Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

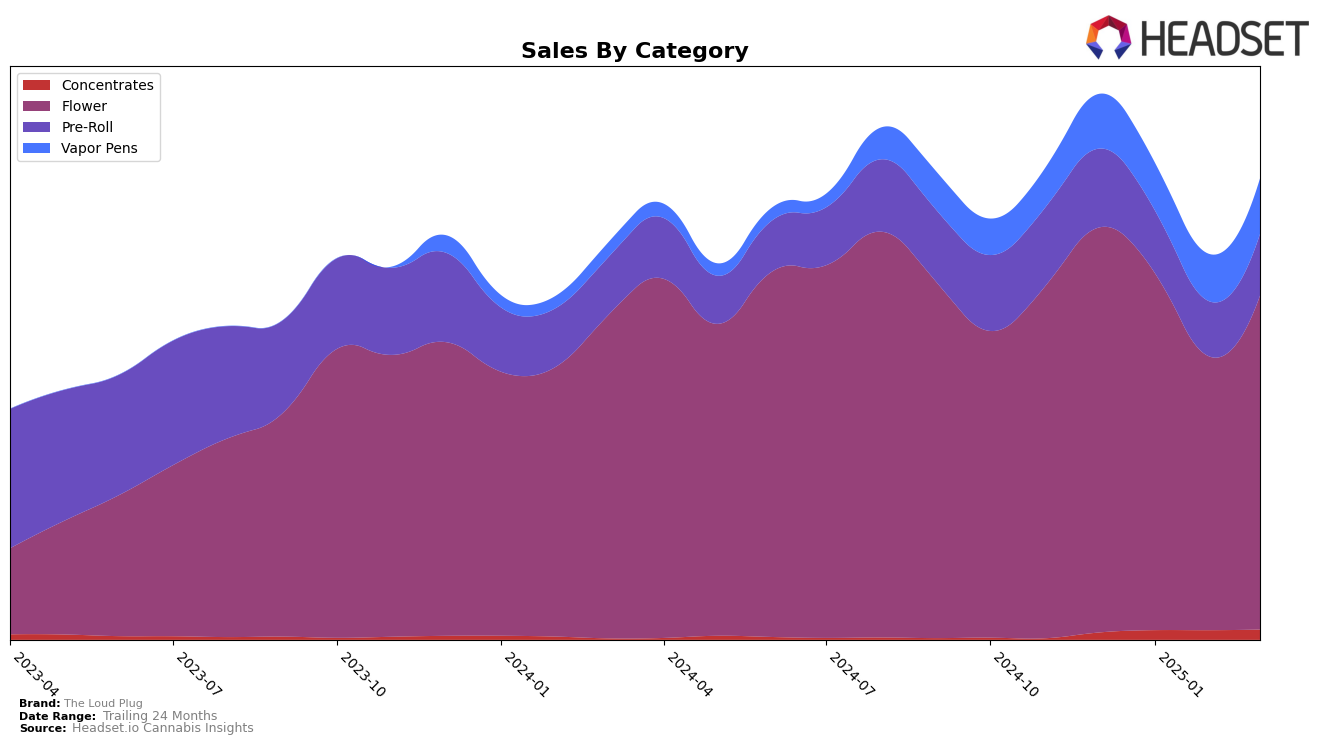

The Loud Plug has demonstrated varied performance across different Canadian provinces and product categories. In British Columbia, the brand has maintained a strong presence in the Flower category, consistently ranking 4th in the first quarter of 2025, despite a slight dip from the 2nd position in December 2024. This steady performance indicates a robust foothold in the market. However, their Pre-Roll category in the same province has not been as impressive, with rankings fluctuating around the 49th to 53rd positions, suggesting potential areas for improvement in this category. Meanwhile, in Alberta, The Loud Plug has not broken into the top 30 in the Flower category, which highlights a competitive challenge or a potential gap in market strategy that could be addressed to enhance their presence.

In Ontario, The Loud Plug exhibits a mixed performance across categories. While they have seen a decline in their Flower category ranking from 7th in December 2024 to 12th by March 2025, their Vapor Pens category shows a positive trend, improving from 21st to 17th over the same period. This upward trajectory in Vapor Pens could be a strategic focus for the brand moving forward. In Saskatchewan, The Loud Plug holds a strong position in the Flower category, though it has seen a slight drop from the 1st to the 3rd position by March 2025. Such fluctuations suggest a dynamic market environment and the need for continual adaptation to maintain leadership positions.

Competitive Landscape

In the Ontario flower category, The Loud Plug has experienced notable fluctuations in its competitive positioning from December 2024 to March 2025. Initially ranked 7th in December, The Loud Plug saw a decline to 15th by February, before recovering slightly to 12th in March. This volatility is significant when compared to competitors like Big Bag O' Buds, which maintained a more stable presence, fluctuating between 8th and 12th place, and FIGR, which improved its rank from 15th to 12th before settling back at 14th. Meanwhile, Versus showed a positive trend, moving from 14th to 11th place by March. The Loud Plug's sales trajectory mirrors its rank changes, indicating potential challenges in maintaining market share against these competitors. This dynamic landscape suggests that The Loud Plug may need to innovate or adjust its strategies to regain a stronger foothold in the Ontario flower market.

Notable Products

In March 2025, Venom OG 28g maintained its top position as the best-selling product for The Loud Plug, with sales reaching 6,628 units. Exotic Gas 28g, which had previously been ranked first in January, secured the second spot in March, showing a notable decline in sales. Frosted Swirl Pre-Roll 3-Pack 1.5g held steady at the third position, reflecting consistent demand from February. Venom OG 3.5g dropped to fourth place, despite being second in February, indicating a shift in consumer preference within the flower category. Meanwhile, Exotic Gas Live Resin Cartridge 1g remained in fifth place, showing slight improvement in sales compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.