Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

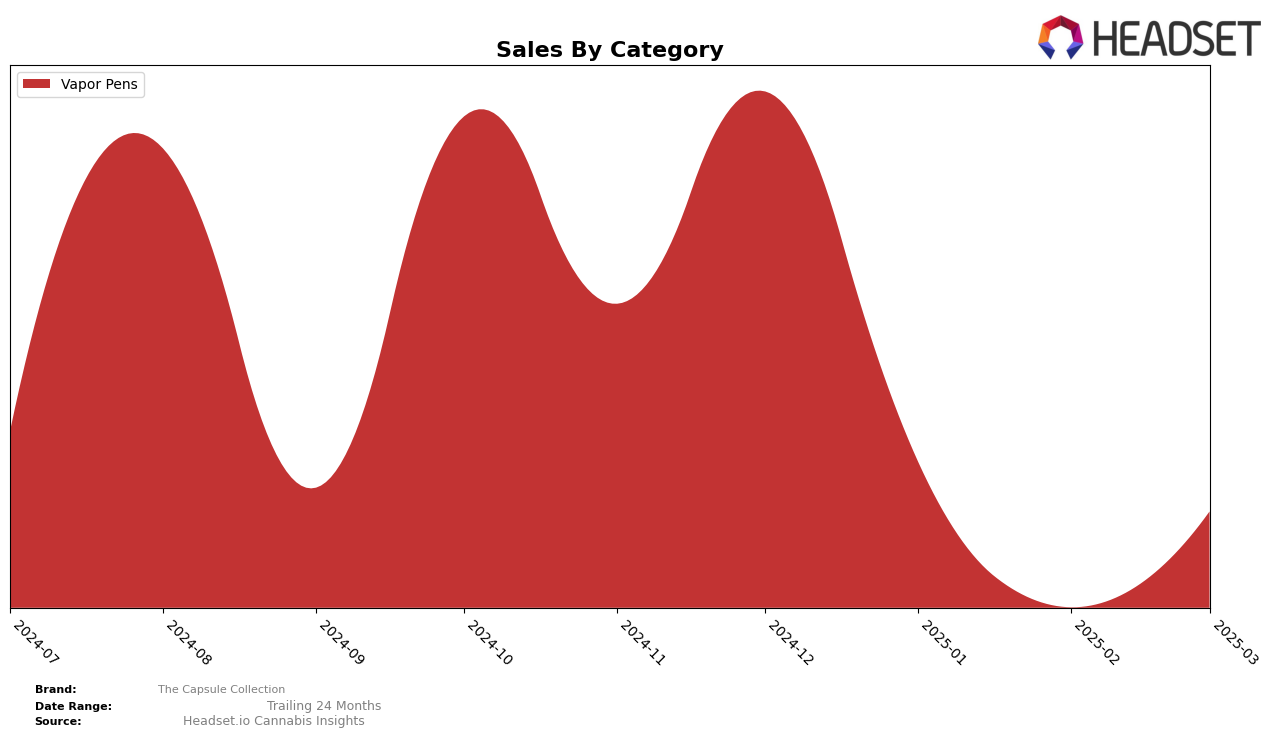

The Capsule Collection has shown a consistent performance in the Vapor Pens category within Washington, maintaining a steady rank of 17th place from December 2024 through February 2025, before slightly improving to 16th place in March 2025. This upward movement, albeit minor, suggests a positive reception or strategic adjustment that has slightly boosted their market presence. While their sales figures have fluctuated, with a notable dip in January 2025, the brand's ability to remain within the top 20 indicates a resilient market position in a competitive category.

Despite the fluctuations in sales figures, the brand's consistent ranking within the top 20 in Washington's Vapor Pens category is a positive indicator of their brand strength and customer loyalty. However, it is important to note that The Capsule Collection did not make it into the top 30 brands in any other state or category during this period. This lack of presence in other markets could be interpreted as a limitation in their geographical reach or category diversification, potentially highlighting areas for growth and expansion. Understanding the dynamics and consumer preferences in other states could provide valuable insights for future strategic planning.

Competitive Landscape

The Capsule Collection, operating in the Vapor Pens category in Washington, has shown a consistent presence in the market, maintaining a steady rank from December 2024 to March 2025. It started at 17th place and improved slightly to 16th by March 2025. This stability in rank is notable given the competitive landscape, where brands like Slusheez have maintained a solid 14th rank throughout the same period, indicating a strong foothold. Meanwhile, Buddies has fluctuated slightly but remained ahead of The Capsule Collection, holding the 15th position in March 2025. Despite these challenges, The Capsule Collection's sales trajectory shows a recovery from a dip in January and February 2025, suggesting effective strategies to regain market share. As competitors like AiroPro and O'Geez (WA) also vie for consumer attention, The Capsule Collection's ability to improve its rank and stabilize sales is a testament to its resilience and potential for growth in the Washington market.

Notable Products

In March 2025, The Capsule Collection's top-performing product was the White Gummiez Distillate Disposable (1g) in the Vapor Pens category, reclaiming the number one spot with sales of 2,461 units. Mixed Berriez Distillate Disposable (1g) followed closely in second place, maintaining its position from the previous month. The Happy Pill - Pineapple Maui Wowie Distillate Disposable (1g) ranked third, showing a slight decline from February where it was second. Watermelon OG Distillate Disposable (1g) held steady in fourth place, consistently staying within the top five over the past months. Blueberry Dream Flavored Distillate Disposable (1g), which was the top product in February, fell to fifth place in March, indicating a notable shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.