Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

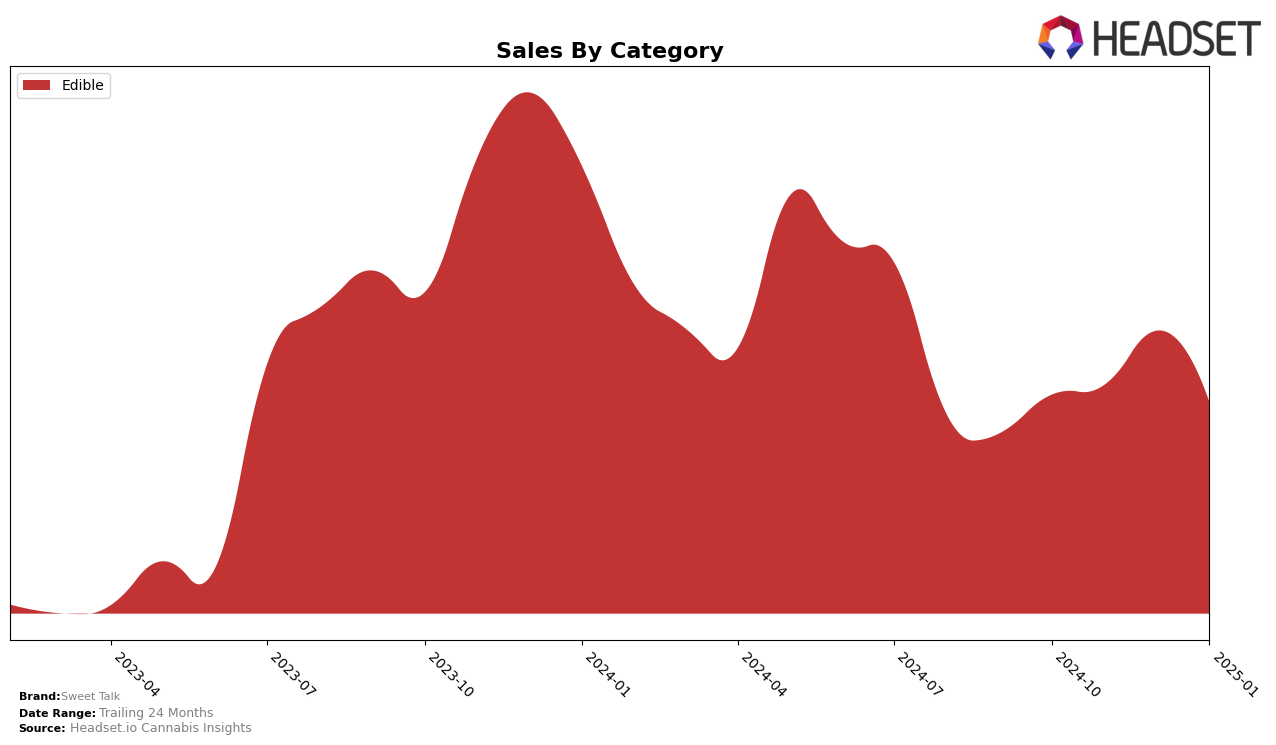

Sweet Talk has shown a consistent presence in the Edible category within Maryland, maintaining a steady yet modest ranking. The brand oscillated between the 20th and 21st positions from October 2024 to January 2025. Notably, the sales figures peaked in December 2024, reaching $107,607, which suggests a strong performance during the holiday season. However, this peak was followed by a decline in January 2025, indicating potential challenges in sustaining the momentum post-holidays. The consistent ranking just within the top 30 highlights Sweet Talk's stable but not dominant position in the Maryland edible market.

While Sweet Talk has maintained its presence in Maryland's edible market, the absence of rankings in other states or categories suggests that the brand may not have a significant footprint outside this specific niche. This could imply either a strategic focus on the Maryland edible market or challenges in expanding their brand influence across different states and product categories. The lack of top 30 placements in other regions or categories could be a point of concern if the brand aims for broader market penetration. Such data points highlight opportunities for growth and diversification that Sweet Talk might consider to enhance its overall market performance.

Competitive Landscape

In the Maryland edible market, Sweet Talk has experienced fluctuations in its rank over the past few months, indicating a competitive landscape. Despite a temporary improvement in December 2024, where Sweet Talk climbed to the 20th position, it slipped back to 21st by January 2025. This movement suggests a challenge in maintaining a consistent upward trajectory amidst strong competition. Notably, Bubby's Baked and Sunnies by SunMed have consistently outperformed Sweet Talk, holding ranks 18 and 19 respectively, with Bubby's Baked even improving to 18th in January 2025. These competitors have maintained higher sales figures, indicating a stronger market presence. Meanwhile, Oria and Garcia Hand Picked have shown less stability, with Oria demonstrating a notable improvement from 26th to 22nd, suggesting potential volatility in the lower ranks. For Sweet Talk, this competitive environment underscores the need for strategic initiatives to enhance brand visibility and sales performance to regain and sustain a higher rank.

Notable Products

In January 2025, the top-performing product from Sweet Talk was the Guava Passionfruit Gummies 10-Pack (100mg), which maintained its number one rank from November 2024. The Blue Raspberry Gummies 10-Pack (100mg) climbed to the second position, showing a steady increase from its third-place ranking in the previous two months. Notably, the Hybrid Cherry Yuzu Nano Gummies 10-Pack (100mg) debuted at the third rank with sales of 490 units. The Indica Strawberry Kiwi Nano Gummies 10-Pack (100mg) held the fourth position, a slight drop from its fifth-place finish in December 2024. Lastly, the Watermelon Gummies 20-Pack (100mg) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.