Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

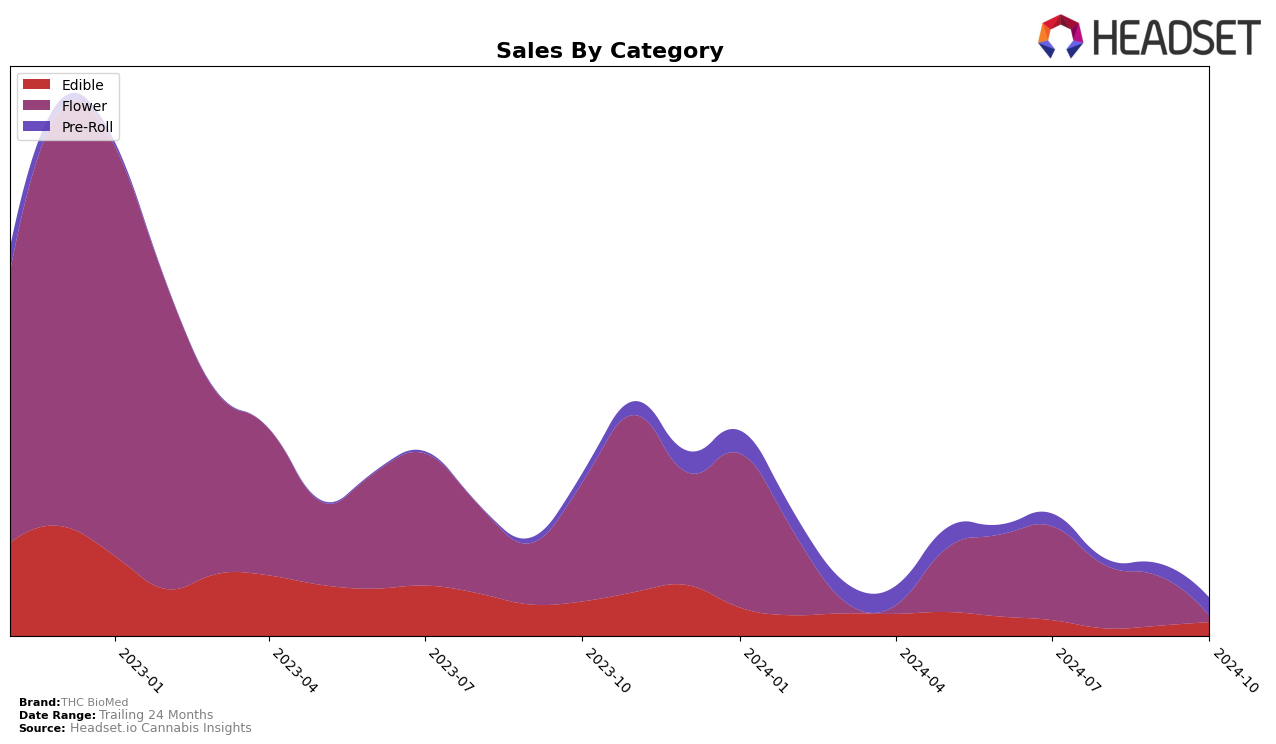

In the province of British Columbia, THC BioMed has shown a notable improvement in the Flower category. After not being ranked in the top 30 brands for July 2024, THC BioMed made significant strides by achieving the 97th rank in August and further climbing to the 87th position in September. This upward trend indicates a positive reception of their products within the province, although they still have room for growth to break into the top 30. The increase in sales from July to August, from $17,213 to $18,817, supports this positive trajectory, suggesting that THC BioMed's market strategies might be gaining traction among consumers in British Columbia.

The absence of THC BioMed from the top 30 rankings in October 2024 across all categories in British Columbia may be a cause for concern, as it suggests a potential decline in market presence or increased competition from other brands. This drop could indicate that while there was an initial surge in interest, sustaining that momentum has proven challenging. The lack of a ranking in October could also reflect seasonal fluctuations or shifts in consumer preferences that THC BioMed might need to address. Understanding these dynamics is crucial for THC BioMed to strategize effectively and regain or enhance its market position in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, THC BioMed has experienced notable fluctuations in its market position. Despite not ranking in July 2024, THC BioMed made a significant leap to 97th place in August and further improved to 87th in September. However, it did not maintain a top 20 position in October. This upward trend in rank suggests a positive reception of their products, although they still trail behind competitors like Delta 9 Cannabis, which started at 39th place in July and gradually declined to 68th by September. Meanwhile, Greybeard and All Nations showed varied performances, with Greybeard ranking 75th in July and dropping to 100th by September, and All Nations appearing in the top 100 only in July and October. The entry of Herbal Dispatch Craft in October at 89th place further intensifies the competition. These dynamics indicate that while THC BioMed is gaining traction, it faces stiff competition from established brands, necessitating strategic efforts to sustain and enhance its market presence.

Notable Products

In October 2024, THC BioMed's top-performing product was THC Kiss Shortbread Biscuit (10mg), which climbed to the number one rank with sales of 1,181 units. Following closely in second place was the Durga Mata II CBD Pre-Roll 3-Pack (1.5g), which improved its position from third in September to second in October. THC Kiss Cinnamon Biscuit (10mg) also showed a notable rise, moving from fourth in September to third in October. THC Kiss - Cocoa Biscuit (10mg) maintained a steady presence, securing the fourth spot, while BC Grizzly (3.5g) experienced a significant drop from first place in September to fifth in October. The rankings highlight a strong performance in the Edible category, with THC Kiss products dominating the top positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.