Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

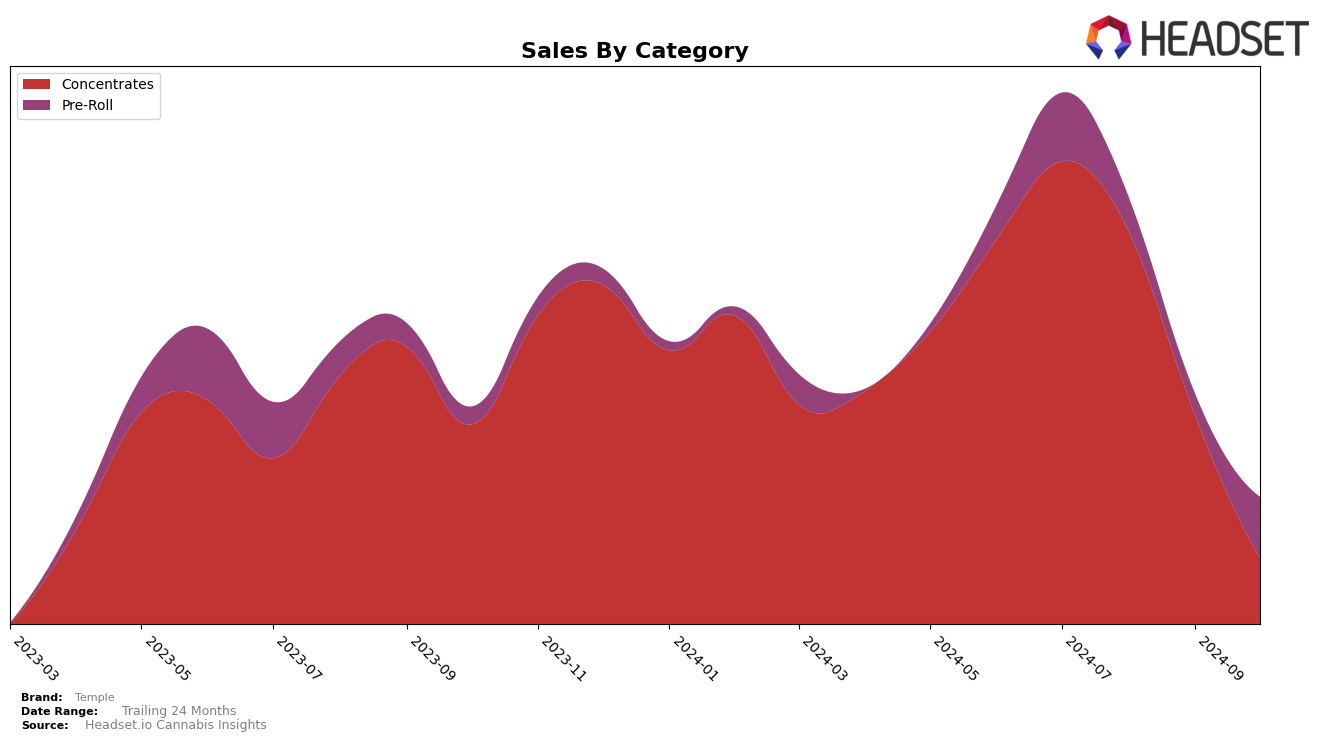

Temple's performance in the Concentrates category in Maryland has shown a noticeable decline over the past few months. In July 2024, Temple was ranked 18th, but by October, it had fallen out of the top 30. This downward trend is reflected in their sales figures, which saw a significant drop from July to September. The absence of Temple from the top 30 in October suggests a challenging market environment or a shift in consumer preferences within the state, potentially indicating increased competition or a need for strategic adjustments.

The data highlights a critical area of concern for Temple, particularly in maintaining its market position in Maryland. The decline in rankings across consecutive months underlines the importance of addressing the factors contributing to this trend. While the specific reasons for Temple's performance are not detailed here, understanding the dynamics of the Concentrates category and consumer behavior in Maryland could provide insights into potential recovery strategies. The lack of a ranking in October underscores the urgency for Temple to innovate or reposition itself to regain its standing in the market.

Competitive Landscape

In the Maryland concentrates market, Temple has experienced a notable decline in rank over the past few months, slipping from 18th in July 2024 to 22nd by September 2024, and failing to make the top 20 in October. This downward trend in rank is mirrored by a significant drop in sales, suggesting a potential need for strategic adjustments. In contrast, Roll One has shown a positive trajectory, moving up from 20th in August to 18th in September, indicating a strengthening position in the market. Meanwhile, Kings & Queens and Avexia have remained relatively stable, though they have not broken into the top 20, highlighting a competitive landscape where maintaining visibility is crucial. For Temple, understanding these dynamics and the competitive strategies of rising brands like Roll One could be key to regaining market share and improving sales performance.

Notable Products

In October 2024, the top-performing product from Temple was Sweeties Hash Infused Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 304 units. Sweeties Temple Ball Hash (1g) in the Concentrates category secured the second position, dropping from its previous first position in September. Peach Cobbler Temple Ball Hash (1g) saw a consistent decline in rankings from first in July to third in October. Sugar Cookies Nepalese Hash Ball (3.5g) entered the rankings for the first time in October, securing the third position in the Concentrates category. Hot Mint Sundae Hash Infused Pre-Roll (1g) reappeared in the rankings in October at fourth place, maintaining the same rank it held in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.