Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

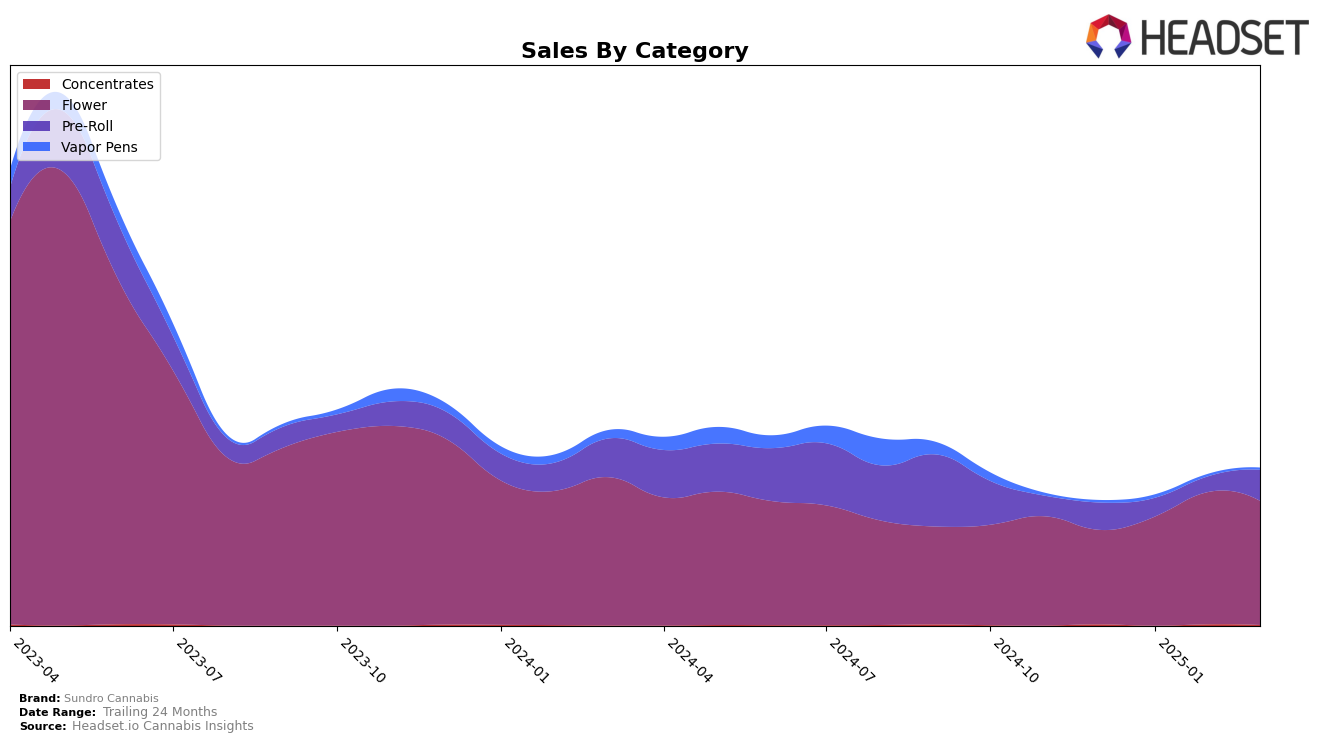

Sundro Cannabis has shown a notable performance trajectory in the Missouri market, particularly within the Flower category. The brand climbed from a rank of 30 in December 2024 to 23 by February 2025, before stabilizing slightly at 24 in March 2025. This upward movement indicates a growing consumer base and increased market penetration. The sales figures support this trend, with a marked increase from approximately $457,683 in December 2024 to over $643,203 in February 2025, before a slight dip in March. Such trends suggest that Sundro Cannabis is gaining traction and solidifying its presence in the Flower category, although there remains room for further growth and consistency.

In contrast, the performance of Sundro Cannabis in the Pre-Roll category in Missouri has been more volatile. After starting at rank 25 in December 2024, the brand fell out of the top 30 in January 2025, only to make a comeback to rank 26 by March 2025. This fluctuation points to potential challenges in maintaining a steady market position. Despite these challenges, the brand's sales in this category showed a positive turnaround, rebounding from a low in February to a higher sales figure in March. However, the brand's presence in the Vapor Pens category remains minimal, as it hasn't secured a spot in the top 30, suggesting a need for strategic initiatives to enhance its competitiveness in this segment.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Sundro Cannabis has shown a promising upward trajectory in its market position from December 2024 to March 2025. Starting at rank 30 in December, Sundro Cannabis climbed to rank 24 by March, showcasing a consistent improvement in its market standing. This positive trend is contrasted by brands like Nugz, which fell from rank 13 in December to 25 by March, indicating a significant decline in their market presence. Meanwhile, CAMP Cannabis also improved its rank from 29 to 22 during the same period, suggesting a competitive edge in the market. Additionally, Atta experienced fluctuations but ended March at a higher rank than Sundro Cannabis, while Galactic entered the top 30 in February and improved its position by March. These dynamics highlight Sundro Cannabis's potential for growth in the Missouri flower market, despite facing stiff competition from both established and emerging brands.

Notable Products

In March 2025, the top-performing product for Sundro Cannabis was Bunny Runtz (3.5g) in the Flower category, maintaining its number one rank from February with sales of 3824. Lemon Oreoz (3.5g) climbed to the second position, showing a significant increase in sales from previous months. White Caviar (3.5g) made its debut in the rankings at the third spot with sales of 1900, indicating strong market entry. Cadillac Rainbow (3.5g) and Dirty Banana (3.5g) both shared the fourth rank, with Dirty Banana experiencing a notable decline from its previous second place in February. This shift highlights a dynamic change in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.