Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

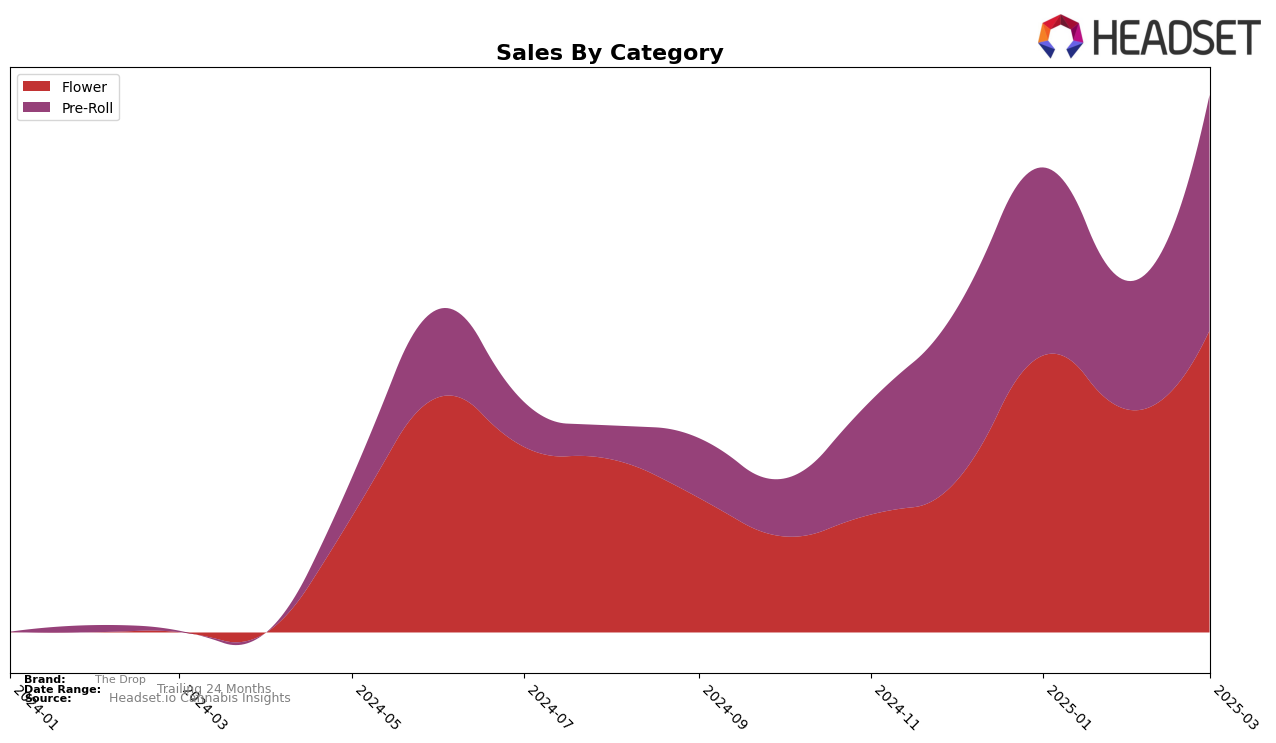

The Drop has shown notable movements in its performance across different categories and states, particularly in Alberta. In the Flower category, The Drop made a significant leap in rankings from being outside the top 30 in December 2024 to securing the 30th position by March 2025. This upward trend in Alberta's Flower market indicates a strengthening presence and potential growth in consumer demand. While the Pre-Roll category also saw improvements, The Drop did not break into the top 30 until March 2025, when it reached the 42nd position, suggesting a slower yet positive trajectory in this segment.

Despite not being in the top 30 brands in Alberta's Pre-Roll market for several months, The Drop's progress to 42nd place by March 2025 is indicative of growing traction. The sales figures for both categories reflect a consistent upward trend, with the Flower category seeing a notable increase from December 2024 to March 2025. This suggests that while The Drop is gaining ground in Alberta, there is still significant room for improvement, particularly in the Pre-Roll sector. The brand's ability to climb the rankings in the Flower category could be a precursor to similar success in other categories if current trends continue.

Competitive Landscape

In the competitive landscape of the flower category in Alberta, The Drop has shown a significant upward trajectory in its rankings from December 2024 to March 2025. Starting from a rank of 53 in December, The Drop made a substantial leap to rank 30 by March 2025, indicating a positive shift in market position. This improvement is noteworthy when compared to competitors like Twd., which saw a decline from rank 14 to 34 over the same period, and Boaz, which maintained a relatively stable position around the high 20s. Meanwhile, Tribal and RIPPED experienced minor fluctuations but did not exhibit the same upward momentum as The Drop. This trend suggests that The Drop is gaining traction and potentially capturing market share from its competitors, which could be attributed to strategic marketing efforts or product differentiation. As The Drop continues to climb the ranks, it positions itself as a formidable player in the Alberta flower market, appealing to consumers and investors alike.

Notable Products

In March 2025, the Rainbow P Pre-Roll 3-Pack (1.5g) maintained its top position as the best-selling product for The Drop, with an impressive sales figure of 6850 units. The Black Milk Pre-Roll 3-Pack (1.5g) reclaimed its second-place rank after dropping to third in February. Rainbow Pie (7g) consistently held the third position, showing a steady performance across the months. Guava Bomba (7g) experienced a slight dip, moving from second place in February to fourth in March. Notably, Okanagan Pink Kush Smalls (28g) made a return to the rankings, landing at twelfth place after being absent in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.