Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

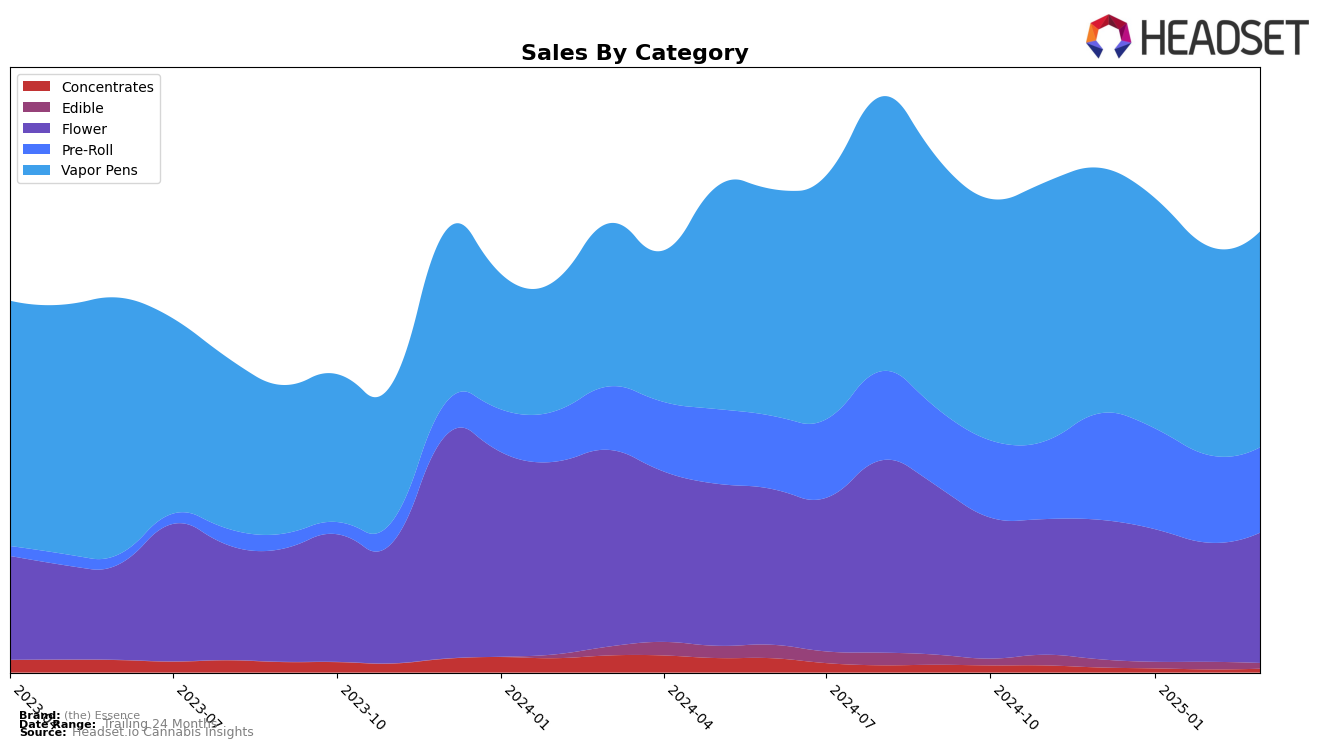

In Illinois, (the) Essence has shown varied performance across different product categories. Their Flower category experienced slight fluctuations in rank, moving from 22nd in December 2024 to 21st by March 2025. This indicates a relatively stable presence in the market, albeit not in the top tier. In contrast, their Pre-Roll category maintained a stronger position, ranking consistently within the top 10, though it did slip from 4th to 6th place by March 2025. The Vapor Pens category demonstrated notable stability, holding the 5th position throughout the period, reflecting a strong and consistent consumer preference for this product type in Illinois.

In Maryland, (the) Essence's performance highlights some interesting trends. Their Flower category improved steadily, climbing from 22nd in December 2024 to 18th by March 2025, indicating growing popularity. However, the Pre-Roll category saw a lack of data in February 2025, suggesting a drop out of the top 30 brands, which could be a concern for maintaining market share. Vapor Pens, on the other hand, showed a positive trajectory, improving from the 11th rank to 8th by March 2025, suggesting increasing consumer interest. Meanwhile, in New Jersey, the brand's Vapor Pens consistently ranked in the top 3, underscoring a strong foothold in the state. However, the Pre-Roll category experienced a noticeable decline, dropping from 2nd to 6th place, which may require strategic adjustments to regain higher rankings.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, (the) Essence has maintained a consistent rank at 5th place from December 2024 through March 2025, indicating a stable position amidst fluctuating market dynamics. Despite this consistency, (the) Essence faces significant competition from brands like Joos and Ozone, which have alternated between 3rd and 4th positions, suggesting a stronger market presence. Notably, Joos experienced a sales surge in March 2025, potentially impacting (the) Essence's market share. Meanwhile, Rove has shown an upward trend, moving from 9th to 6th position by February 2025, which could pose a future threat to (the) Essence's rank. As the market evolves, (the) Essence's ability to innovate and capture consumer interest will be crucial in maintaining or improving its competitive standing.

Notable Products

In March 2025, the top-performing product for (the) Essence was Yum Yum 3.5g in the Flower category, maintaining its leading position from February with sales reaching 11,056 units. B52 Bomber 3.5g, also in the Flower category, emerged as the second best-seller, showing strong sales figures for its debut rank. Pineapple Express Distillate Cartridge 1g in the Vapor Pens category climbed to the third spot from its previous absence in the rankings, indicating a significant increase in popularity. Strawberry Cough Distillate Cartridge 1g, although dropping to fourth place from its consistent second position in prior months, still recorded notable sales. Sour Diesel Distillate Cartridge 1g rounded out the top five, maintaining a stable presence in the rankings with a slight dip from February's fourth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.