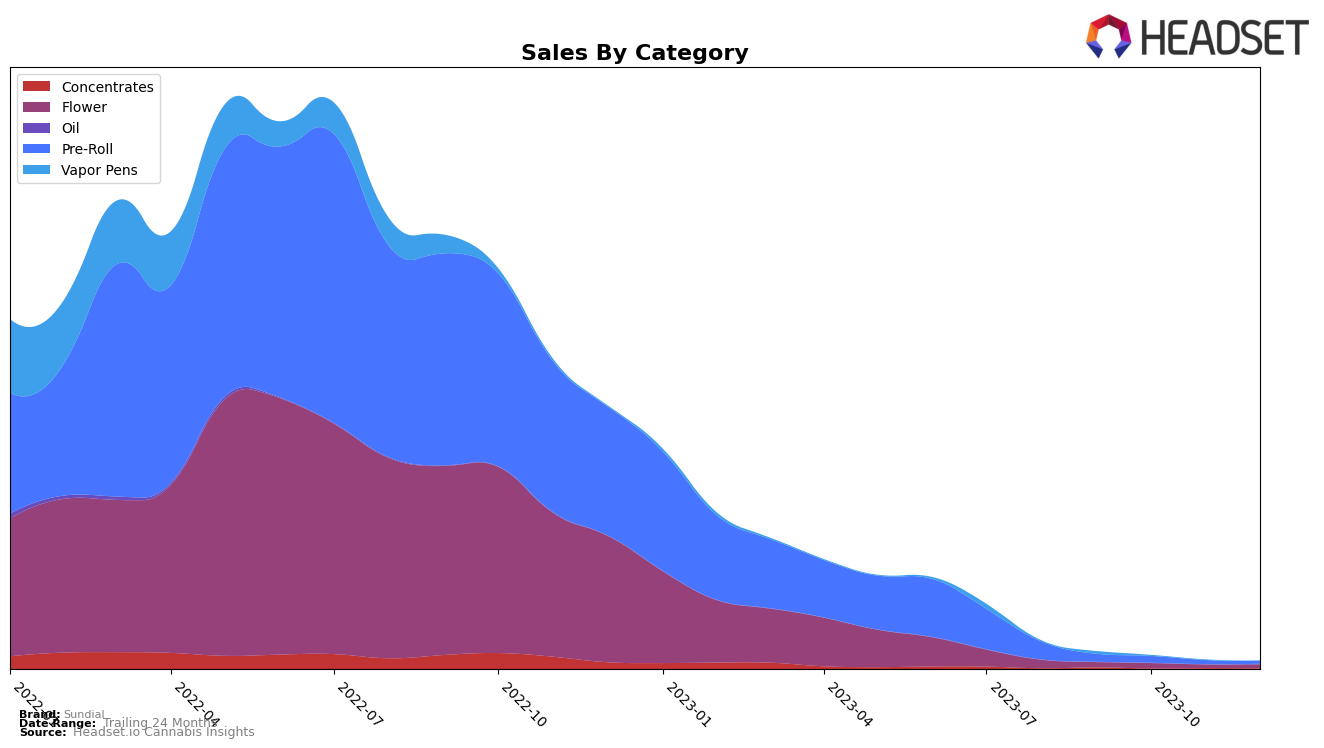

For the cannabis brand Sundial, performance across categories and states varies. In the concentrates category, Sundial's performance in Alberta shows a downward trend, as indicated by its rank going from 53 in September 2023 to 62 in December 2023. The lack of ranking for November 2023 suggests that the brand did not make it to the top 20, which is a point of concern. Meanwhile, in Ontario, the brand's ranking fluctuated between 82 and 91 over the four months, showing a lack of consistency. Notably, Sundial's sales in this category in Ontario peaked in November 2023 with a total of 1170 units sold.

In the province of British Columbia, Sundial's performance in the oil and vapor pens categories presents a mixed picture. The brand entered the top 20 in the oil category in December 2023, with a total of 772 units sold. However, the brand's performance in the vapor pens category shows a decline, with its ranking dropping from 61 in September 2023 to 66 in October 2023, and no ranking for the following two months. In Saskatchewan, Sundial's ranking in the vapor pens category improved from 88 to 82 between October and November 2023. However, the lack of ranking for September and December 2023 indicates that the brand was not among the top 20 in those months.

Competitive Landscape

In the Oil category for British Columbia, Sundial has experienced a competitive market with several other brands. Notably, Cove ranked higher in December 2023, indicating a potential increase in market share. Twd. has shown a fluctuating rank, but remained in the top 20, suggesting a stable presence in the market. Dosecann, while not always in the top 20, showed a significant increase in sales in November 2023, indicating a potential rise in popularity. XMG consistently ranked higher than Sundial, but showed a downward trend in sales over the last quarter of 2023. These dynamics suggest a competitive landscape where Sundial's position may be challenged by both established and emerging competitors.

Notable Products

In December 2023, Sundial's top-performing product was the LA Kush Cake Pre-Roll 3-Pack (1.5g), maintaining its number one position from the previous three months, albeit with slightly decreased sales of 172 units. The second best-selling product was Wedding Cake (3.5g) from the Flower category, improving its rank from third in October and November to second in December. Citrus Orchard (3.5g) also from the Flower category, ranked third, a drop from its position in September but an improvement from its unranked status in November. The Lift - Citrus Orchard Pre Roll 3-Pack (1.5g) from the Pre-Roll category saw a consistent drop in rank over the four months, ending at the fourth position in December from the second in September. Finally, the CBD Isolate (1g) in the Concentrates category remained stable at the fifth position in December, matching its rank from September and November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.