Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

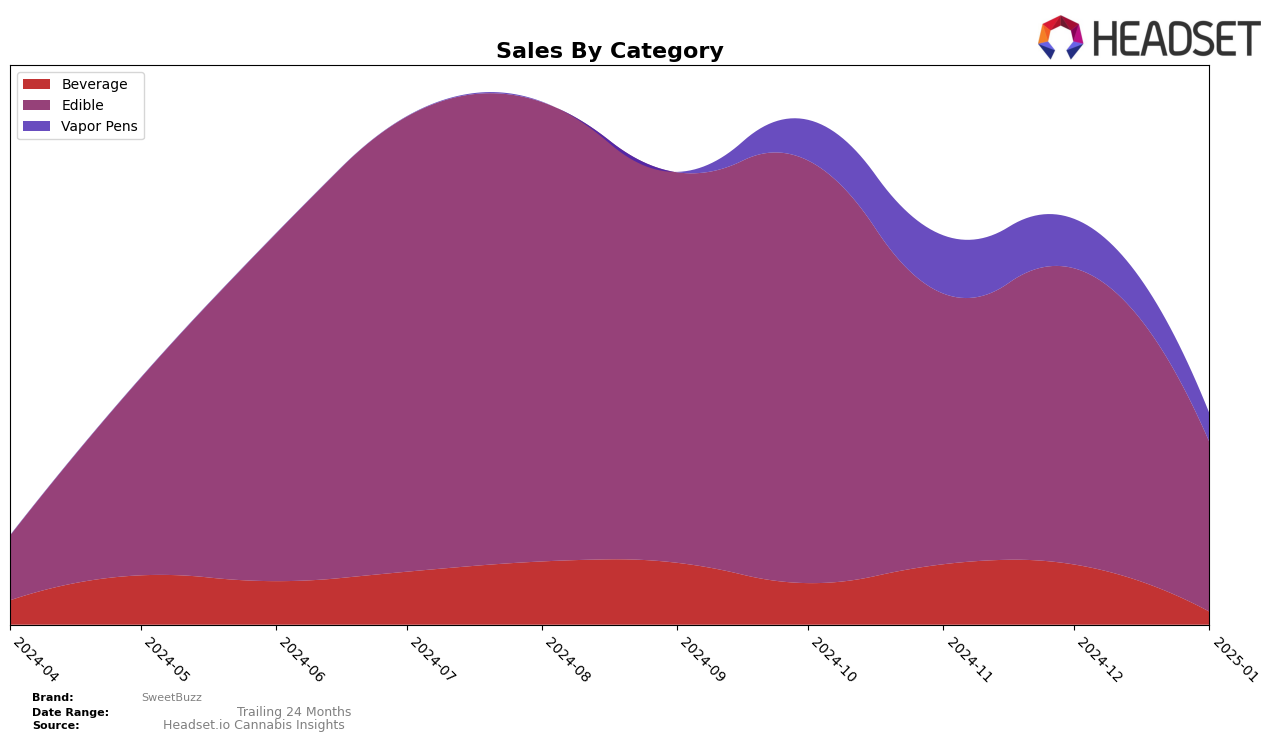

SweetBuzz's performance in the Illinois edible category has seen a downward trajectory over the past few months. In October 2024, the brand was ranked 48th, but by January 2025, it had slipped to the 60th position. This decline in rankings is mirrored by a decrease in sales, with January 2025 sales figures showing a significant drop from October 2024. This movement suggests that SweetBuzz is facing challenges in maintaining its market presence in the Illinois edible category, which may be attributed to increasing competition or changing consumer preferences.

It's important to note that SweetBuzz's absence from the top 30 rankings in the Illinois edible category indicates a struggle to capture a significant share of the market. While the brand has managed to stay within the top 60, the consistent decline in both rank and sales highlights potential areas for improvement. This trend could be indicative of broader market dynamics or specific challenges faced by the brand in Illinois. Further analysis could provide insights into whether this pattern is unique to Illinois or if it reflects a wider trend across other states or categories.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Illinois, SweetBuzz has experienced notable fluctuations in its rank and sales over the past few months. Starting from October 2024, SweetBuzz was ranked 48th, but it saw a decline to 60th by January 2025. This downward trend in rank is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. In comparison, Hedy consistently outperformed SweetBuzz, maintaining a rank within the top 50, despite a decrease in sales from November to January. Meanwhile, Chew & Chill (C & C) and Petra have shown more stability in their rankings, hovering around the 60th position, with Petra even improving its rank in January. These insights suggest that SweetBuzz may need to reassess its strategies to regain its competitive edge in the Illinois edible market.

Notable Products

In January 2025, SweetBuzz's top-performing product was Sweet Sparks Chocolate Candies 20-Pack (400mg) in the Edible category, securing the first rank with sales of 270 units. Following closely in second place were the Sweet Sparks Chocolate Candies 100-Pack (100mg), which saw a drop from the first rank in October 2024 but remained a strong contender. Cookie Got Creamed Candy Cups 10-Pack (100mg) debuted in the rankings at the third position, indicating a positive reception. Caramel Met Cookie Cups 10-Pack (100mg) experienced a decline, falling to fourth place from their second rank in December 2024. Lastly, Chocolate Hybrid 4-Pack (40mg) rounded out the top five, making its first appearance on the list in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.