Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

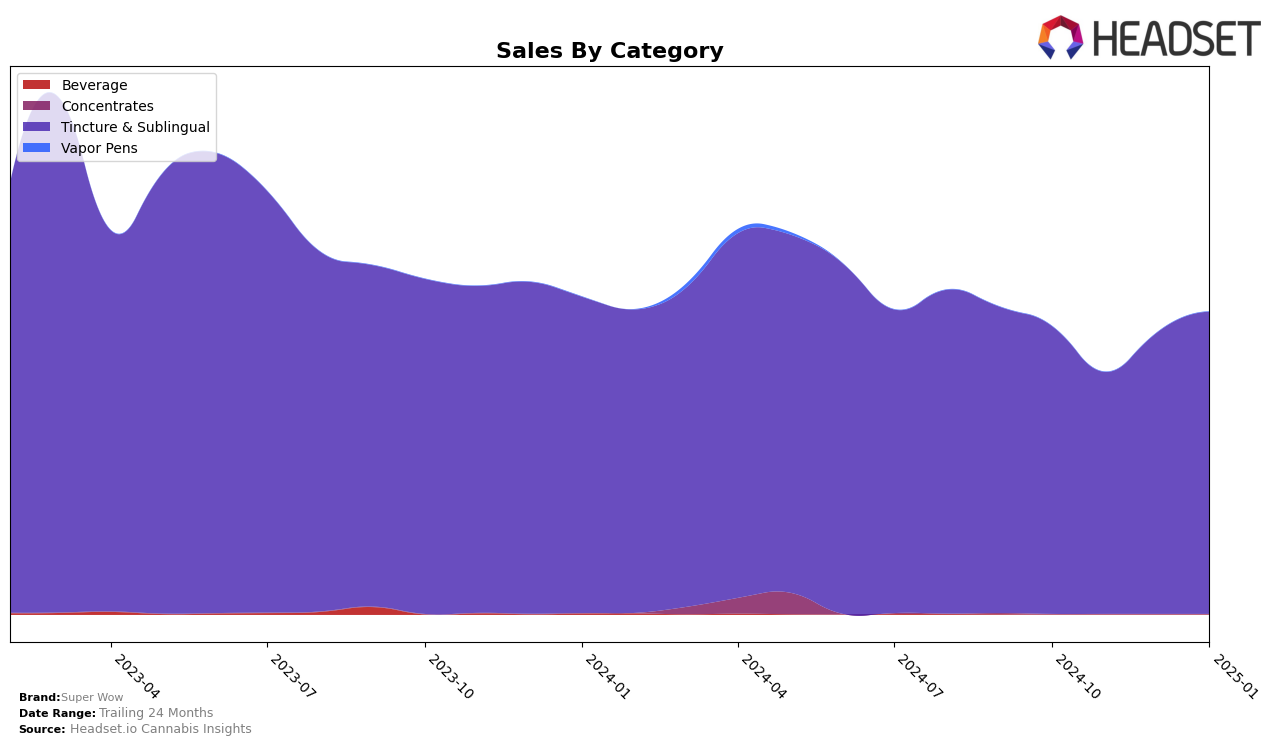

Super Wow has shown consistent performance in the Tincture & Sublingual category within the state of California. Over the four-month period from October 2024 to January 2025, the brand maintained a steady presence, largely holding onto the 11th position, with a brief dip to 12th in November. This indicates a stable market presence and suggests that Super Wow has carved out a niche for itself in this category. The fluctuation in sales figures, such as the increase from $44,615 in November to $55,735 in January, highlights a positive trend in consumer demand, possibly driven by seasonal factors or successful marketing strategies.

While Super Wow has managed to maintain its ranking within the top 15 in California, the absence of a ranking in other states or categories suggests areas of potential growth or the need for strategic adjustments. The lack of presence in the top 30 across other regions or product categories could be seen as a challenge or an opportunity, depending on the brand's goals and market strategy. This information underscores the importance of understanding regional market dynamics and consumer preferences, which could guide Super Wow in expanding its footprint and improving its ranking in other competitive markets.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Super Wow has experienced a dynamic shift in its market position over the past few months. Starting at the 11th rank in October 2024, Super Wow briefly dropped to 12th in November before regaining its 11th position by December and maintaining it through January 2025. This fluctuation in rank highlights the competitive pressure from brands like Moods Spray, which swapped positions with Super Wow in November and December. Despite these changes, Super Wow's sales trajectory shows a positive trend, with a notable increase from November to January, suggesting a recovery and potential growth in consumer demand. In contrast, Proof consistently outperformed Super Wow, maintaining a stable rank of 9th, indicating a strong market presence. Meanwhile, St Ides entered the top 20 in November and held the 10th position, showcasing their rising influence in the market. These insights suggest that while Super Wow faces stiff competition, its ability to rebound in sales and rank positions it well for future growth in California's Tincture & Sublingual market.

Notable Products

In January 2025, the top-performing product for Super Wow was the Strawberry Drops Tincture (1000mg THC, 30ml), reclaiming its top spot after a dip in December with sales reaching 330 units. The Blue Raspberry Drops Tincture (1000mg THC, 30ml) made a significant leap from fourth place in December to second place in January, showcasing a strong increase in popularity. The Watermelon Tincture (1000mg THC, 30ml) slipped from first place in December to third in January, indicating a slight decline in sales momentum. The Pink Lemonade Drops Tincture (1000mg THC, 30ml) maintained a steady presence, ranking fourth consistently over the past months. The THC:CBN Sleepy Wow Tincture (1000mg THC, 30mg CBN, 30ml) dropped to fifth place, suggesting a decrease in demand compared to its peak in November when it was ranked second.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.