Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

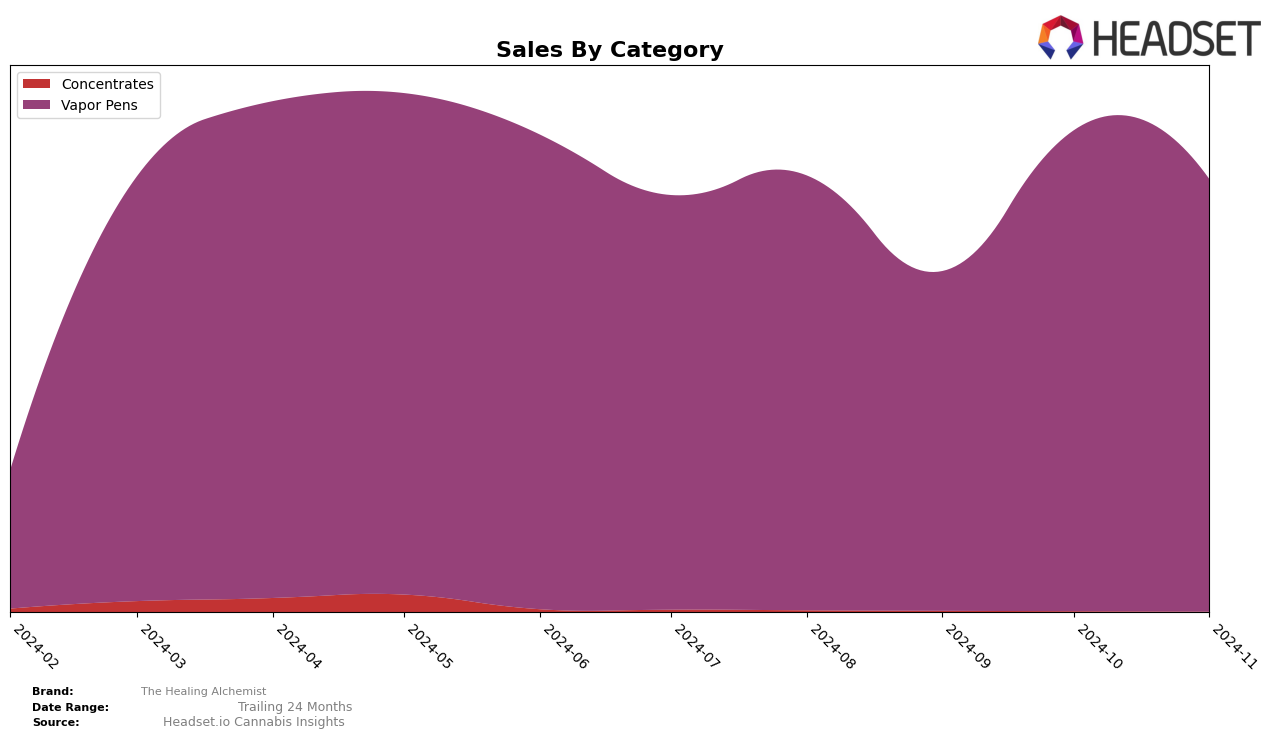

The Healing Alchemist has shown varied performance across different states and categories, with notable fluctuations in its rankings. In the Vapor Pens category in Arizona, the brand demonstrated a slight upward trend, moving from a rank of 31 in October 2024 to 30 in November 2024. This improvement suggests a positive response from consumers, perhaps due to product innovation or effective market strategies. However, the brand was not ranked in the top 30 in September, indicating a period of struggle or increased competition during that month. Such fluctuations highlight the dynamic nature of the market and the need for brands to continuously adapt to maintain or improve their standings.

Despite these ups and downs, The Healing Alchemist's sales figures reveal interesting insights into its market presence. For instance, the brand experienced a significant sales increase in October 2024, which could be attributed to seasonal demand or successful promotional campaigns. However, November saw a dip in sales, suggesting potential challenges in maintaining momentum or external factors affecting consumer purchasing behavior. The absence of rankings in certain months across other states or categories could indicate either a strategic focus on specific markets or difficulties in gaining traction in those areas. Understanding these patterns can provide valuable insights into the brand's strategy and areas for potential growth or improvement.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, The Healing Alchemist has shown a dynamic performance from August to November 2024. Despite starting at rank 28 in August, the brand experienced fluctuations, dropping to 34 in September, then climbing back to 31 in October, and further improving to 30 in November. This upward trend in the latter months indicates a potential recovery in market positioning. Comparatively, Amber started at rank 19 in August but fell significantly to 34 by November, suggesting a decline in their market presence. Meanwhile, Sauce Essentials showed inconsistency, ranking 13 in August, dropping out of the top 20 in October, and reappearing at 27 in November. Jukebox and Venom Extracts maintained relatively stable positions, with Jukebox consistently ranking around 28-29 and Venom Extracts hovering in the low 30s. These insights suggest that while The Healing Alchemist faces strong competition, its recent upward trajectory could be leveraged to enhance sales and brand positioning in the Arizona vapor pen market.

Notable Products

In November 2024, GMO Cookies Distillate Cartridge (1g) emerged as the top-performing product for The Healing Alchemist, climbing from the 5th position in October to the 1st, with impressive sales of 969 units. Brian Berry Cough Distillate Cartridge (1g) maintained a strong performance, securing the 2nd position, while Lime OG Distillate Cartridge (1g) made a notable entry at 3rd place after not being ranked in October. OG Kush Distillate Cartridge (1g) saw a drop from 2nd to 4th place, indicating a decline in sales momentum. Strawberry Cough Distillate Cartridge (1g), which was the top product in October, fell to the 5th position, suggesting a significant decrease in sales activity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.