May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

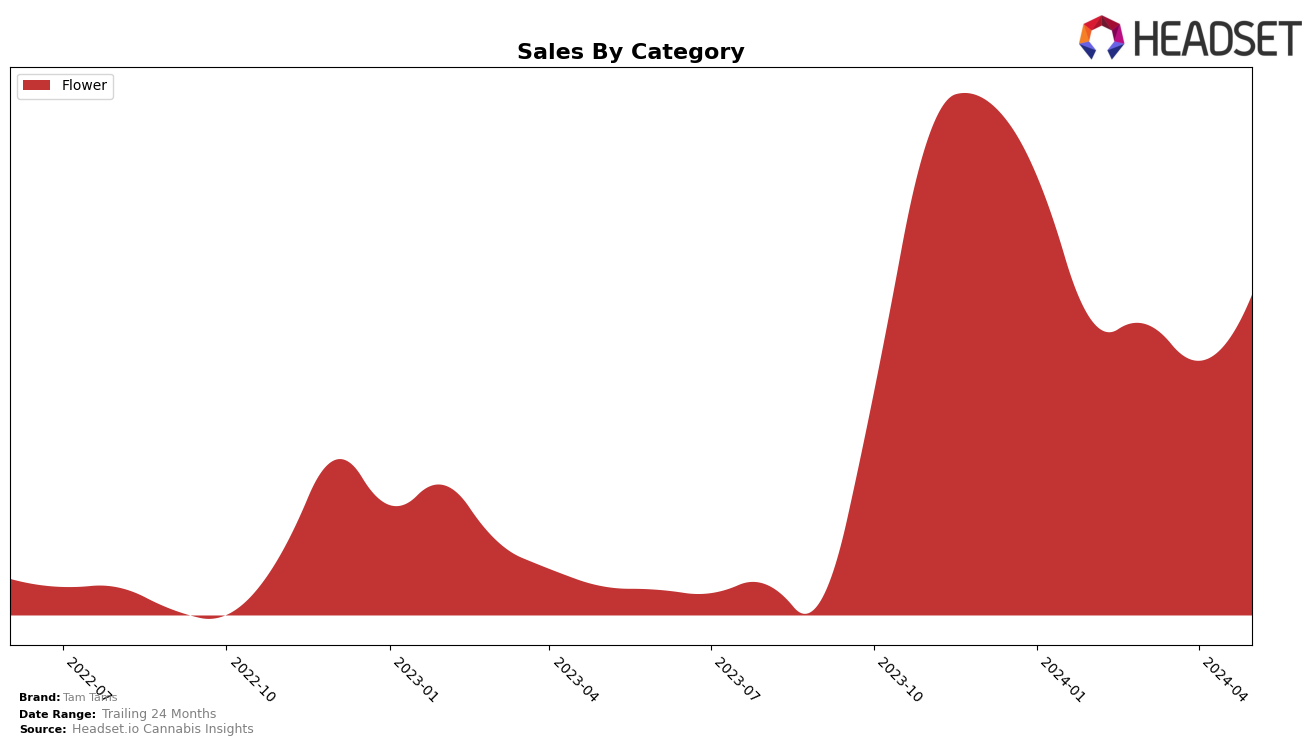

In the province of Alberta, Tam Tams has shown notable fluctuations in its performance within the Flower category. Starting from a rank of 32 in February 2024, the brand saw a slight decline in March to 33 and further slipped out of the top 30 in April, ranking at 40. However, May witnessed a significant rebound as Tam Tams climbed back to rank 29. This movement indicates a volatile market presence, with a strong recovery towards the end of the period. The brand's sales figures also reflect this trend, with a dip in March and April, but a substantial increase in May, suggesting a possible strategic shift or successful promotional efforts during that month.

While Tam Tams' performance in Alberta's Flower category had its ups and downs, the brand's absence from the top 30 in April is a point of concern. This drop could imply competitive pressures or seasonal variations affecting the brand's market share. However, the resurgence in May highlights the brand's resilience and potential for recovery. The overall trend suggests that while Tam Tams faces challenges, it also has the capability to bounce back, making it a brand to watch in the coming months. For a more detailed analysis of Tam Tams' performance across other states and categories, further data would be required.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Tam Tams has experienced notable fluctuations in its rank and sales over the past few months. Despite a dip in April 2024, where Tam Tams fell to the 40th position, it rebounded to the 29th rank by May 2024, showcasing resilience and potential for growth. This recovery is significant when compared to competitors like 1964 Supply Co, which consistently hovered around the 30s but improved to the 33rd rank in May 2024, and Palmetto, which maintained a stronger position in the mid-20s to 30s range. Carmel also showed a steady climb, reaching the 28th rank in May 2024, while Freedom Cannabis experienced a slight drop from the 21st to the 27th rank in the same period. These dynamics suggest that while Tam Tams faces stiff competition, its ability to bounce back indicates a competitive edge that could be further leveraged with strategic marketing and product positioning.

Notable Products

In May-2024, the top-performing product for Tam Tams was Tropical Milkshake (3.5g) in the Flower category, achieving the highest rank. Honeydew Melon (3.5g) followed closely in second place, also in the Flower category. Strawberry Guava (7g), which had previously held the top rank in April, dropped to third place with sales of 1034. Cherry Bloom (7g) and Strawberry Guava (3.5g) rounded out the top five, ranking fourth and fifth respectively. Notably, Cherry Bloom (7g) has seen a steady decline from its first-place position in February, while Strawberry Guava (3.5g) dropped from third in April to fifth in May.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.