Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

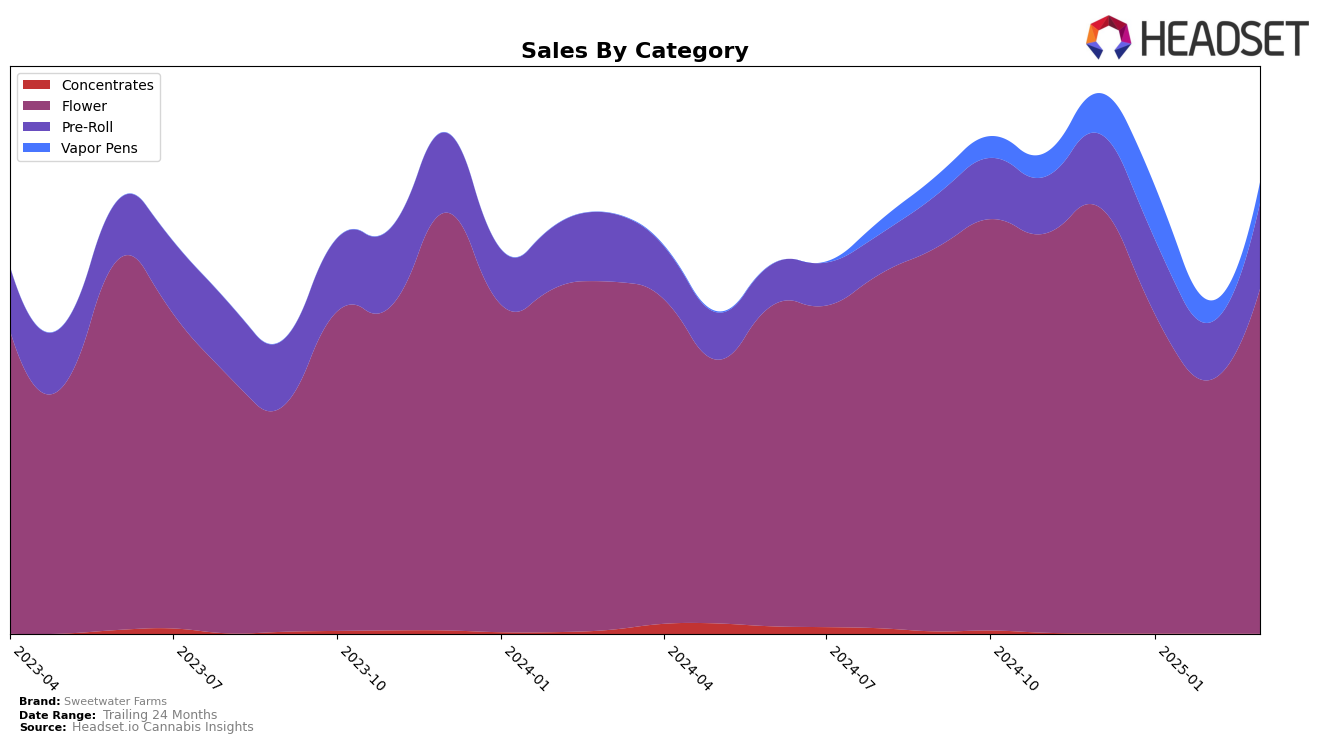

Sweetwater Farms has shown varied performance across different product categories in Washington. In the Flower category, the brand experienced a decline in rankings from December 2024 to February 2025, dropping from 21st to 30th place. However, March 2025 saw a rebound to 26th place, indicating a potential recovery. This fluctuation in rankings is mirrored by the sales figures, which saw a dip in January and February before rising again in March. Such movements suggest that while Sweetwater Farms faced challenges at the start of the year, they may be on an upward trajectory as they adapt to market conditions.

In the Pre-Roll category, Sweetwater Farms made a noteworthy improvement, climbing from 75th place in December 2024 to 54th place by March 2025. This upward movement could be indicative of successful strategies in increasing their market share or enhancing product appeal. On the other hand, the brand's presence in the Vapor Pens category in Washington was less prominent, as they only appeared in the rankings once in January 2025 at 91st place, and did not make the top 30 in other months. This absence suggests a potential area for growth or a need to reevaluate their approach in this category to gain a stronger foothold in the market.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Sweetwater Farms has experienced fluctuating rankings and sales, indicating a dynamic market position. Starting at rank 21 in December 2024, Sweetwater Farms saw a decline to rank 30 by February 2025, before slightly recovering to rank 26 in March 2025. This downward trend in rank coincided with a significant drop in sales from December to February, although there was a partial rebound in March. In contrast, Royal Tree Gardens maintained a relatively stable position, hovering around the 20th rank, despite a gradual decrease in sales. Meanwhile, Passion Flower Cannabis demonstrated resilience by climbing to the 18th rank in January 2025, with sales peaking during the same period. Withit Weed and Bodega Buds also showed varied performance, with Withit Weed making a notable jump from rank 40 in February to 27 in March. These competitive dynamics suggest that while Sweetwater Farms faces challenges in maintaining its market position, there are opportunities for strategic adjustments to regain traction in the Washington flower market.

Notable Products

In March 2025, the top-performing product for Sweetwater Farms was the Durban Poison Pre-Roll 2-Pack (1g) in the Pre-Roll category, climbing to the number 1 rank with a notable sales figure of 1003 units. Pie Squared (3.5g) in the Flower category secured the 2nd position, marking a strong entry as it was unranked in previous months. Laughing Gas (3.5g), also in the Flower category, held steady in the 3rd position, demonstrating consistent performance after a slight dip in February. Greasy Grapezz Pre-Roll 2-Pack (1g) dropped to 4th place from its 2nd position in January, indicating a decrease in sales momentum. Tropicana Jet Fuel Pre-Roll 2-Pack (1g) emerged in the 5th spot, showing a positive trend as it was previously unranked.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.