Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

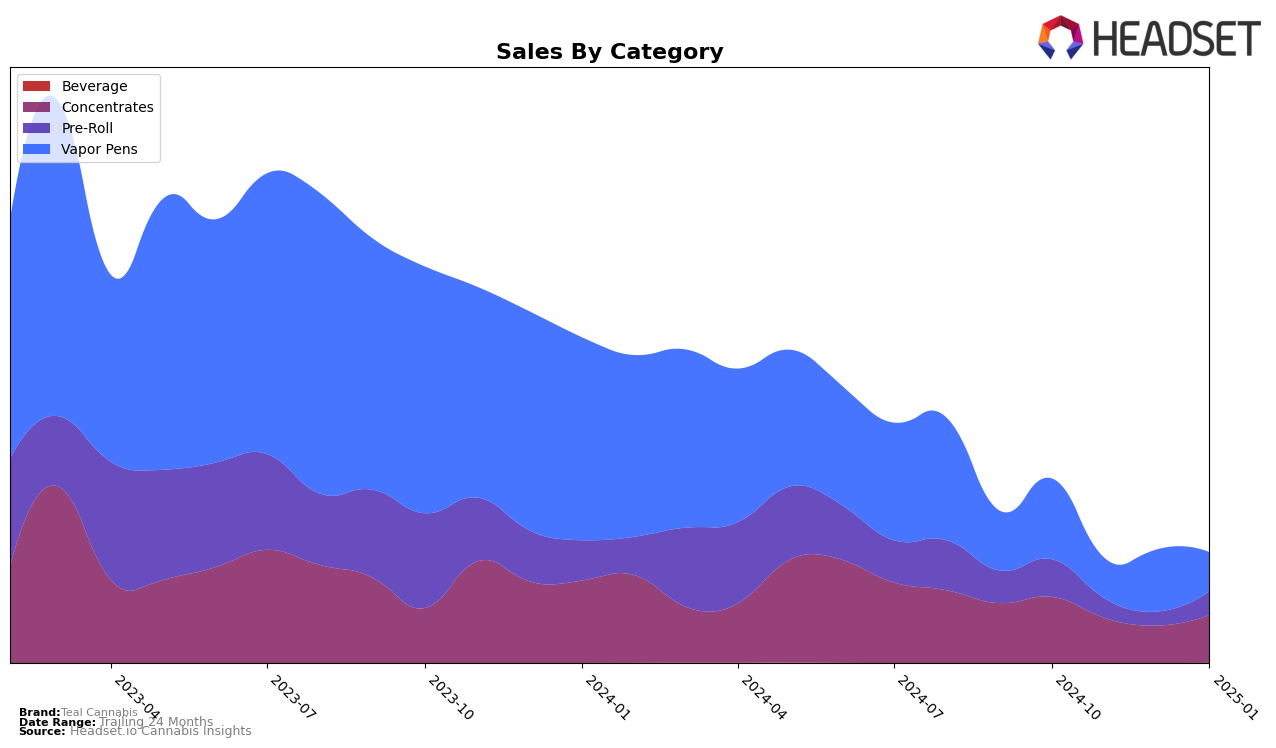

Teal Cannabis has shown varying performance across different product categories in Missouri. In the Concentrates category, the brand maintained a presence in the top 30, with rankings fluctuating from 21st in October 2024 to 28th by January 2025. This indicates a dip in their market position, although they managed to re-enter the top 30 after slipping to 32nd in December 2024. The sales figures reflect this volatility, with a notable drop in November but a subsequent recovery in January. Such trends suggest that while Teal Cannabis is facing challenges, it remains competitive in the Concentrates market.

In contrast, Teal Cannabis struggled in the Pre-Roll and Vapor Pens categories, failing to break into the top 30 in any month from October 2024 to January 2025. Specifically, in the Pre-Roll category, their rankings hovered in the 40s and 50s, with sales declining significantly in November and December before a slight recovery in January. Similarly, the Vapor Pens category saw inconsistent rankings, with a notable drop in sales in January 2025. This performance highlights potential areas for improvement, as Teal Cannabis seeks to strengthen its market presence and climb the rankings in these categories.

Competitive Landscape

In the Missouri concentrates market, Teal Cannabis has experienced fluctuating rankings over the past few months, indicating a competitive landscape. In October 2024, Teal Cannabis was ranked 21st, but by December, it had slipped to 32nd before recovering slightly to 28th in January 2025. This volatility contrasts with competitors like Dabstract, which maintained a relatively stable presence, peaking at 17th in November before dropping to 26th in January. Meanwhile, Buoyant Bob showed strong performance, reaching as high as 12th in November, although it also experienced a decline to 27th by January. The absence of Greenlight from the top 20 until December, when it appeared at 30th, suggests a late entry or resurgence in the market. Additionally, The Standard had an inconsistent presence, missing from the top 20 in November but reappearing at 27th in December. These dynamics highlight the challenges Teal Cannabis faces in maintaining a strong market position amidst aggressive competition and shifting consumer preferences.

Notable Products

In January 2025, Teal Cannabis saw Bubba Fett Pre-Roll 2-Pack (1g) reclaim its position as the top-performing product, with sales reaching 797 units. Cannalope Haze Pre-Roll 2-Pack (1g) emerged as a strong contender, securing the second rank with notable sales. Grape Frozay Pie Pre-Roll 2-Pack (1g) followed closely in third place, maintaining its presence in the top rankings from previous months. Goofiez Pre-Roll 2-Pack (1g) moved up to fourth position, showing an improvement from its debut in December. Super Skunk Live Badder (1g) was introduced to the rankings, achieving fifth place, indicating a promising start in the concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.