Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

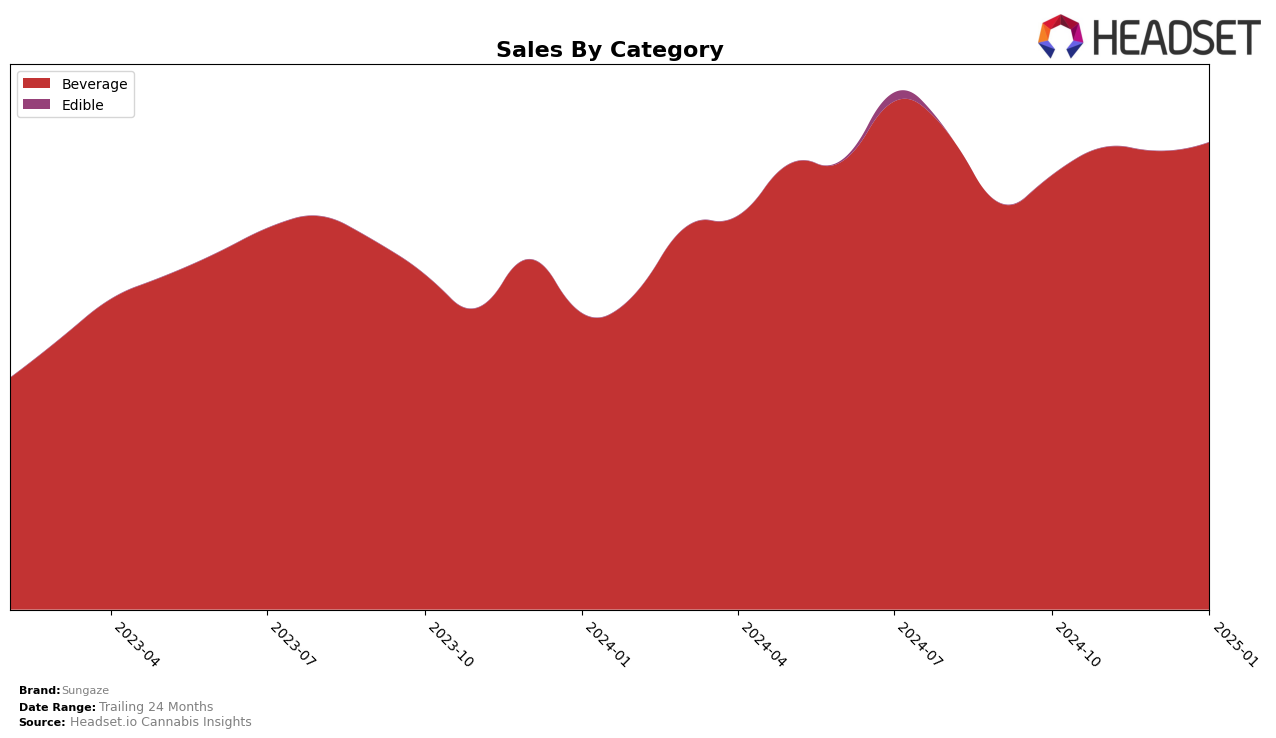

Sungaze has shown consistent performance in the Beverage category across the state of Washington, maintaining a steady 11th place ranking from October 2024 through January 2025. This stability suggests a solid consumer base and effective brand positioning within the market. Despite the competitive nature of the cannabis beverage sector, Sungaze's ability to hold its rank indicates a strong product offering and customer loyalty. However, it is worth noting that the brand has not broken into the top 10, which could be an area of focus for growth strategies moving forward.

While Sungaze's consistent ranking in Washington is commendable, the absence of the brand from the top 30 in other states or provinces may indicate a lack of market penetration or brand awareness outside of Washington. This could be viewed as a potential area for expansion, as the brand might benefit from exploring new markets or enhancing its marketing efforts in other regions. The steady increase in sales from October 2024 to January 2025 in Washington, with a notable rise to $37,354 in January, underscores the brand's potential for growth if similar strategies are applied elsewhere.

Competitive Landscape

In the competitive landscape of the Washington beverage category, Sungaze consistently holds the 11th rank from October 2024 through January 2025, demonstrating stability in its market position. Despite this consistency, Sungaze faces significant competition from brands like Blaze Soda and Ratio (WA), both of which maintain higher ranks at 10th and 9th respectively. Notably, Ratio (WA) shows a strong upward sales trend, with January 2025 sales more than tripling those of Sungaze, indicating a robust consumer preference. Meanwhile, CQ (Cannabis Quencher) and Swell Edibles hover around the 12th and 13th ranks, suggesting that while they are close competitors, they do not pose an immediate threat to Sungaze's position. For Sungaze to improve its rank and sales, it may need to innovate or enhance its marketing strategies to better compete with the likes of Blaze Soda and Ratio (WA), which are currently outperforming it in sales.

Notable Products

In January 2025, the top-performing product from Sungaze was the CBD:THC 2:1 Strawberry Citrus Seltzer 2-Pack (10mg CBD, 5mg THC) in the Beverage category, maintaining its first-place rank from previous months with notable sales of 1753 units. The CBD:THC 2:1 Lemon Ginger Seltzer 2-Pack (10mg CBD, 5mg THC) climbed to the second position, improving from its consistent third-place ranking in the last three months. The CBD:THC 2:1 Strawberry Citrus Seltzer 4-Pack (20mg CBD, 10mg THC) dropped to third place, despite being second in the previous months. The CBD/THC 2:1 Lime Agave Seltzer 2-Pack (10mg CBD, 5mg THC, 24oz) re-entered the rankings at fourth place after not being ranked in November and December. Lastly, the CBD/THC 2:1 Strawberry Citrus Seltzer 6-Pack (30mg CBD, 15mg THC) remained steady in fifth place, showing minimal change from its earlier positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.