Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

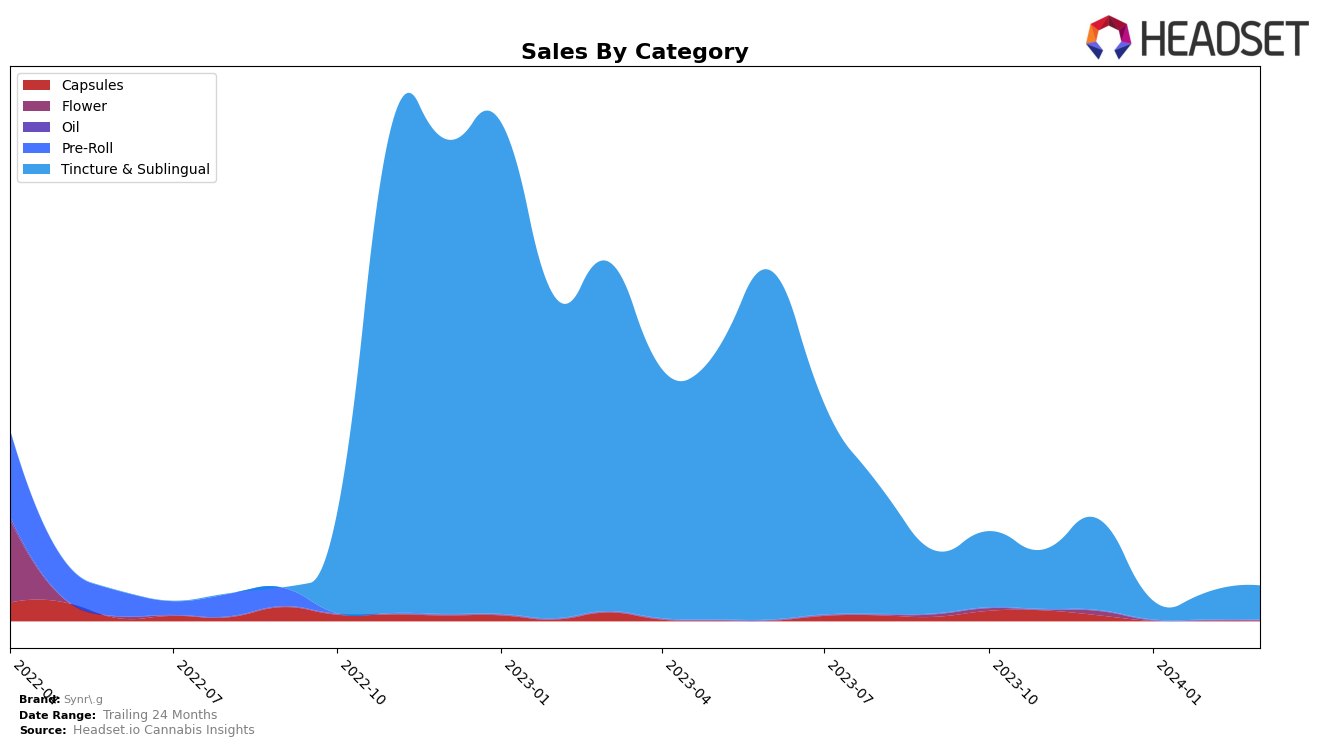

In the Alberta market, Synr.g has shown a consistent performance in the Tincture & Sublingual category, maintaining a second-place ranking from December 2023 through March 2024. This consistency is noteworthy, especially considering the fluctuation in sales figures, with a significant drop from December's 2447 units to 532 in January, then a slight decrease to 520 in February, followed by a substantial increase to 1082 units in March. This rollercoaster in sales, yet stability in ranking, suggests a strong brand loyalty or a lack of competition in Alberta's Tincture & Sublingual market. The provided data does not specify the reasons behind these sales fluctuations, but the sustained high ranking indicates a solid market position within Alberta. For more insights, one might explore the dynamics of the Tincture & Sublingual category in this province, including competitor analysis and consumer preferences, through the provided link.

On the other hand, Synr.g's performance in Ontario presents a mixed picture. In the Tincture & Sublingual category, the brand has experienced a slight decline, moving from a third-place ranking in December 2023 and January 2024 to fourth in February and March 2024. This shift, although minor, could indicate emerging competition or changing consumer preferences within Ontario's market. Interestingly, in the Capsules category, Synr.g was ranked 33rd in December 2023 but did not make it into the top 30 brands for the subsequent months. This disappearance from the rankings could be perceived negatively, signaling challenges in maintaining market visibility or consumer interest in this category. The absence of sales data for January through March leaves room for speculation on whether this was due to a drop in sales, changes in consumer behavior, or other market dynamics. Further analysis and comparison with other brands in Ontario's Capsules category could provide deeper insights, accessible through the link.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Alberta, Synr.g has maintained a consistent second rank from December 2023 through March 2024, indicating a stable position within the market. However, its primary competitor, Kin Slips, has consistently held the top rank during the same period, showcasing a significant lead in terms of market share. Notably, Synr.g's sales have seen fluctuations, with a notable dip in January and February 2024 before recovering in March 2024. In comparison, Kin Slips experienced a decrease in sales from December 2023 to February 2024 but saw a substantial increase in March 2024, widening the gap between the two brands. This trend suggests that while Synr.g is a strong contender in the Alberta Tincture & Sublingual market, Kin Slips' dominance and sales performance pose a significant challenge for Synr.g in terms of improving its rank and market share.

Notable Products

In Mar-2024, Synr.g's top product was the Fades - CBD:THC 1:1 Splash of Peach Sublingual Strips 10-Pack (50mg CBD, 50mg THC) from the Tincture & Sublingual category, maintaining its position from Feb-2024 with sales figures reaching 28 units. Following closely in second place was the Fades - CBD Zest of Orange Sublingual Strips 10-Pack (200mg CBD), also from the Tincture & Sublingual category, which saw a slight rank improvement from the third position in Feb-2024 to second, with undisclosed sales figures. Notably, the CBD:THC 1:1 Low Dose Capsule 15-Pack (37.5mg CBD, 37.5mg THC) from the Capsules category, which was previously ranked third in Dec-2023, did not make it to the top rankings from Jan-2024 onwards, indicating a shift in consumer preference or inventory changes. The Fades - Swirl of Raspberry Sublingual Strips 5-Pack (50mg) and Fantasy Island (1g) were not ranked in Mar-2024, suggesting a possible discontinuation or lack of sales. These shifts highlight an evolving market interest, with the Tincture & Sublingual category dominating Synr.g's product lineup in Mar-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.