Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

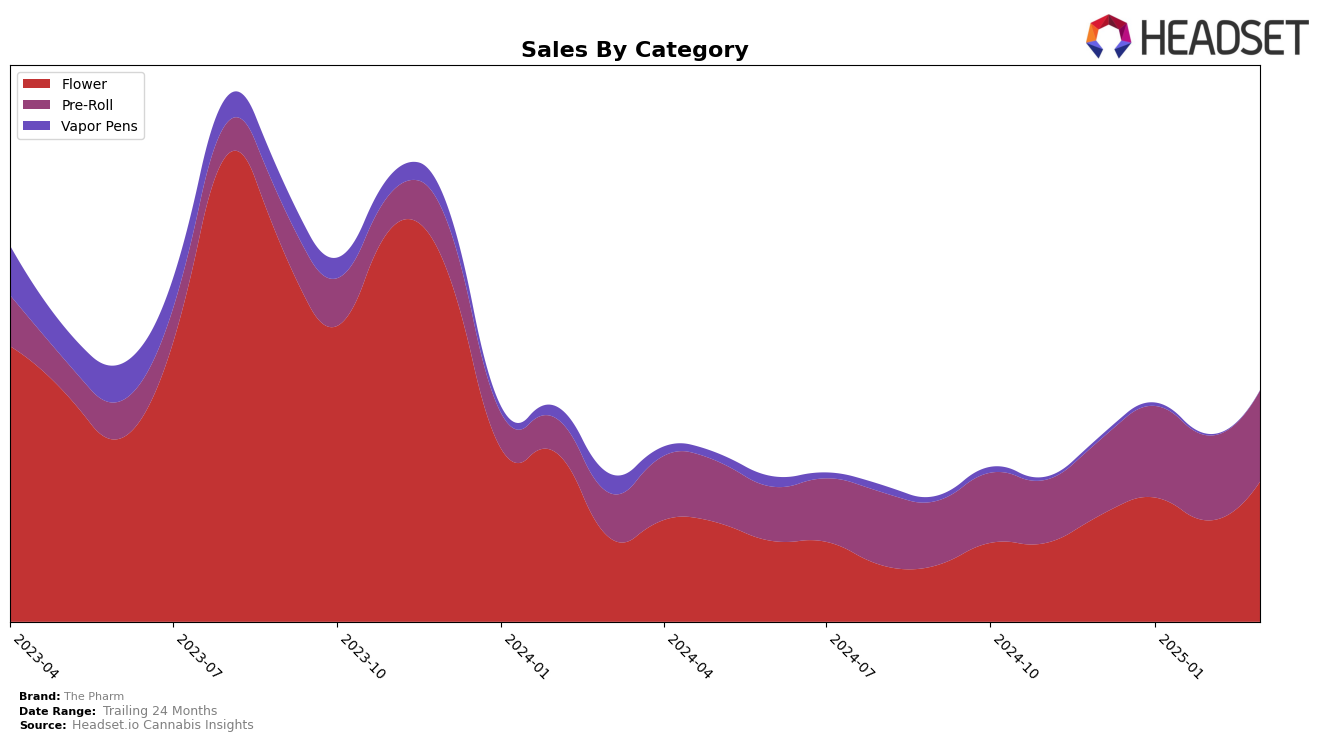

The performance of The Pharm in the Arizona market has shown notable trends across different product categories. In the Flower category, The Pharm has experienced an upward trajectory, improving its rank from 9th in December 2024 to 6th by March 2025. This positive movement is accompanied by a significant increase in sales, suggesting a strengthening position in the market. Meanwhile, in the Pre-Roll category, The Pharm has maintained a consistent 5th place ranking from December 2024 through March 2025, indicating a stable demand for their products in this category.

However, the Vapor Pens category presents a different narrative for The Pharm in Arizona. The brand's ranking hovered around the 50s, with a slight dip in February 2025, failing to make the top 30 by March 2025. This decline could signal challenges in capturing market share within this segment. The absence from the top 30 in March 2025 could be seen as a potential area for improvement or strategic reevaluation. Such fluctuations highlight the competitive nature of the cannabis market and the varying consumer preferences across product categories.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, The Pharm has demonstrated a notable upward trajectory in its market positioning from December 2024 to March 2025. Initially ranked 9th in December 2024, The Pharm improved its rank to 6th by March 2025, indicating a positive trend in consumer preference and sales performance. This upward movement is significant when compared to competitors such as Connected Cannabis Co., which fluctuated between the 10th and 7th positions, and Alien Labs, which maintained a relatively stable rank around 8th. Meanwhile, Cheech & Chong's and High Grade experienced more volatility, with High Grade notably dropping to 17th in February before recovering to 4th in March. The Pharm's consistent improvement in rank suggests a strengthening brand presence and effective market strategies, positioning it as a formidable competitor in the Arizona flower market.

Notable Products

In March 2025, Wedding Cake (3.5g) emerged as the top-performing product for The Pharm, climbing from the second position in February to the first, with notable sales of 13,712 units. Government Oasis (3.5g) made a significant debut, securing the second rank. Dusties - Sapphire Infused Pre-Roll 6-Pack (3.6g), previously holding the top spot consistently since December 2024, slipped to third place. Dusties - Emerald Infused Pre-Roll 6-Pack (3.6g) maintained its fourth position from February. Meanwhile, Dusties - Ruby Infused Pre-Roll 6-Pack (3.6g) dropped from third to fifth, despite a steady increase in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.