Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

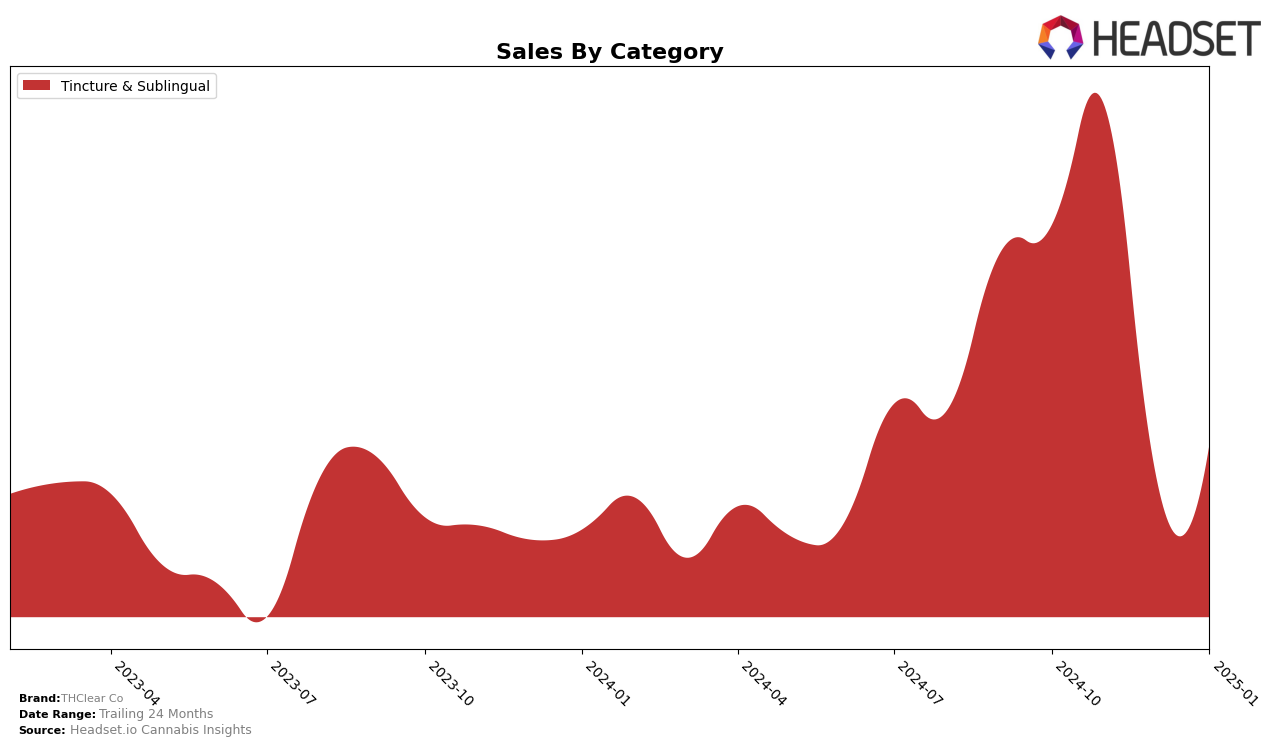

THClear Co has shown varying performance across different categories and states, with notable movements in the Tincture & Sublingual category in Oregon. In October 2024, THClear Co ranked 13th in this category, improving to 8th in November. However, by December, they fell out of the top 30, indicating a significant drop in market presence. By January 2025, they regained their 13th position, suggesting a partial recovery. This fluctuation may reflect changes in consumer preferences or competitive dynamics within the state, highlighting the challenges and opportunities in maintaining a consistent market position.

The absence of THClear Co from the top 30 rankings in December 2024 in Oregon could be seen as a setback, especially given their earlier progress. Despite this, their ability to re-enter the rankings by January 2025 demonstrates resilience and possibly strategic adjustments. The sales figures also reflect this volatility, with a peak in November followed by a decline in subsequent months. Such trends may suggest that while THClear Co can capture market interest, sustaining it requires ongoing effort and adaptation to market conditions. Understanding these dynamics could be crucial for stakeholders looking to leverage or invest in the brand's potential growth.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Oregon, THClear Co has demonstrated notable fluctuations in its ranking over the last few months, reflecting dynamic shifts in market positioning. In October 2024, THClear Co held the 13th position, which improved significantly to 8th in November, indicating a strong upward trend in sales performance. However, the brand did not maintain a top 20 rank in December, suggesting a temporary decline or increased competition. By January 2025, THClear Co regained its footing, returning to the 13th position. This volatility contrasts with brands like Medicine Farm, which consistently hovered around the 12th to 14th ranks, and Luminous Botanicals, which showed a steady improvement, reaching the 11th rank by January 2025. Meanwhile, Dr. Jolly's experienced a decline from 5th in October to falling out of the top 20 by January, highlighting the competitive pressures in this category. The emergence of Resonance Farm in January at the 12th rank further underscores the shifting dynamics, presenting both challenges and opportunities for THClear Co to strategize and stabilize its market position.

Notable Products

In January 2025, the top-performing product for THClear Co was the CBD Pineapple Syrup Tincture (100mg CBD), maintaining its first-place ranking consistently from October 2024 through January 2025. This product, part of the Tincture & Sublingual category, achieved sales of 282 units in January. Its sustained top position highlights its popularity and consistent demand over consecutive months. Notably, despite fluctuations in sales figures from month to month, this product has managed to retain its leading position. The steady performance of the CBD Pineapple Syrup Tincture underscores its strong market presence within THClear Co's lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.