Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

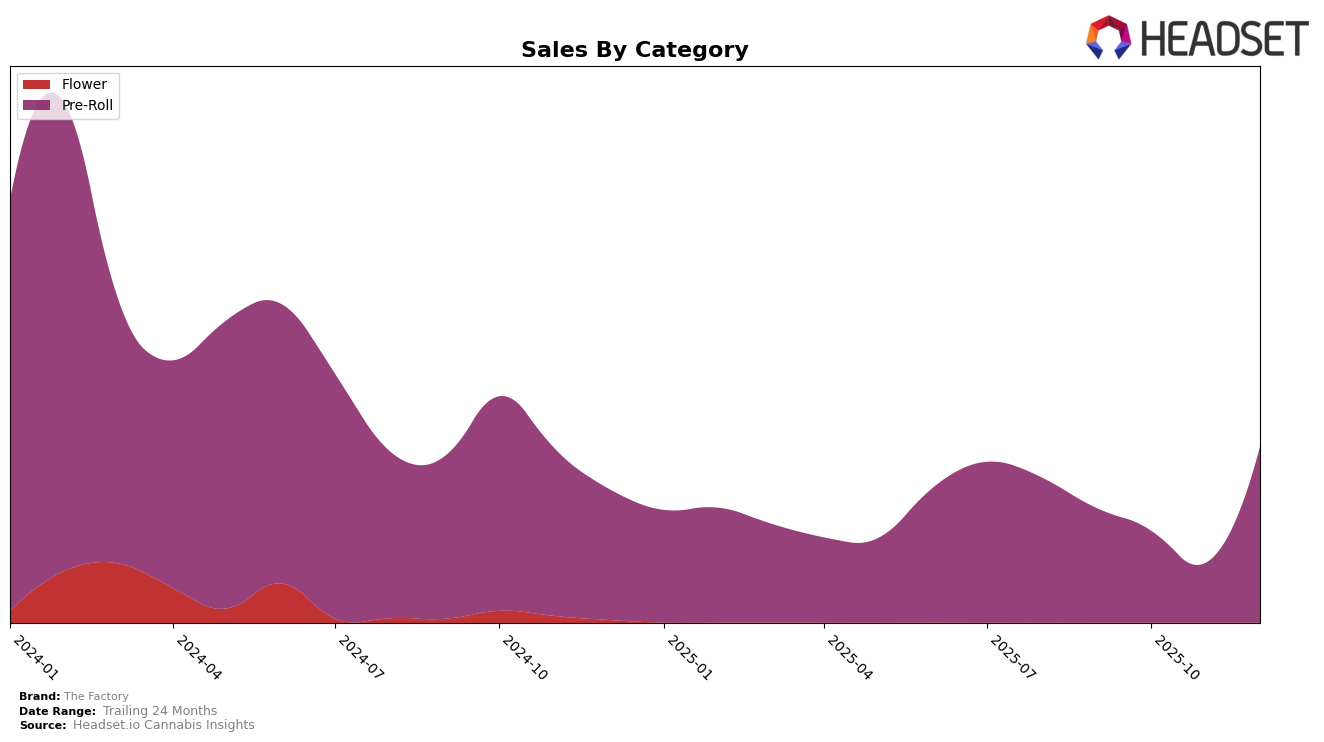

The Factory has shown a dynamic performance across various states, with notable fluctuations in their rankings, particularly in the pre-roll category. In Michigan, The Factory experienced a significant turnaround in the pre-roll segment. After not making it into the top 30 brands from September to November 2025, they surged to the 25th position by December. This improvement is underscored by a substantial increase in sales from November to December, indicating a strong recovery or strategic shift that resonated with consumers. Such a leap suggests that The Factory might have implemented effective changes in marketing, distribution, or product offerings that have begun to pay off.

Despite the positive movement in Michigan, the earlier months of September through November 2025 were challenging, with The Factory not placing in the top 30 rankings. This absence from the top tier could indicate a period of adjustment or competition from other brands that temporarily outperformed them. However, the December comeback highlights a potential for growth and adaptation in a competitive market. Observing how The Factory continues to maneuver through these challenges in the coming months will be crucial for understanding their long-term strategy and market position.

Competitive Landscape

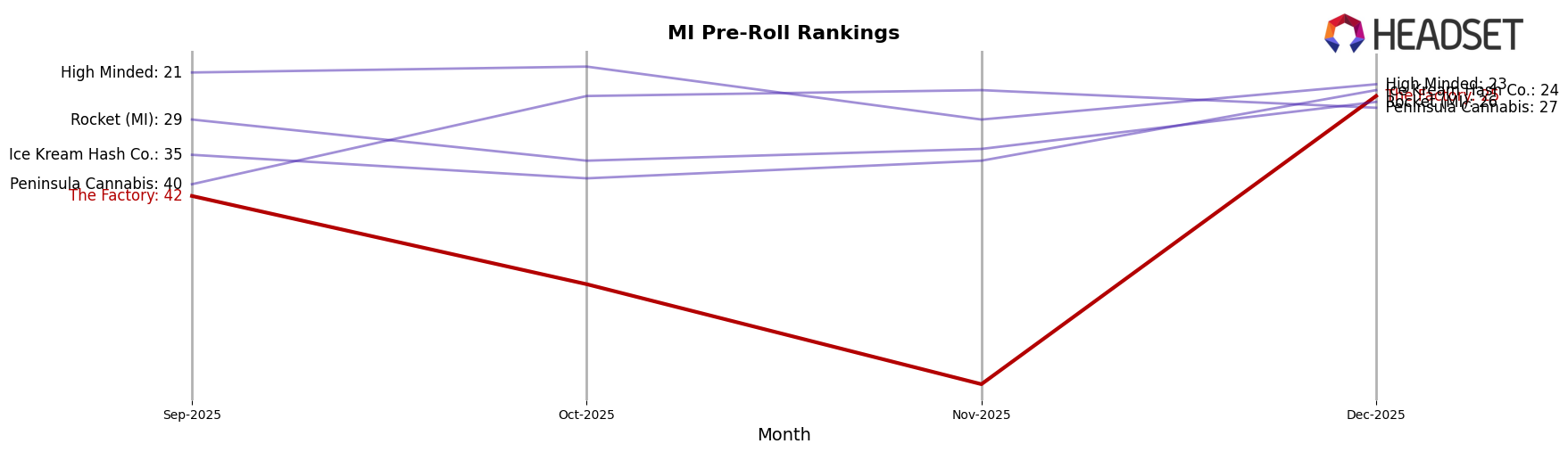

In the competitive landscape of the Michigan pre-roll category, The Factory experienced significant fluctuations in its ranking and sales performance from September to December 2025. Initially ranked at 42nd in September, The Factory's position plummeted to 74th by November, indicating a challenging period with declining sales. However, a remarkable recovery in December saw The Factory ascend to 25th place, surpassing competitors like Rocket (MI) and Peninsula Cannabis, both of which also experienced rank fluctuations but maintained a more stable trajectory. Notably, High Minded consistently outperformed The Factory, maintaining a top 30 position throughout the period. This volatility suggests that while The Factory can achieve competitive sales, it faces challenges in sustaining its market position against established brands like Ice Kream Hash Co., which ended the year just one rank ahead at 24th place. These insights highlight the dynamic nature of the Michigan pre-roll market and underscore the importance of strategic adjustments for The Factory to maintain and improve its competitive standing.

Notable Products

In December 2025, The Factory's top-performing product was NYC Diesel Infused Pre-Roll (1g) in the Pre-Roll category, reclaiming the top rank from its previous fourth position in November, with notable sales of $10,175. Tropicana Cookies Pre-Roll (1g) made a strong debut, securing the second position. Acapulco Gold Infused Pre-Roll (1g) rose to third place, showing a resurgence from its absence in November rankings. Jack Herer Infused Pre-Roll (1g) maintained a consistent performance, ranking fourth, a slight drop from its third position in November. Rainbow Sherbert Infused Pre-Roll (1g) entered the rankings for the first time in December at fifth place, indicating growing consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.