May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

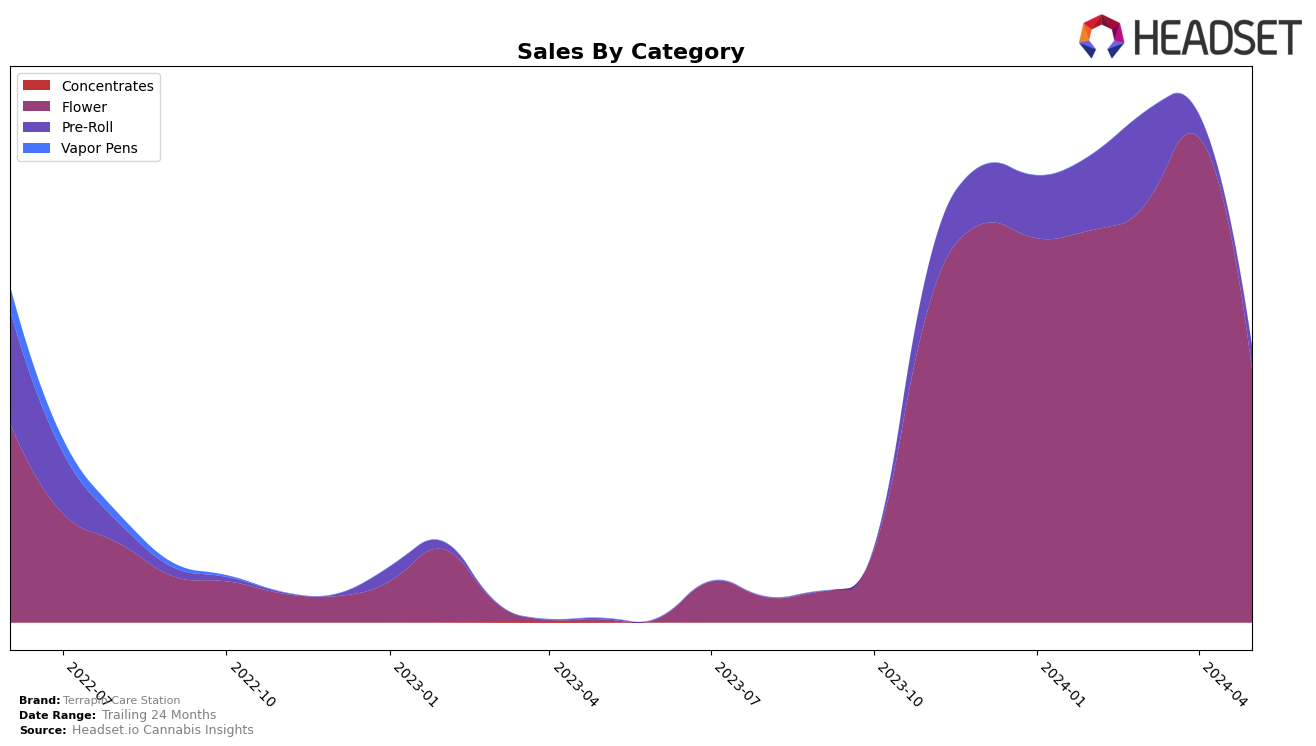

Terrapin Care Station has shown notable performance across different categories in Colorado. In the Flower category, the brand maintained a strong presence, consistently ranking within the top 10 from February to May 2024. Specifically, it held the 4th position in February and April, 5th in March, and dropped to 7th in May. Despite the dip in May, the brand's sales figures reveal an upward trend from February through April, peaking at over $1.3 million in April before a decrease in May. This indicates a solid performance in the Flower category, although the recent drop suggests potential challenges or increased competition.

In contrast, Terrapin Care Station faced more volatility in the Pre-Roll category in Colorado. The brand started strong, improving from the 10th position in February to 8th in March. However, by April and May, it had fallen out of the top 30, landing at 37th place. This significant drop is concerning, as it suggests a sharp decline in market presence and sales, which were markedly lower in April and May compared to the earlier months. This performance disparity between the Flower and Pre-Roll categories highlights the brand's varying success across different product lines, indicating areas that may require strategic adjustments.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Terrapin Care Station has experienced notable fluctuations in rank and sales from February to May 2024. Despite starting strong with a rank of 4th in February and maintaining a similar position in April, Terrapin Care Station saw a decline to 7th place in May. This drop is significant when compared to competitors such as Green Dot Labs, which improved its rank from 10th in April to 5th in May, and The Health Center, which also climbed from 11th in April to 6th in May. Additionally, Artsy Cannabis Co showed a steady improvement, moving from 14th in March to 8th in May. These shifts suggest that while Terrapin Care Station has a strong presence, it faces increasing competition from brands that are rapidly gaining market share. The dynamic changes in rankings highlight the importance for Terrapin Care Station to innovate and adapt its marketing strategies to maintain and grow its market position.

Notable Products

In May 2024, the top-performing product for Terrapin Care Station was Sunset Sherbert (3.5g) in the Flower category, achieving the highest sales with $2971. Gorilla Glue #4 (3.5g), also in the Flower category, closely followed in second place. Galactic Sunset Pre-Roll 5-Pack (5g) secured the third position in the Pre-Roll category. Garlicane (14g) and Tropsanto #5 (3.5g), both in the Flower category, ranked fourth and fifth respectively. Notably, these rankings represent the first recorded positions for these products, indicating a strong performance in May compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.