Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

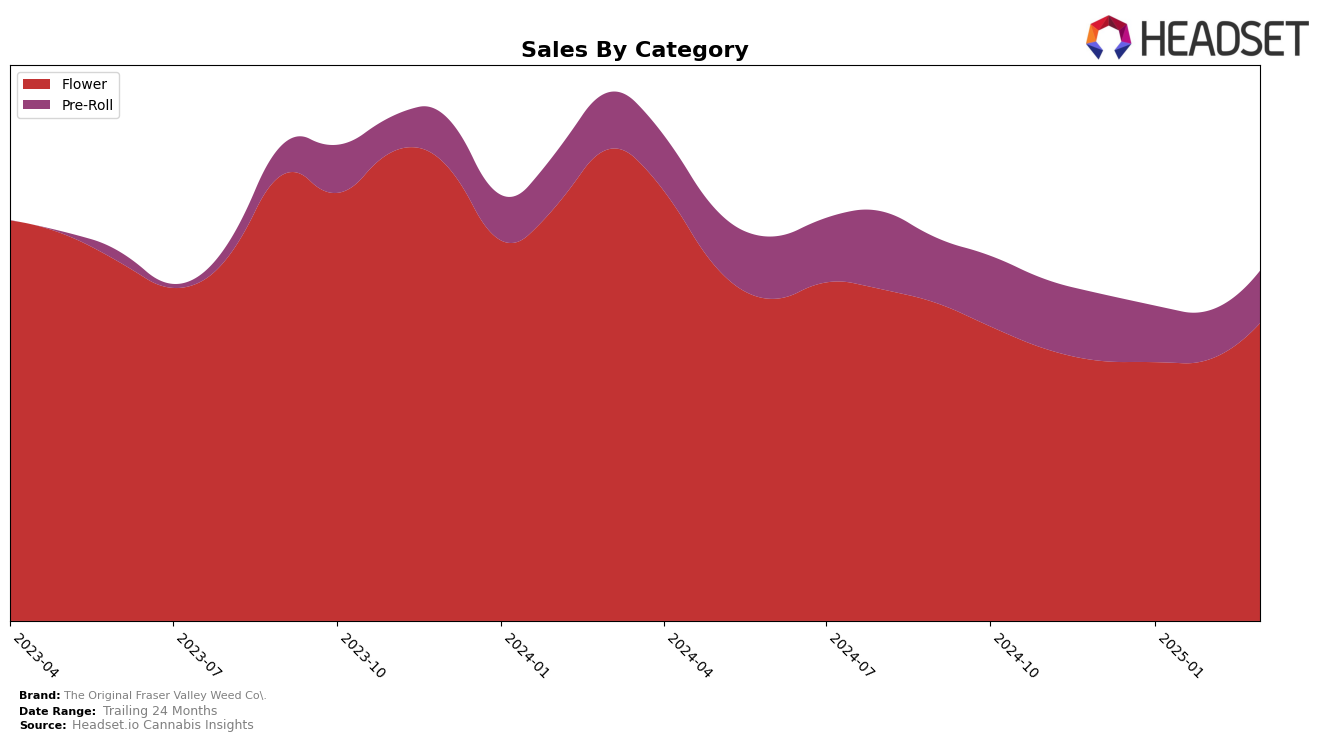

The Original Fraser Valley Weed Co. has shown a strong upward trend in the Flower category across multiple provinces. In Alberta, the brand improved its ranking from 8th in December 2024 to an impressive 3rd by March 2025, indicating a consistent increase in sales. Similarly, in British Columbia, they climbed from 5th to 2nd place over the same period. This upward movement in rankings is indicative of growing consumer preference and market penetration. In contrast, in the Ontario market, the brand maintained a relatively stable position, fluctuating between 6th and 9th place, which suggests a steady market presence even though the sales figures showed a slight decline before rebounding in March 2025.

However, the performance in the Pre-Roll category tells a slightly different story. In Alberta, The Original Fraser Valley Weed Co. did not make it into the top 30 rankings, highlighting a potential area for growth or improvement. In British Columbia, the brand saw a modest improvement from 31st to 27th place, suggesting some positive traction but still leaving room for significant growth. Ontario presented a challenge, as the brand's ranking fell from 25th to 34th by March 2025, indicating a need to reassess strategies in this category. These insights reveal a mixed performance across categories and provinces, pointing to the brand's stronghold in the Flower category while highlighting opportunities for growth in Pre-Rolls.

Competitive Landscape

In the competitive landscape of the flower category in Ontario, The Original Fraser Valley Weed Co. has experienced notable fluctuations in its ranking over the past few months. Starting at 9th place in December 2024, it climbed to 6th in January 2025, only to drop to 8th in February and rise again to 7th in March. This volatility suggests a dynamic market environment where consumer preferences and competitive actions significantly impact brand positioning. Notably, Good Supply has maintained a consistent 5th place ranking, indicating strong brand loyalty or effective marketing strategies. Meanwhile, SUPER TOAST has shown a positive trend, moving from 10th to 6th place over the same period, potentially posing a competitive threat. The sales figures, while not disclosed here, suggest that The Original Fraser Valley Weed Co. is in close competition with these brands, necessitating strategic adjustments to capture more market share and stabilize its ranking.

Notable Products

In March 2025, the top-performing product for The Original Fraser Valley Weed Co. was Big Red Pre-Roll 20-Pack (10g) in the Pre-Roll category, maintaining its leading position for four consecutive months with sales of 18,335. Strawberry Amnesia (28g) in the Flower category held steady in second place, showing an increase in sales compared to February. BC Bounty Milled (28g) also retained its third-place ranking, continuing its consistent performance since December 2024. Donny Burger (28g) followed in fourth place, experiencing a notable increase in sales from the previous month. Top Crop (28g) remained in fifth position, although its sales figures slightly declined compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.