Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

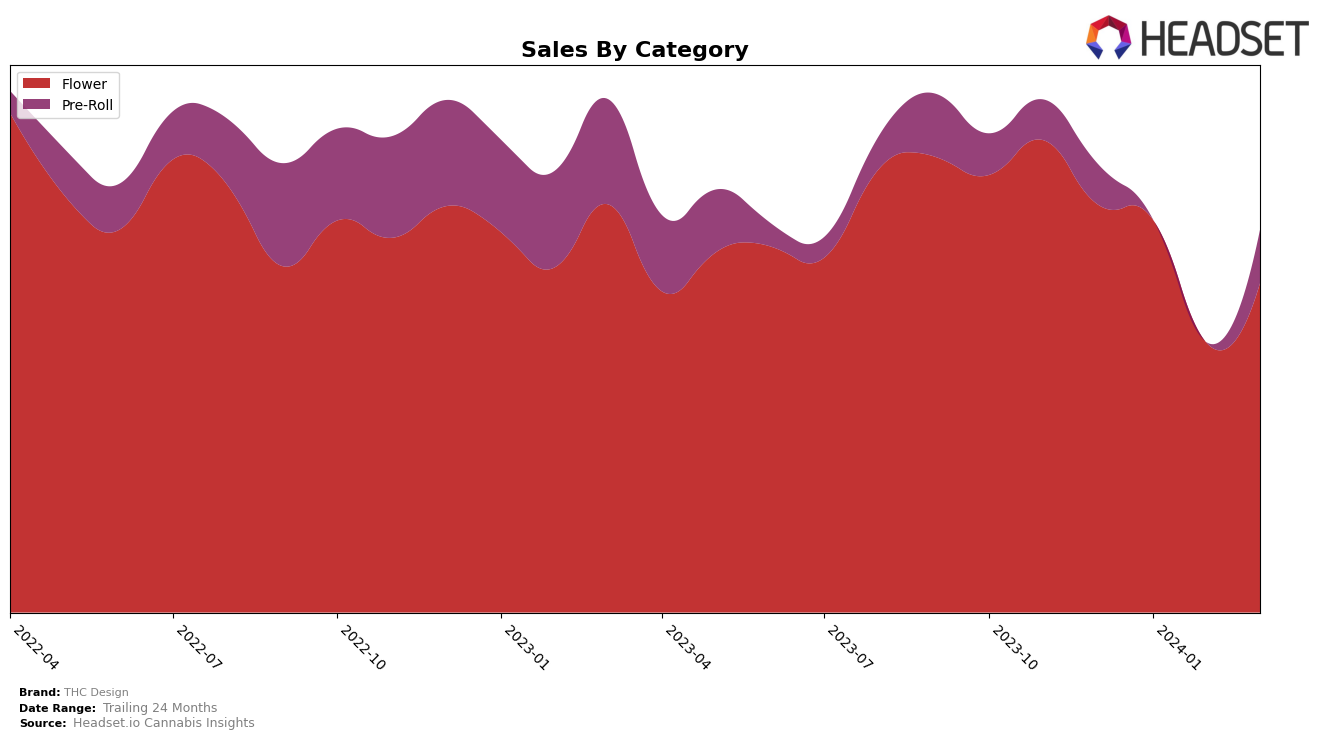

In California, THC Design has shown a fluctuating performance across different cannabis product categories. In the Flower category, the brand witnessed a slight decline in its ranking from December 2023 to February 2024, moving from 25th to 35th place, which indicates a struggle to maintain its position within the top 30 brands. However, there was a slight improvement in March 2024, with the rank moving up to 29th. This recovery suggests a potential rebound in consumer interest or strategic adjustments by THC Design. The sales figures reflect this journey, with a notable dip in February 2024 to 861,743, followed by a partial recovery in March 2024. The Pre-Roll category tells a story of resilience and improvement. Despite starting outside the top 30 in December 2023 and experiencing further decline, THC Design made a significant leap in March 2024 to rank 38th, alongside an increase in sales, hinting at effective strategic changes or increased consumer acceptance in this category.

The overall performance of THC Design in California suggests a brand navigating through challenges and opportunities within a competitive market. The Flower category, while experiencing a temporary setback, shows signs of recovery which might interest stakeholders looking for trends in consumer preferences or market dynamics. The Pre-Roll category's improvement from not ranking within the top 30 to achieving a notable position by March 2024 is particularly noteworthy. It highlights THC Design's potential to adapt and grow, even in less favorable conditions. These movements across categories underscore the importance of monitoring brand performance over time to understand the underlying factors driving changes in rankings and sales. While the specifics of these strategic adjustments are not disclosed, the observed trends provide valuable insights into THC Design's market resilience and areas of growth.

Competitive Landscape

In the competitive landscape of the California flower market, THC Design has experienced fluctuations in its ranking and sales over recent months. From December 2023 to March 2024, THC Design saw a decline in rank from 25th to 29th, indicating a challenging period with decreasing sales figures. Competitors such as Cream Of The Crop (COTC) and HOTBOX (CA) have shown variable performance but remained in closer proximity to THC Design in rankings, with Cream Of The Crop (COTC) experiencing a slight drop to 31st by March 2024, and HOTBOX (CA) improving to 30th. Notably, Rio Vista Farms and Astronauts (CA) demonstrated significant upward mobility, with Astronauts (CA) making a remarkable leap from 66th to 27th place within the same period, surpassing THC Design by March 2024. This shift suggests a dynamic and competitive market environment where brands such as THC Design must continuously innovate and adapt to maintain and improve their market position amidst fluctuating sales and the aggressive ascent of competitors.

Notable Products

In March 2024, THC Design's top-performing product was Garlic Cocktail (3.5g) within the Flower category, achieving the highest sales with 6374 units sold. Following closely behind was Crescendo (3.5g), also in the Flower category, which moved from the top position in previous months to second place. Confidential OG (3.5g) secured the third spot, showing consistent improvement in its ranking over the past months. Notably, Crescendo Pre-Roll 6-Pack (3.5g) made its debut in the rankings at fourth place, indicating a growing interest in the Pre-Roll category. The rankings highlight a dynamic shift in consumer preferences, with Crescendo Pre-Roll (1g) rounding out the top five, despite its absence in the rankings in February 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.