Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

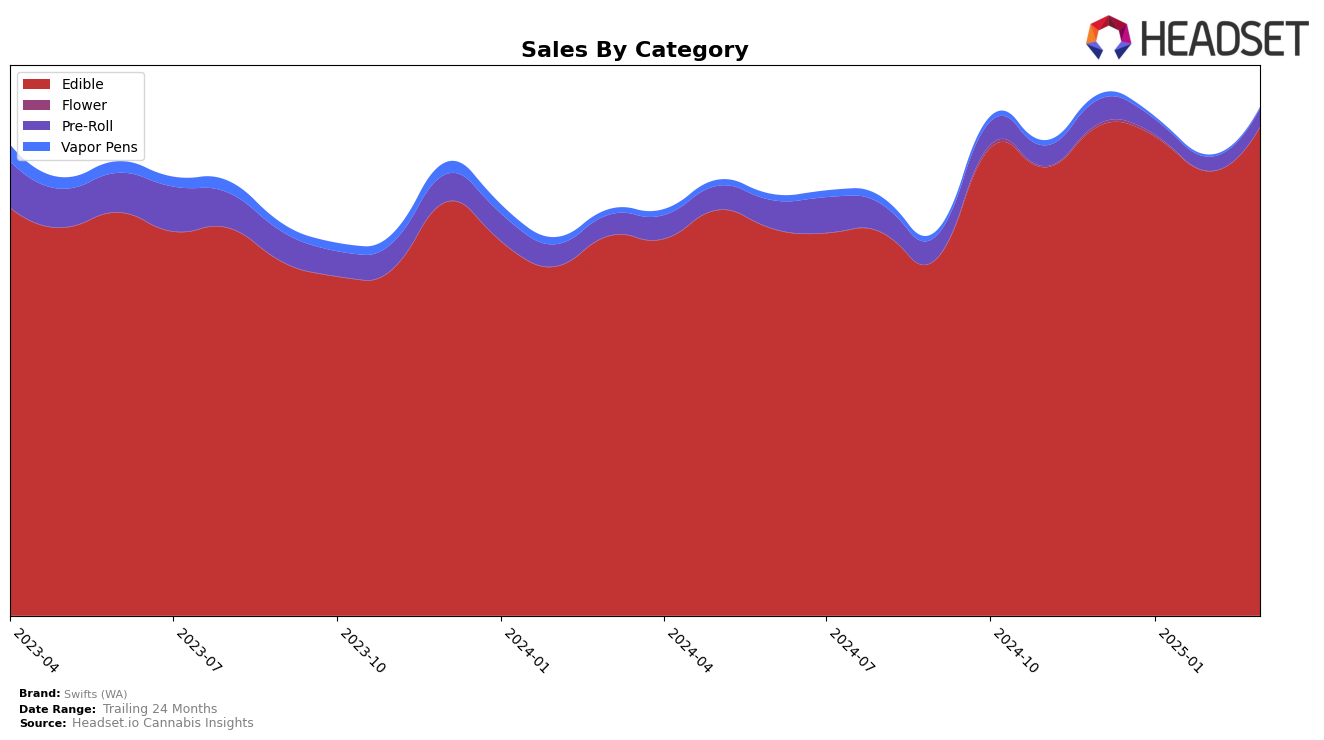

Swifts (WA) has shown a stable yet slightly fluctuating performance in the Edible category within the state of Washington. The brand maintained a strong presence, consistently ranking in the top 10. In December 2024, Swifts (WA) was ranked 7th, and it improved its position to 6th in both January and February 2025, before dropping back to 8th in March 2025. This indicates a competitive landscape where Swifts (WA) is a significant player, although the fluctuations suggest potential challenges or shifts in consumer preferences. Despite these rank changes, the sales figures reflect a resilience, with a noticeable increase in March 2025, hinting at a potential recovery or strategic adjustment by the brand.

The absence of Swifts (WA) in the top 30 rankings in other states or provinces suggests that the brand's presence is currently concentrated within Washington. This could be interpreted as a strategic focus on dominating the local market before expanding elsewhere, or it may point to a need for broader market penetration strategies. The consistent appearance in the rankings within Washington highlights the brand's stronghold in its home state, yet the lack of presence in other markets could be seen as a missed opportunity for growth. This localized success could serve as a foundation for future expansion, but the brand may need to assess its market strategies to replicate its Washington success in other regions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Swifts (WA) has experienced notable fluctuations in its rank and sales performance from December 2024 to March 2025. Swifts (WA) started at rank 7 in December 2024, improved to rank 6 in January and February 2025, but slipped to rank 8 in March 2025. This decline in rank coincides with a sales dip in February, although sales rebounded in March, suggesting a potential recovery. Competitors like Smokiez Edibles have shown a consistent upward trend, rising from rank 9 in December 2024 to rank 6 by March 2025, with sales peaking in March. Meanwhile, Good Tide experienced a slight decline in rank, moving from 6 in December 2024 to 7 in March 2025, despite a sales increase in March. Ceres maintained a steady rank at 9, while Cormorant consistently held the 10th position. These dynamics highlight the competitive pressure Swifts (WA) faces, particularly from brands like Smokiez Edibles, which could impact its market share if the trend continues.

Notable Products

In March 2025, Swifts (WA) saw Pink Lemonade Gummies 10-Pack (500mg) rank as the top-performing product, maintaining its number one position from January, with a notable sales figure of 2649. Milk Chocolate Peanut Butter Cups 10-Pack (500mg) followed closely in second place, slipping from its previous top rank in February. CBD Huckleberry Max Gummies 10-Pack (500mg CBD) climbed to third place from fourth, demonstrating a positive trend in sales. Sativa Peanut Butter Dark Chocolate Cups 10-Pack (100mg) remained steady, holding fourth place as in February. Sativa Peanut Butter Milk Rosin Chocolate 10-Pack (100mg) continued to rank fifth, consistent with its February position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.