Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

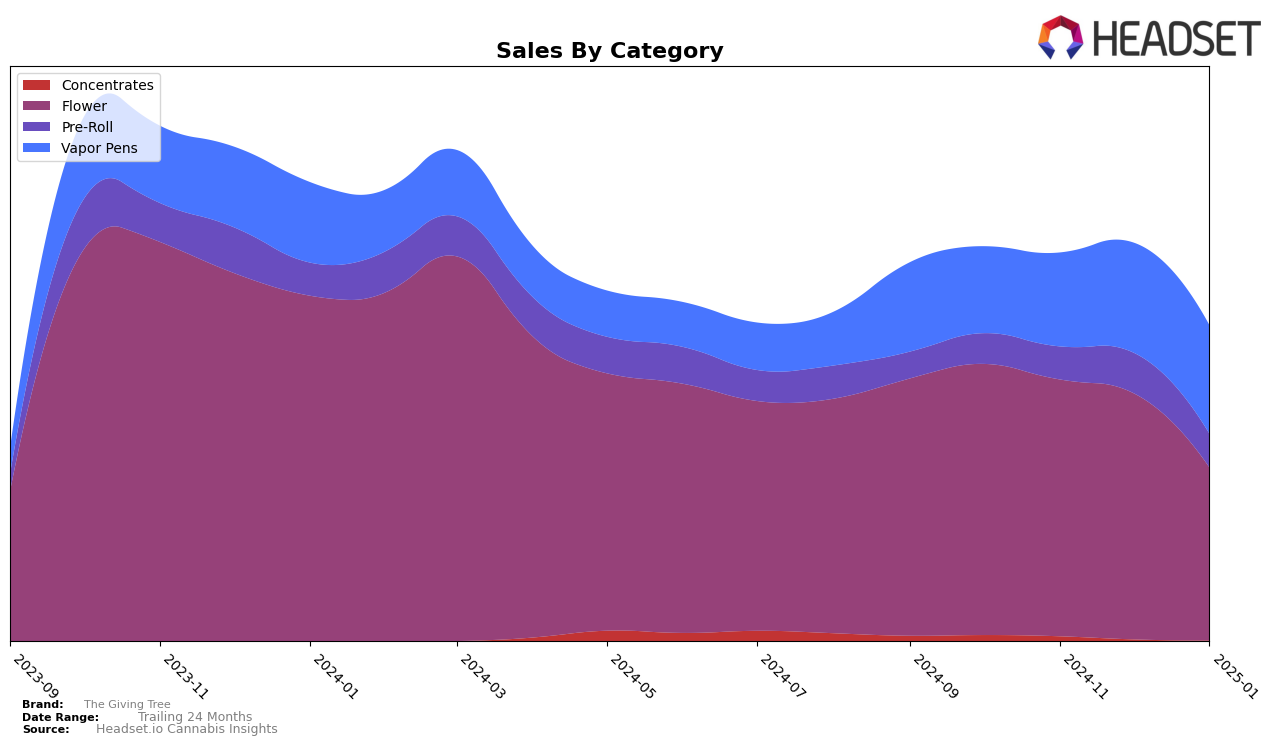

The Giving Tree's performance in the Arizona market showcases a varied trajectory across different product categories. In the Flower category, the brand experienced a notable decline, dropping from a rank of 5 in October 2024 to 11 by January 2025. This downward trend aligns with a decrease in sales, suggesting potential challenges in maintaining competitiveness or consumer preference shifts. Conversely, in the Pre-Roll category, The Giving Tree demonstrated a positive movement, improving its rank from 21 in October 2024 to 14 in January 2025. This ascent indicates a growing acceptance or strategic improvement in this segment, despite not breaking into the top 10 rankings.

In the Vapor Pens category, The Giving Tree maintained a relatively stable presence, with its rank fluctuating slightly between 13 and 12 over the four-month period. This consistency suggests a steady consumer base and effective market strategies in this category. However, it's important to note that The Giving Tree did not appear in the top 30 rankings for other states or provinces, which could imply a focused regional strategy or potential areas for expansion. The brand's ability to maintain or improve its standings in these categories amidst a competitive landscape in Arizona highlights both its strengths and opportunities for growth in the cannabis market.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, The Giving Tree has experienced some notable shifts in its market position from October 2024 to January 2025. Initially ranked 5th in October, The Giving Tree saw a gradual decline to 11th by January. This change in rank suggests increasing competition, particularly from brands like Alien Labs, which consistently maintained a higher rank, peaking at 7th in November. Meanwhile, Curaleaf showed a dramatic fluctuation, dropping from 4th in October to 30th in November, before recovering to 13th by January, indicating potential volatility in their sales strategy or market reception. Riggs Family Farms and Fade Co. have shown more stability, with Riggs Family Farms consistently ranking around 9th to 10th. The Giving Tree's decline in rank, despite relatively strong sales figures, highlights the dynamic and competitive nature of the Arizona flower market, suggesting a need for strategic adjustments to regain its earlier standing.

Notable Products

In January 2025, the top-performing product from The Giving Tree was Indica Pre-Roll (1g) in the Pre-Roll category, which achieved the number one rank with sales of 9,558 units. Sativa Pre-Roll (1g) also performed well, securing the second position, showing a significant improvement from its absence in December 2024. Tiramisu (3.5g) in the Flower category entered the rankings for the first time, taking the third spot. Deathstar Pre-Roll (1g), which was previously at the top in December 2024, dropped to fourth place. Acapulco Gold (3.5g) re-entered the rankings at fifth, having last appeared in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.