Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

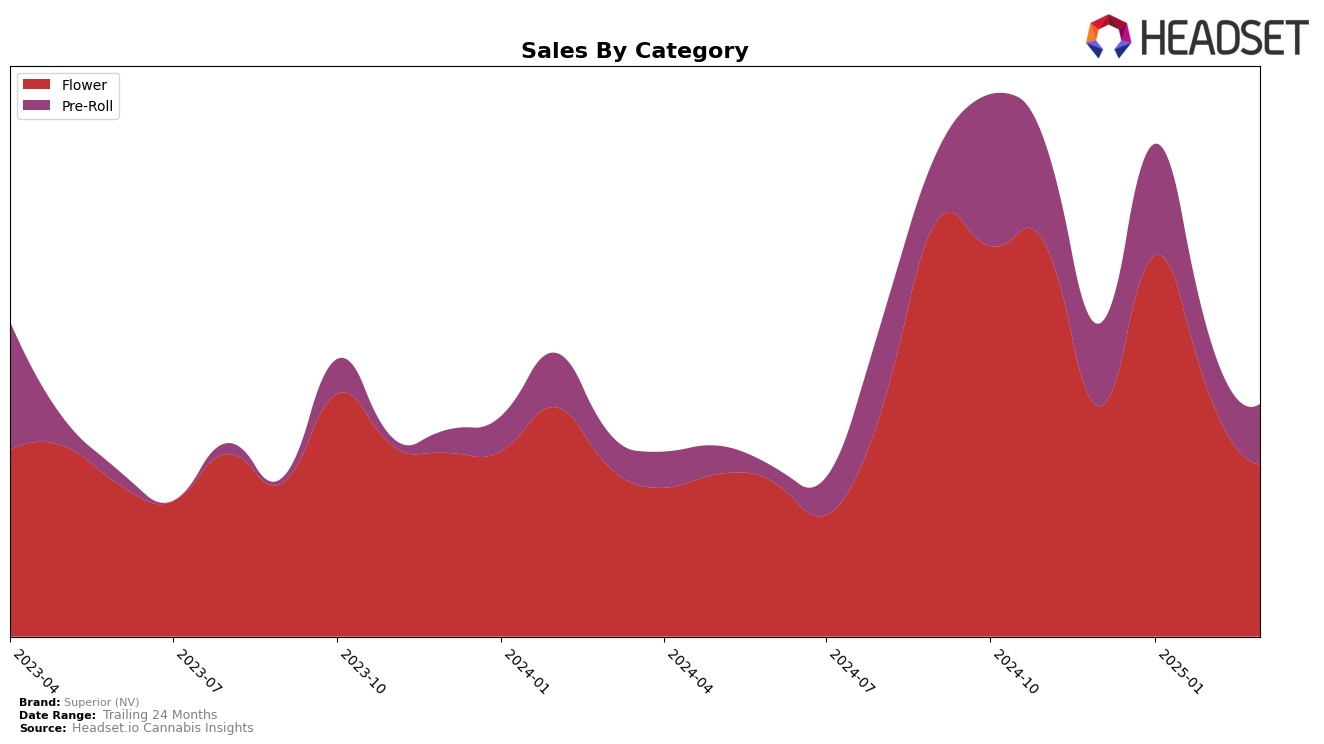

In the Nevada market, Superior (NV) has shown varied performance across different cannabis categories over the months from December 2024 to March 2025. In the Flower category, the brand experienced a significant rise in its ranking from 22nd in December to 12th in January, reflecting a strong increase in sales during this period. However, this momentum did not sustain, as the rankings fell to 18th in February and further down to 28th in March. This fluctuation indicates potential volatility in consumer preference or market competition. The Pre-Roll category also showed a similar trend, with an initial improvement in ranking from 19th to 12th, followed by a decline to 22nd and then a slight recovery to 21st. These movements suggest that while Superior (NV) can capture market interest, maintaining a stable position remains a challenge.

The absence of Superior (NV) from the top 30 brands in any other states or categories during these months highlights a potential area for growth or concern, depending on the brand's strategic goals. The inconsistency in rankings within Nevada might suggest the need for a reassessment of market strategies or product offerings to stabilize and enhance brand presence. The fluctuations in sales figures, particularly the drop from January to March in both categories, could indicate seasonal trends, competitive pressures, or shifts in consumer demand that require attention. Understanding these dynamics can help in crafting more targeted approaches to capture and retain market share effectively.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Superior (NV) has experienced notable fluctuations in its market position over the past few months. Starting from December 2024, Superior (NV) was ranked 22nd, climbing impressively to 12th in January 2025, indicating a significant surge in sales performance. However, the brand saw a decline to 18th in February and further dropped to 28th by March 2025. This downward trend suggests a potential challenge in maintaining its earlier momentum. In contrast, competitors like Kynd Cannabis Company and FloraVega / Welleaf have shown varied performances, with FloraVega / Welleaf notably rising from 56th in January to 23rd in February, surpassing Superior (NV) by March. Such shifts highlight the dynamic nature of the market and the importance for Superior (NV) to strategize effectively to regain its competitive edge and stabilize its sales trajectory.

Notable Products

In March 2025, Superior (NV) saw Hawaiian Punch Pre-Roll (1g) rise to the top as the number one product in the Pre-Roll category, with sales reaching 2152 units. Governmint Oasis Pre-Roll (1g), which had consistently held the top spot in previous months, slipped to second place. Papaya Pre-Roll (1g) made a notable jump from fifth in February to third in March, indicating a growing popularity. Acai Gelato Pre-Roll (1g) experienced a slight decline, moving from second to fourth place. Alien Moon Pie (3.5g) entered the rankings for the first time in March, securing the fifth position in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.