Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

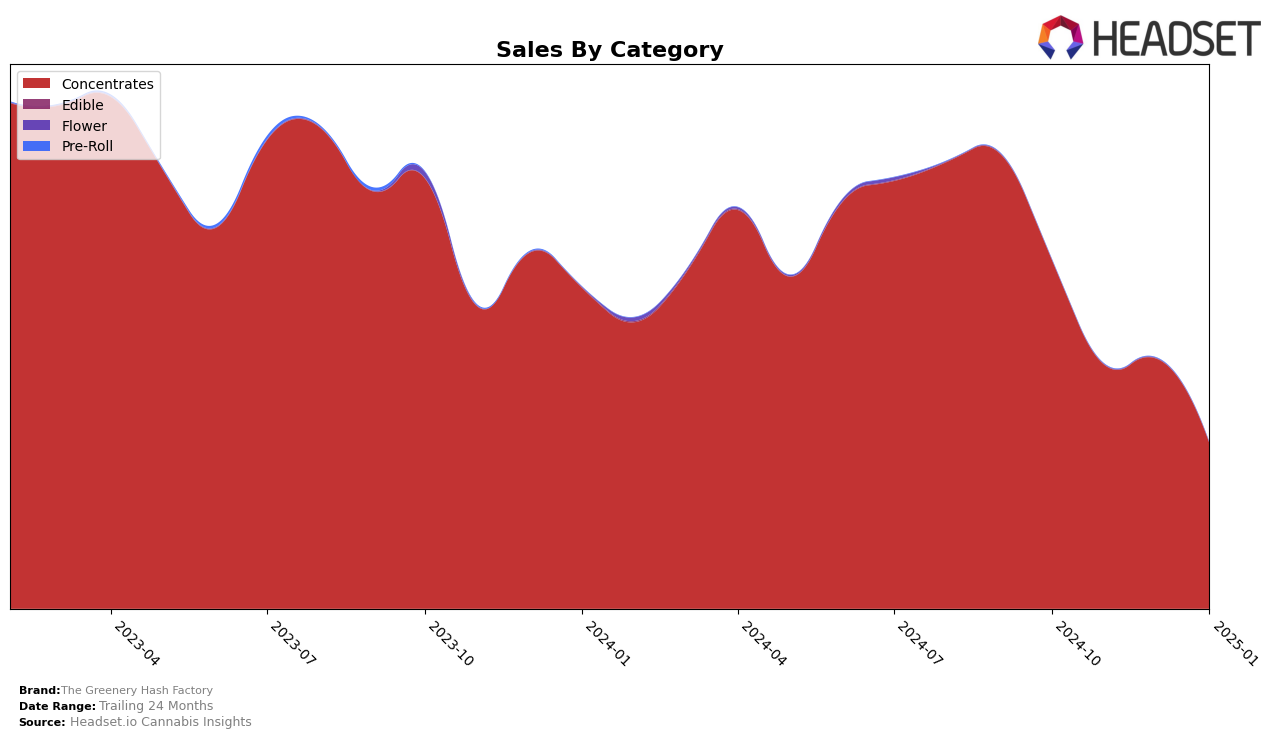

The Greenery Hash Factory has shown a consistent presence in the Concentrates category within Colorado. Over the four-month period from October 2024 to January 2025, the brand maintained its position within the top 30, albeit with some fluctuations. Starting at rank 21 in October, the brand experienced a dip to 27 in November, slightly recovered to 25 in December, and then slipped to 29 by January. This pattern indicates some volatility in their market positioning, possibly due to changing consumer preferences or competitive dynamics within the state. Despite these fluctuations, maintaining a presence in the top 30 suggests a resilient market performance.

When examining sales figures, The Greenery Hash Factory saw a notable decline from October's sales of $109,583 to $51,839 in January, indicating a downward trend in revenue over the months. This decline could be attributed to various factors such as seasonal demand changes or increased competition. Interestingly, the brand managed to re-enter the top 30 in January despite the drop in sales, which may suggest strategic adjustments or market conditions that favored their ranking. The absence of rankings in other states or categories highlights a potential area for expansion or increased focus to diversify their market footprint.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, The Greenery Hash Factory has experienced fluctuating rankings over the past few months, indicating a dynamic market position. In October 2024, The Greenery Hash Factory held a rank of 21, but by January 2025, it had slipped to 29. This downward trend in rank is mirrored by a decrease in sales, suggesting increased competition and possibly market saturation. Notably, 14er Gardens showed a strong performance, peaking at rank 17 in November 2024, before descending to 31 by January 2025, which may have contributed to the competitive pressure. Meanwhile, Newt Brothers Artisanal and Green Treets also displayed varying ranks, with Green Treets improving to rank 27 in January 2025. These shifts highlight the volatile nature of the market, where The Greenery Hash Factory must strategize to regain its competitive edge and stabilize its sales trajectory.

Notable Products

In January 2025, the top-performing product from The Greenery Hash Factory was Cake Pie Moroccan Hash (1g) in the Concentrates category, achieving the number one rank with notable sales of 198 units. Sativa Lebanese Hash (1g) followed closely in second place, maintaining its position from October 2024, despite a slight decrease in sales to 153 units. Indica Moroccan Hash (1g) and Orange Push Pop Moroccan Hash (1g) both secured the third rank, with the latter making a re-entry into the top ranks after not being listed in November and December 2024. Yuck Mouth x Cake Pie Moroccan Hash (1g) also shared the third rank, marking an entry into the top ranks for the first time. This month showed a dynamic shift in product rankings, with Cake Pie Moroccan Hash (1g) emerging as a new leader in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.