Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

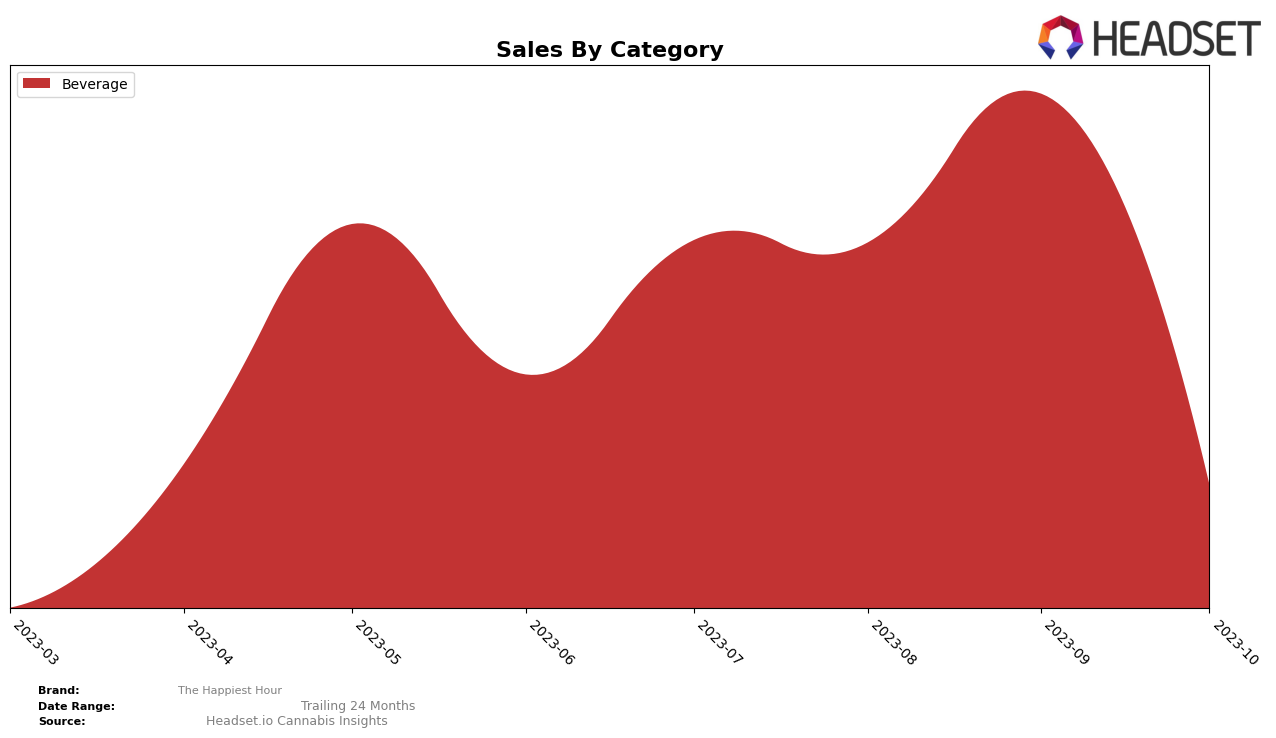

In the Beverage category, The Happiest Hour has shown some interesting trends in Nevada. The brand managed to improve its ranking from 18th in July 2023 to 15th in September 2023. This upward movement indicates a positive growth trajectory and a potential increase in market share. However, it's worth noting that the brand's ranking dipped back to 18th in October 2023. While specific sales data is proprietary, the general trend suggests a temporary spike in sales in September, followed by a significant drop in October.

Despite the fluctuations, The Happiest Hour remained in the top 20 brands for the Beverage category in Nevada throughout the period. This is an achievement in itself considering the competitive nature of the market. However, the brand's inconsistent performance indicates room for improvement. The dip in October could be a cause for concern, but it also presents an opportunity for the brand to analyze its strategies and make necessary adjustments to maintain a steady growth. The key takeaway here is that while The Happiest Hour has a solid presence in Nevada, there's still potential for growth and improvement.

Competitive Landscape

In the beverage category within Nevada, The Happiest Hour has been experiencing some fluctuations in rank and sales. In July 2023, it was ranked 18th, moving up to 17th in August, and further up to 15th in September. However, in October, it dropped back to 18th. This fluctuation in rank is mirrored by its sales, which saw a peak in September before dropping significantly in October. Among its competitors, WYLD has consistently ranked higher, albeit with a similar pattern of fluctuation. In contrast, Two Roots Brewing Co. has maintained a steady rank, consistently outperforming The Happiest Hour. Vada and TRYKE have generally ranked lower, with TRYKE not even making it into the top 20 in September and October. This competitive landscape suggests that while The Happiest Hour has had some success, it faces stiff competition and will need to work to maintain and improve its position.

Notable Products

In October 2023, the top-performing products from The Happiest Hour were the Blood Orange Drink Mixer (100mg) and the Watermelon Drink Mixer (100mg). The Blood Orange Drink Mixer maintained its position as the number one product, despite a decrease in sales to 41 units. The Watermelon Drink Mixer retained the second position with 30 units sold. Interestingly, these two beverages have been alternating between the first and second positions since July 2023. This shows a consistent consumer preference for these products within the beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.