Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

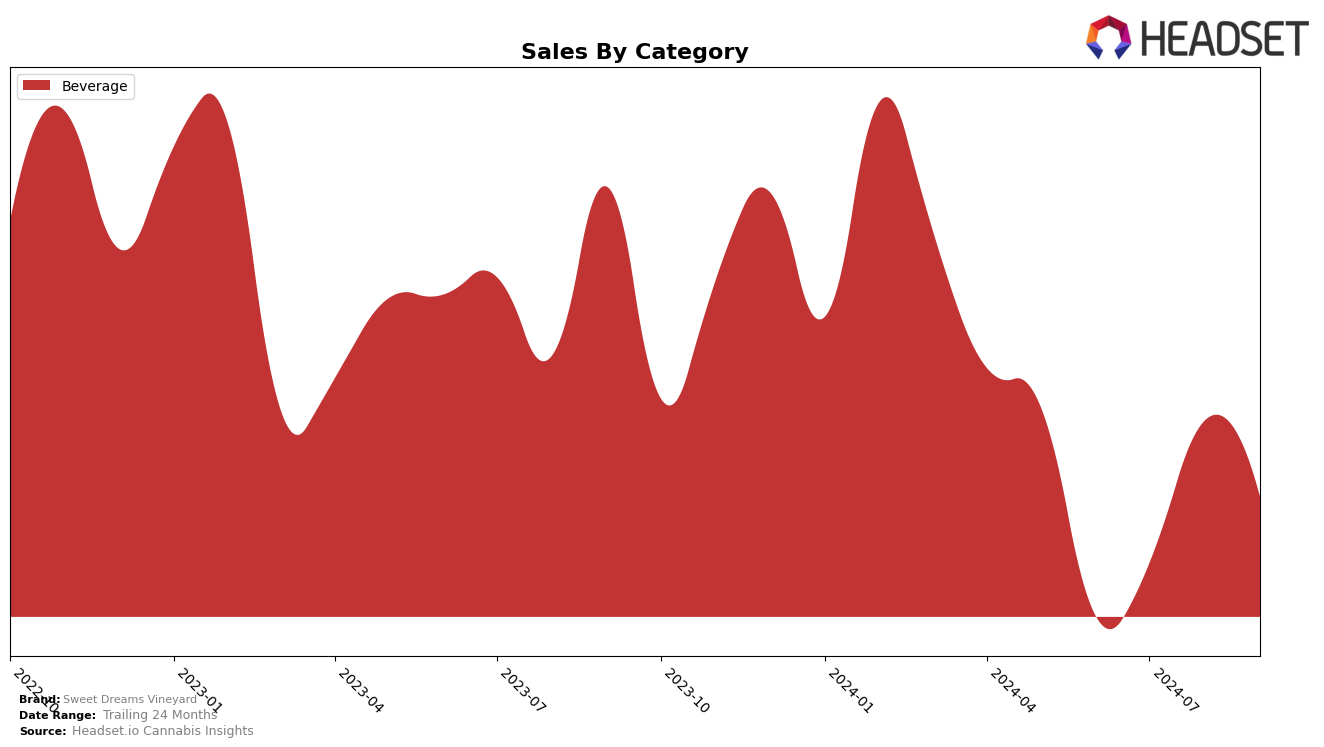

Sweet Dreams Vineyard has shown a notable performance in the Beverage category in Ohio as of September 2024. After not appearing in the top 30 rankings for June, July, or August, the brand made a significant leap to secure the 7th position in September. This sudden emergence indicates a strong upward trend and suggests that Sweet Dreams Vineyard might have implemented strategic changes or benefited from market dynamics that favored their offerings. The absence of rankings in the earlier months could highlight either a previous lack of market penetration or a strategic entry into the market that paid off in September.

Despite their impressive entry in Ohio, Sweet Dreams Vineyard's performance in other states and categories remains undisclosed, suggesting that their market presence might be limited or still developing outside of Ohio. The data does not provide insights into their standing in other regions, which could imply that the brand is either focusing its efforts specifically in Ohio or has not yet gained significant traction elsewhere. The lack of rankings in other states might be a point of concern or an area of opportunity for the brand to expand its reach and replicate its success in Ohio across different markets.

Competitive Landscape

In the Ohio beverage category, Sweet Dreams Vineyard is showing signs of growth, achieving a rank of 7th in September 2024 after not being in the top 20 in the preceding months. This upward movement suggests a positive trend in their market presence. In contrast, Vapen maintained a stable position at 6th in both July and August 2024, indicating consistent performance. Meanwhile, Butterfly Effect - Grow Ohio experienced a slight decline, dropping from 1st in June to 2nd in July, which could imply a potential opportunity for Sweet Dreams Vineyard to capture more market share if this trend continues. Additionally, Wellspring Fields held steady at 4th place from August to September, showcasing resilience in their sales strategy. Sweet Dreams Vineyard's recent entry into the top 10 suggests they are gaining traction, and continued strategic efforts could further improve their ranking and sales in this competitive landscape.

Notable Products

In September 2024, the top-performing product from Sweet Dreams Vineyard was Limonada Infused Water (110mg), maintaining its first-place rank from the previous months with a notable sales figure of 1872 units. This product has consistently been the best-seller since June 2024, showing a significant increase in sales each month. Cannabernet Non-Alcoholic Wine (100mg THC, 210ml) and Marijuarita Non-Alcoholic Margarita (100mg THC, 210ml) were not ranked in September, indicating a potential drop in their popularity or availability. Limonada Sweet Dreams Drink (100mg) held the second position in August but was not ranked in September, suggesting a shift in consumer preference or inventory changes. The dominance of Limonada Infused Water highlights its strong consumer appeal and market presence in the beverage category for Sweet Dreams Vineyard.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.