Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

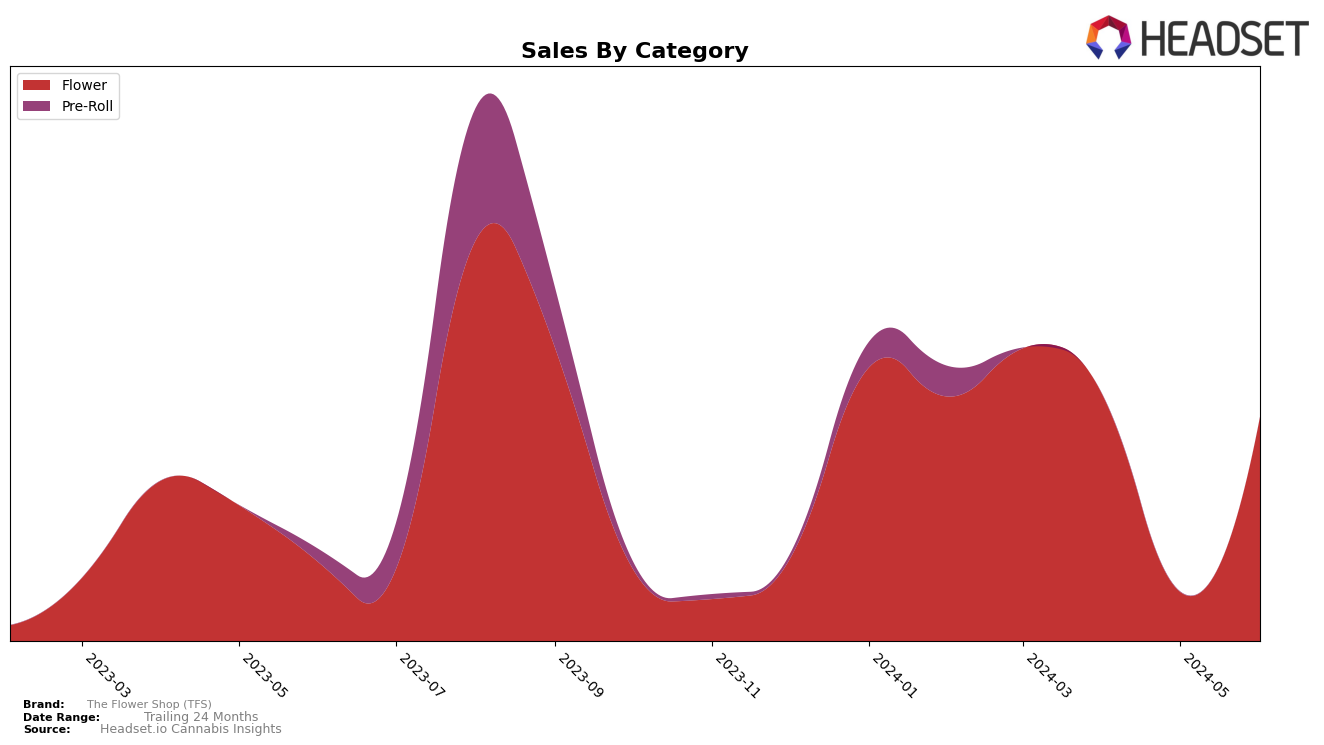

The Flower Shop (TFS) has experienced notable fluctuations in its performance across different states and categories. In Arizona, TFS saw a significant drop in its Flower category ranking from 24th in March 2024 to 53rd in May 2024, before rebounding to 22nd in June 2024. This volatility suggests a highly competitive landscape in Arizona's Flower market, but TFS's ability to recover indicates resilience and potential for growth. The sales figures reflect this movement, with a peak in March followed by a dip in April and May, and a subsequent rise in June.

In other states and categories, TFS's performance has varied, with the brand not appearing in the top 30 rankings for some months, highlighting areas for potential improvement. For instance, the absence of TFS in the top 30 rankings in certain months could be seen as a challenge that the brand needs to address to maintain consistent visibility and market share. However, the overall trend in Arizona provides a positive outlook, suggesting that with strategic adjustments, TFS could enhance its stability and presence across more markets.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, The Flower Shop (TFS) has experienced notable fluctuations in its rank and sales over recent months. In March 2024, TFS held the 24th position, but by May 2024, it had dropped significantly to 53rd, indicating a substantial decline in market presence. However, TFS managed to recover to the 22nd position by June 2024, suggesting a potential rebound. In contrast, 22Red maintained a relatively stable performance, consistently ranking around 13th to 14th before dropping to 21st in June. Meanwhile, Connected Cannabis Co. showed a gradual decline from 15th in March to 20th in June, and Triple Seven demonstrated a positive trend, climbing from 31st in March to 22nd in May before slightly slipping to 23rd in June. Abundant Organics also showed variability, with ranks ranging from 24th to 33rd. These dynamics highlight the competitive volatility in the Arizona Flower market, emphasizing the need for TFS to strategize effectively to stabilize and improve its market position.

Notable Products

In June 2024, the top-performing product for The Flower Shop (TFS) was Honey Banana (14g) in the Flower category, achieving the highest sales figure of 2782 units. Lemon Royale (14g), also in the Flower category, secured the second position with notable sales of 1977 units. Onion Bhaji (14g) climbed to the third rank from its previous fifth position in April 2024, indicating a significant rise in popularity. Kush Mintz (14g) and Kush Mintz (7g) held the fourth and fifth positions, respectively, showing a slight decrease compared to May 2024. Overall, Honey Banana (14g) and Lemon Royale (14g) demonstrated strong and consistent performance, while Onion Bhaji (14g) showed remarkable improvement.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.