Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

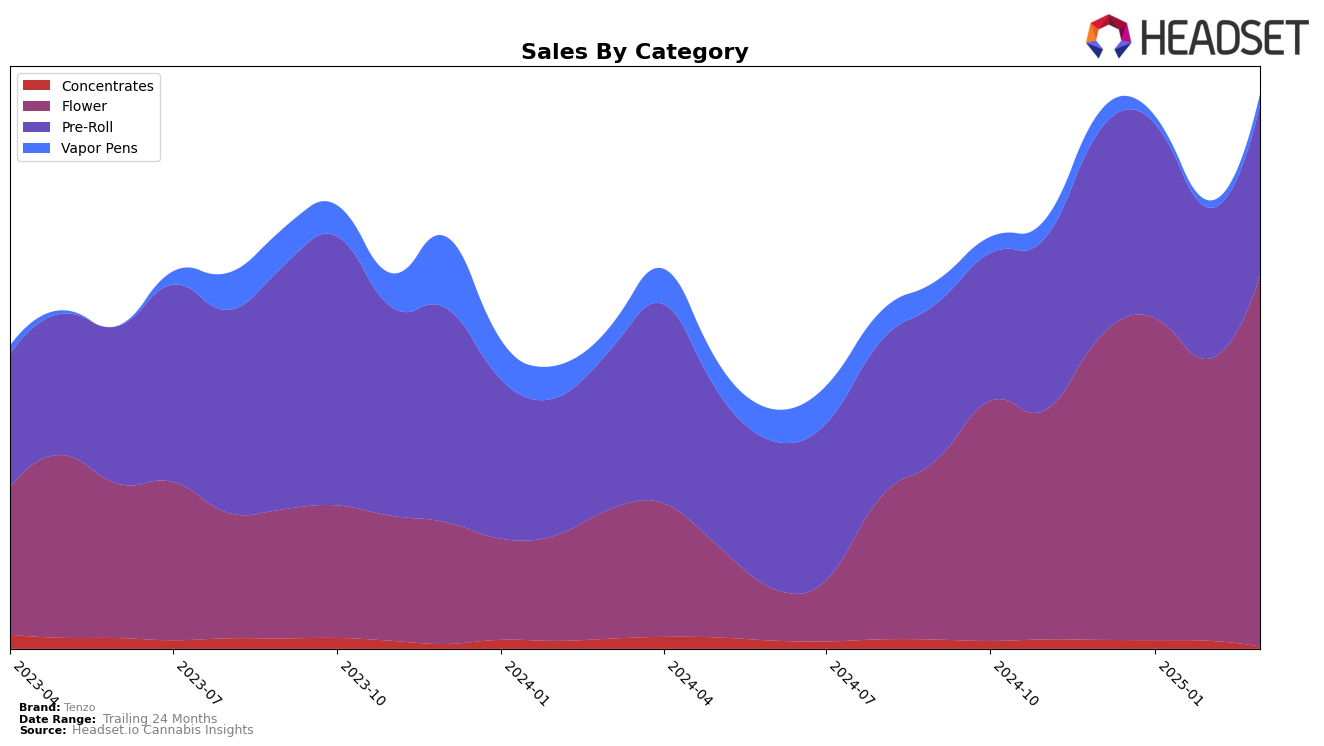

In the British Columbia market, Tenzo's performance in the Pre-Roll category has been relatively stable, though it has not yet broken into the top 30 brands. From December 2024 to March 2025, Tenzo's ranking fluctuated between the 51st and 60th positions, indicating some volatility in their market presence. Despite not making it to the top tier, Tenzo's sales in this category reflect a resilience, with a notable increase in January 2025 compared to December 2024, followed by a dip in February and a recovery in March. This suggests that while Tenzo faces challenges in gaining a stronger foothold, there is potential for growth if they can maintain and capitalize on upward trends.

In Ontario, Tenzo has shown a stronger performance in the Flower category, where they have made significant strides, improving their rank from 44th in December 2024 to 28th by March 2025. This upward trajectory highlights Tenzo's growing influence and competitive edge in the Flower market within Ontario. Conversely, their performance in the Pre-Roll category within the same province has remained relatively stagnant, with ranks hovering in the high 80s and low 90s, indicating a need for strategic realignment to boost their presence. The contrasting performances across these categories underscore the varying dynamics and consumer preferences in Ontario's cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Tenzo has shown a notable upward trajectory in its ranking, moving from 44th in December 2024 to 28th by March 2025. This improvement is significant, especially when compared to competitors like BLKMKT, which maintained a relatively stable position around the mid-20s, and Muskoka Grown, which fluctuated slightly but did not experience the same upward momentum as Tenzo. Meanwhile, Carmel experienced a slight decline in rank from 24th to 26th, despite having higher sales figures than Tenzo throughout the period. Interestingly, EastCann also showed a significant rise in rank, closely mirroring Tenzo's trajectory, moving from 39th to 29th. These shifts suggest that Tenzo's strategic initiatives may be effectively capturing market share and driving sales growth, positioning it as a rising contender in the Ontario Flower market.

Notable Products

In March 2025, Tenzo's top-performing product was Cocoa Delight Infused Blunt (1g) in the Pre-Roll category, maintaining its position as the best-seller with sales reaching 4456 units. Following closely, Fun Trip Milled (7g) in the Flower category rose to the second spot, up from third place in the previous two months. Frosted Pancakes Infused Pre-Roll (0.5g) secured the third rank, showing improvement from the fourth position in February. Iced Cream Infusion Infused Pre-Roll (0.5g) experienced a decline, dropping from the top rank in February to fourth in March. Big Smallz (14g) in the Flower category remained consistent, holding the fifth rank throughout the months analyzed.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.