Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

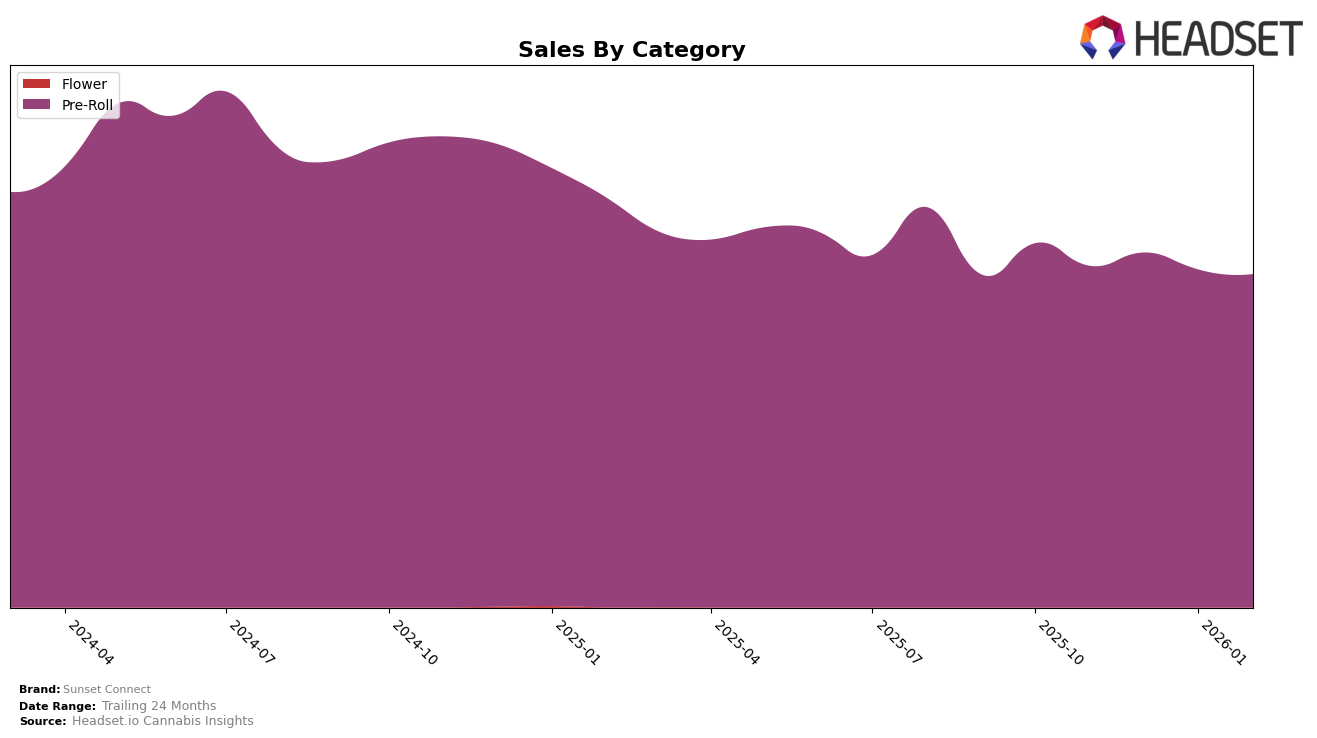

Sunset Connect has shown a consistent presence in the California market within the Pre-Roll category. Over the months from November 2025 to February 2026, the brand has maintained a steady climb in rankings, moving from 26th position in November to 23rd by February. This upward trend suggests a growing consumer preference or effective market strategies in California. While the sales figures experienced slight fluctuations, the overall trend indicates stability and potential for further growth in this competitive category.

It is noteworthy that Sunset Connect did not make it into the top 30 brands in any other state or province during this period, which could be seen as a limitation in their geographical reach or brand recognition outside of California. This lack of presence in other markets might suggest opportunities for expansion or the need to tailor their strategies to different consumer bases. The brand's focused performance in California could be a strategic decision, but diversifying across other states could potentially bolster their market position and drive further success.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Sunset Connect has shown a steady improvement in its ranking, moving from 26th in November 2025 to 23rd by February 2026. This upward trend indicates a positive reception in the market, despite a slight decrease in sales from December 2025 to February 2026. Notably, Selfies and Clsics are key competitors, with Clsics consistently maintaining a higher rank, although it experienced a decline in sales in February 2026. Meanwhile, Gelato has maintained a stable rank at 22nd, just above Sunset Connect, but its sales have also decreased over the same period. Interestingly, Cizi has shown significant growth, jumping from 46th to 25th, suggesting a rising competitive threat. These dynamics highlight the competitive pressure Sunset Connect faces, emphasizing the need for strategic marketing and product differentiation to continue its upward trajectory in the rankings.

Notable Products

In February 2026, the top-performing product from Sunset Connect was Willie Haze Pre-Roll (1g), which climbed to the number one spot with sales reaching 9,609 units. Purple Rainbow Pre-Roll (1g) maintained a strong presence, ranking second after holding the top position in January 2026. Original Danksy Pre-Roll (1g) made its debut in the rankings, securing the third position. Fulton Fiver - George Zkittlez Pre-Roll (1g) saw a decline, dropping to fourth place from its previous peak at the top in December 2025. Magic Johnstoned Pre-Roll (1g) completed the top five, experiencing a slight dip from its fourth-place ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.