Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

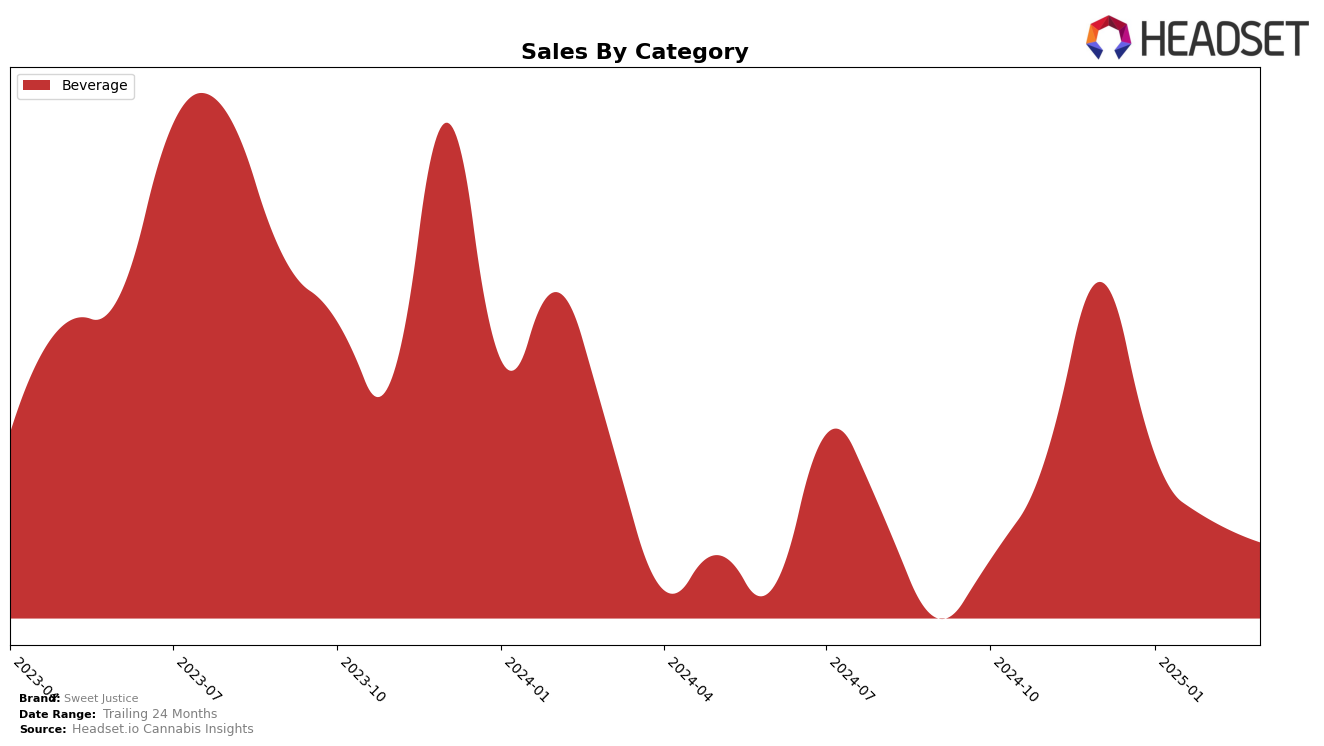

Sweet Justice has maintained a strong presence in the Canadian beverage market, particularly in Alberta and British Columbia. In Alberta, the brand consistently held the number 2 position from December 2024 through March 2025, despite a noticeable decline in sales over these months. Conversely, in British Columbia, Sweet Justice demonstrated an impressive upward trajectory, moving from the second to the top spot by February 2025, maintaining this lead into March. This suggests a growing preference and market penetration in British Columbia, contrasting with a more stable but slightly declining performance in Alberta.

In Ontario, Sweet Justice experienced a gradual decline in rankings, starting at fourth place in December 2024 and settling at sixth by March 2025, though sales showed a slight recovery in the last month. Meanwhile, in Saskatchewan, the brand dropped from third to fourth position, indicating a potential challenge in maintaining its market share. In the United States, Sweet Justice appeared in Michigan for December 2024, securing the 11th spot, but did not feature in the top 30 in subsequent months, highlighting a need for strategic adjustments to enhance its visibility and competitiveness in this market.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Sweet Justice has demonstrated remarkable resilience and growth. Over the analyzed period from December 2024 to March 2025, Sweet Justice ascended to the top rank, overtaking Bubble Kush, which fell from first to third place. This shift highlights Sweet Justice's increasing market dominance, as it maintained the number one position from February through March 2025. Notably, Sweet Justice's consistent sales growth contrasts with XMG, which, despite a strong start in January 2025, remained in the second position for the latter months. The data suggests that Sweet Justice's strategic initiatives are effectively capturing consumer interest and driving sales, positioning it as a formidable leader in the British Columbia beverage market.

Notable Products

In March 2025, OG Cola Free (10mg THC, 355ml) emerged as the top-performing product for Sweet Justice, climbing from its consistent second-place position in the previous months to first. Cherry Cola (10mg THC, 355ml) improved its ranking to second place, although it had been the top seller back in December 2024. The THC/CBG 1:1 OG Root Beer Free Soda (10mg THC, 10mg CBG, 355ml) dropped to third place after leading the sales in January and February 2025. The THC/CBG 1:1 OG Cola (5mg THC, 5mg CBG 355ml) maintained a steady presence, advancing slightly to fourth position. Notably, OG Cola Free recorded sales of 16,137 units, highlighting its strong performance in the beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.