Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

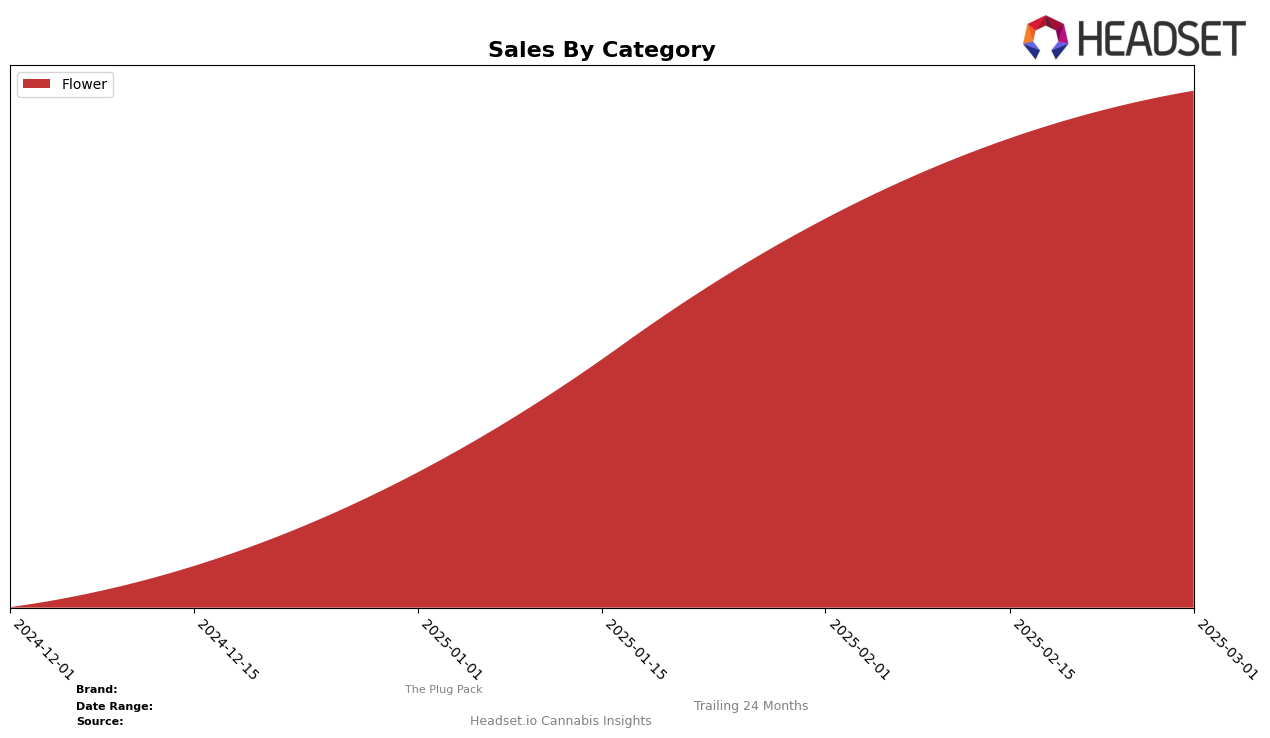

The Plug Pack has shown a remarkable upward trajectory in the Flower category within New York. Beginning from a position outside the top 30 brands in December 2024, the brand made a significant leap to rank 23rd in January 2025. This upward momentum continued with a notable rise to the 7th position by February and further improved to 5th place by March 2025. This consistent climb in rankings suggests a strong and growing presence in the New York market, reflecting an effective strategy in capturing consumer interest and demand in the Flower category.

While The Plug Pack's performance in New York is impressive, the absence of rankings in December 2024 highlights a previous challenge in breaking into the competitive top 30. However, the brand's ability to quickly ascend the ranks in subsequent months indicates a successful pivot or enhancement in their market approach. The sales figures also mirror this positive trend, with a substantial increase from January to March 2025, suggesting that their efforts in product differentiation or marketing have resonated well with consumers. This pattern of growth is a key point of interest for stakeholders looking to understand the dynamics of the Flower category in New York.

Competitive Landscape

The Plug Pack has demonstrated a remarkable upward trajectory in the New York flower category, particularly from January to March 2025. Initially absent from the top 20 in December 2024, The Plug Pack surged to rank 23 in January 2025 and continued its ascent to rank 7 in February, ultimately reaching the 5th position by March. This impressive climb is indicative of a significant increase in consumer preference and market penetration. In contrast, Matter. experienced a decline from 3rd to 6th place over the same period, suggesting a potential shift in consumer loyalty or market dynamics. Meanwhile, Find. maintained a relatively stable presence, oscillating between 3rd and 5th positions, while Rolling Green Cannabis improved its rank from 5th to 3rd, indicating competitive pressure on The Plug Pack. Additionally, Untitled showed a noteworthy rise from 15th to 7th, reflecting a broader trend of emerging brands gaining traction in the New York market. The Plug Pack's rapid rise in rank and sales suggests a successful strategy in capturing market share, although the competitive landscape remains dynamic with other brands also making significant moves.

Notable Products

In March 2025, Tequila Sunrise (28g) emerged as the top-performing product for The Plug Pack, securing the number one rank with notable sales of 2,691 units. Bomb Pop (28g) maintained a strong presence, ranking second, despite a slight dip from its top position in previous months. PB & J (28g) saw a decline from its February peak, settling at third place. Chopped Cheese (28g) continued its downward trajectory, moving from second in January to fourth in March. Cherry Pie (28g) remained consistently in fifth place throughout the analyzed months, showcasing stable but lower sales compared to its peers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.