Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

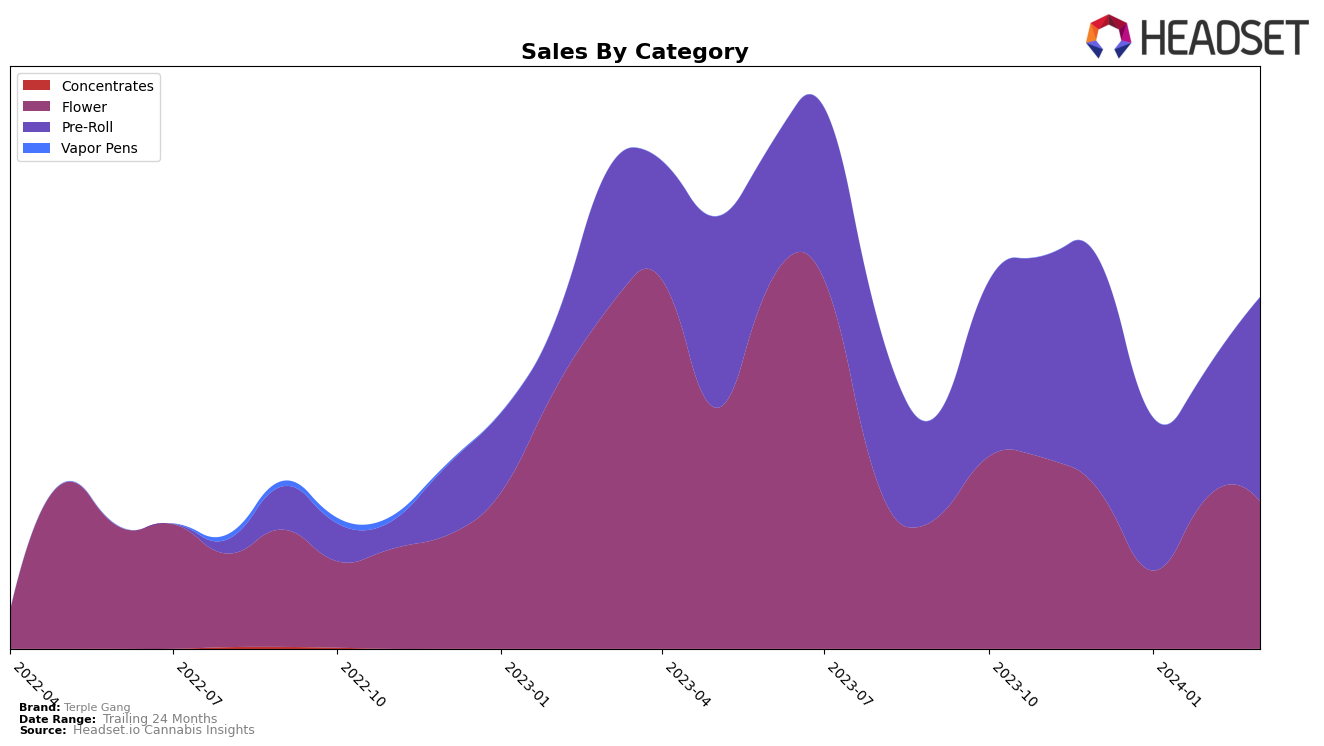

In Michigan, Terple Gang has shown a fluctuating performance in the Pre-Roll category over the recent months. Starting at rank 30 in December 2023, they made a slight improvement to rank 29 in January 2024, which indicates a marginal increase in their market presence. However, February 2024 saw a significant drop, as Terple Gang fell out of the top 30, landing at rank 46. This drop could be considered a setback for the brand, suggesting a decline in their competitiveness within Michigan's Pre-Roll market. Despite this, they managed to climb back to rank 29 by March 2024, showing resilience and an ability to recover. This recovery is further underscored by their sales in March 2024, which increased to 274,020, indicating a rebound in consumer interest and market performance.

Such movements in rankings and sales figures highlight the volatile nature of the cannabis market in Michigan, particularly within the Pre-Roll category. Terple Gang's ability to regain its position in the top 30, after falling significantly in February, suggests that the brand may have adjusted its strategies or benefited from market dynamics to enhance its appeal and sales. This performance trajectory, marked by initial stability, a notable dip, and a subsequent recovery, provides useful insights into the brand's market resilience. However, the details behind their strategies for recovery and the specific factors contributing to their February decline are not disclosed, leaving room for speculation on how Terple Gang navigated these market challenges. The fluctuating performance also underscores the competitive nature of the cannabis market in Michigan, where brand rankings can shift significantly within a short period.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, Terple Gang has experienced a fluctuating journey in terms of its market position. Starting from a rank of 30 in December 2023, it saw a slight improvement in January 2024, moving up to 29, before experiencing a significant drop to 46 in February 2024. However, it managed a slight recovery, reaching rank 29 by March 2024. This trajectory indicates a volatile market presence when compared to its competitors. Notably, Sapphire Farms showed a remarkable improvement, jumping from rank 57 in February to 27 in March, and Caviar Gold made a significant leap from rank 60 in February to 31 in March, showcasing substantial sales increases. In contrast, Grown Rogue and High Minded maintained more stable positions, indicating a consistent performance. Terple Gang's fluctuating rank and the dynamic shifts among its competitors highlight the competitive and ever-changing nature of Michigan's Pre-Roll cannabis market, suggesting the need for strategic adjustments to enhance market standing and sales performance.

Notable Products

In March 2024, Terple Gang saw Super Boof Pre-Roll (1g) as its top-selling product, with impressive sales figures reaching 16,083 units, reclaiming its position as the number one product after being second in the rankings for the previous two months. Following closely, Oreoz Pre-Roll (1g) secured the second spot, moving up from its previous third-place position in both January and February. The third, fourth, and fifth rankings were newly occupied by Cap Junky Pre-Roll (1g), Rocket Fuel Pre-Roll (1g), and Howling Diablo Pre-Roll (1g) respectively, indicating a significant shake-up in the product lineup. Notably, Cap Junky Pre-Roll (1g) made an impressive debut in the rankings at the third position with sales figures that were competitive but not disclosed. This month's data showcases a dynamic shift in consumer preferences within Terple Gang's product offerings, highlighting the popularity and rising demand for their Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.