Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

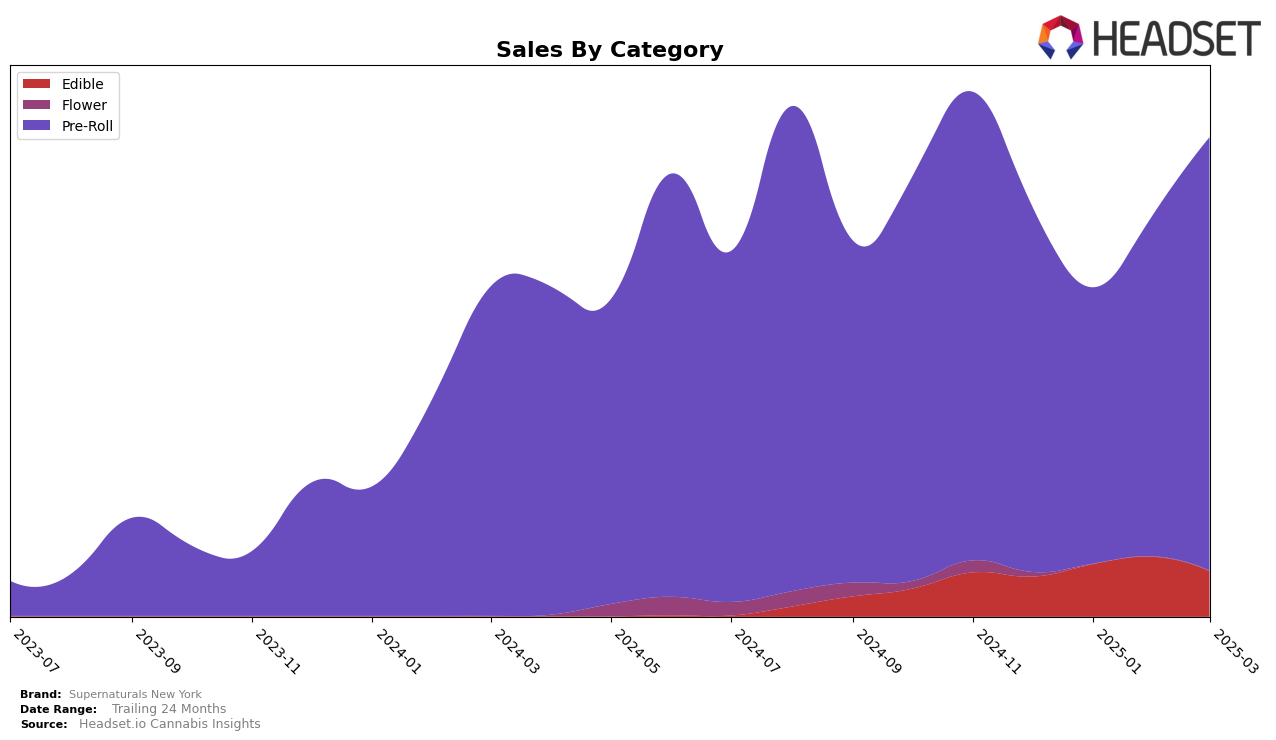

Supernaturals New York has shown varying performance across different categories and states. In the New York market, the brand's presence in the Edible category has fluctuated, with rankings moving from 38th in December 2024 to 37th by March 2025. This suggests a struggle to maintain a strong foothold in the top tier, with the brand only breaking into the top 30 in January and February 2025. Despite this, there was a notable peak in sales during February, indicating some competitive edge, which unfortunately did not sustain into March. This inconsistency highlights potential challenges in market positioning or consumer preference shifts within the Edible category.

In stark contrast, Supernaturals New York has demonstrated more consistent and robust performance in the Pre-Roll category within New York. Here, the brand has consistently ranked within the top 20, even improving its position from 14th in December 2024 to 13th by March 2025. This upward trend, coupled with a significant increase in sales from January to March, underscores a stronger market presence and possibly a more favorable consumer reception in this category. The ability to maintain and slightly improve their ranking in a competitive market suggests that Supernaturals New York is more effectively capitalizing on consumer demand for Pre-Rolls, compared to their performance in the Edible category.

Competitive Landscape

In the competitive landscape of the New York pre-roll market, Supernaturals New York has shown a dynamic performance over the past few months. Despite a temporary drop in rank to 20th place in January 2025, the brand rebounded to 13th by March 2025, indicating a positive recovery trend. This fluctuation contrasts with competitors such as Canna Cure Farms, which maintained a relatively stable position around the 8th to 11th ranks, and Heady Tree, which experienced a similar rank volatility but ended slightly lower at 12th. Meanwhile, Back Home Cannabis Co. showed a consistent upward trajectory, climbing from 19th to 14th, and Rolling Green Cannabis made a significant leap from 27th to 15th. These movements suggest that while Supernaturals New York is capable of regaining lost ground, the brand faces stiff competition from both established and emerging players in the market.

Notable Products

In March 2025, the top-performing product for Supernaturals New York was Rainbow Belts Pre-Roll 2-Pack (1.5g), securing the first rank in sales. Gelatti Pre-Roll 2-Pack (1.5g) maintained its consistent performance, holding the second position for four consecutive months. Trop Cherry Pre-Roll 5-Pack (3.5g) improved its ranking to third place from fourth in the previous month with notable sales of 1,476 units. Mangolope Pre-Roll 2-Pack (1.5g), which previously held the top rank in December and January, fell to fourth place in March. Georgia Pie Pre-Roll 5-Pack (3.5g) ranked fifth, showing a decline from its third position in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.