Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

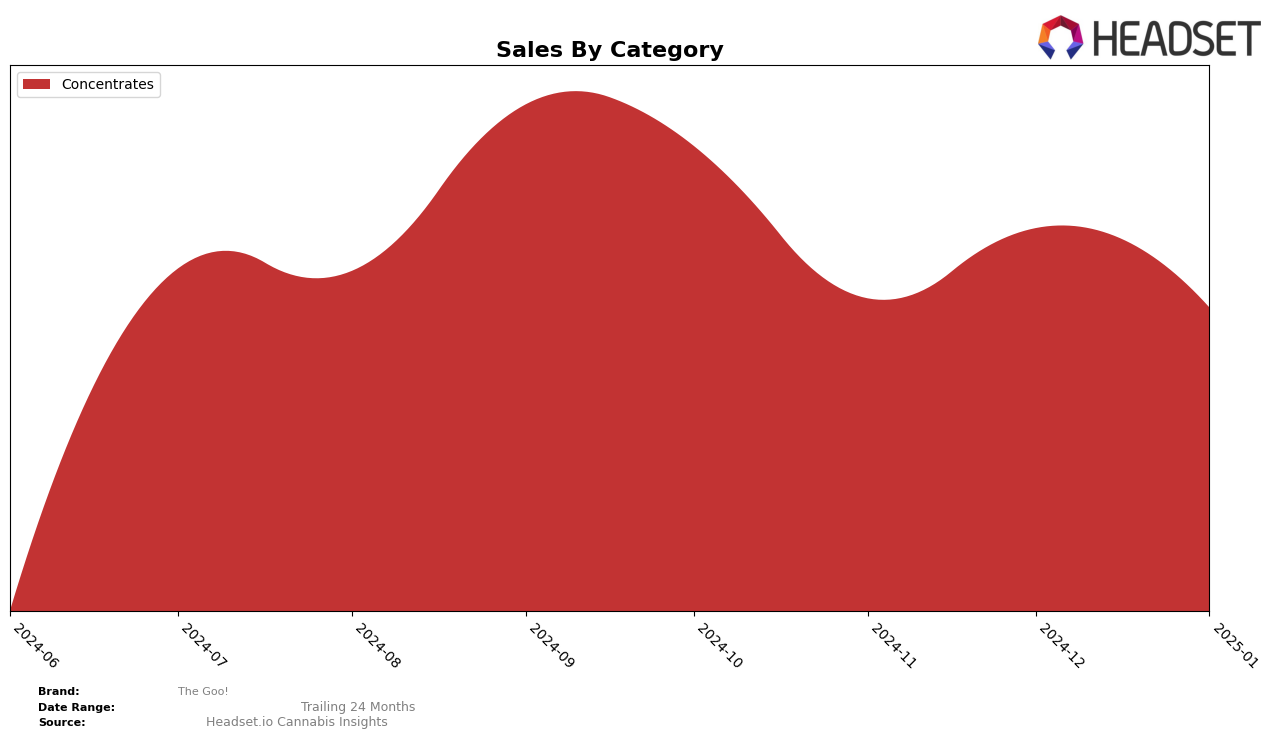

The Goo! has demonstrated varied performance across different categories and states. In the Concentrates category in Alberta, The Goo! maintained a presence within the top 30 brands from October 2024 through January 2025, with rankings fluctuating between 18th and 22nd position. This consistent ranking indicates a stable performance, though not necessarily a leading one. The sales figures reflect this stability, showing a slight decline from October to January, but the brand remained competitive enough to stay on the radar. However, the absence of The Goo! from the top 30 in other categories or states during this period could be seen as a missed opportunity for broader market penetration.

While The Goo! has managed to keep its footing in Alberta's Concentrates category, its lack of presence in the top 30 in other regions and categories suggests potential areas for growth or improvement. The static nature of its rankings in Alberta might indicate a loyal customer base, but the brand may need to innovate or expand its offerings to climb higher or break into new markets. The absence of The Goo! from the rankings in other states or provinces could be a signal that the brand is either not yet established or facing stiff competition. These insights could guide strategic decisions for The Goo! as it looks to enhance its market presence and capitalize on untapped opportunities.

Competitive Landscape

In the Alberta concentrates market, The Goo! has experienced fluctuating rankings over the past few months, indicating a competitive landscape. Starting at 18th place in October 2024, The Goo! dropped to 22nd in November, slightly improved to 21st in December, and returned to 22nd in January 2025. This volatility suggests challenges in maintaining a stable market position amidst strong competition. Notably, Phyto Extractions consistently outperformed The Goo!, maintaining a top 20 presence until January 2025, when it fell to 24th. Meanwhile, RAD (Really Awesome Dope) and Freedom Cannabis have shown lower rankings, indicating potential opportunities for The Goo! to capitalize on their relative weaknesses. Interestingly, Distinkt made a significant leap from 37th in October to 20th in January, highlighting a potential emerging competitor. The Goo!'s sales figures reflect these ranking changes, with a notable dip in November but a recovery in December, suggesting that strategic adjustments could help regain lost ground in this dynamic market.

Notable Products

In January 2025, Brain Fruit Live Rosin (1g) continued to dominate as the top-performing product for The Goo! in the Concentrates category, maintaining its number one rank from the previous three months. Despite a slight decrease in sales to 991 units, it has consistently held the leading position since October 2024. This product's strong performance highlights its sustained popularity and consumer demand. No other products from The Goo! have challenged its top spot, indicating a stable market preference. The consistency in rankings suggests that The Goo! has successfully captured a loyal customer base for this particular concentrate.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.