Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

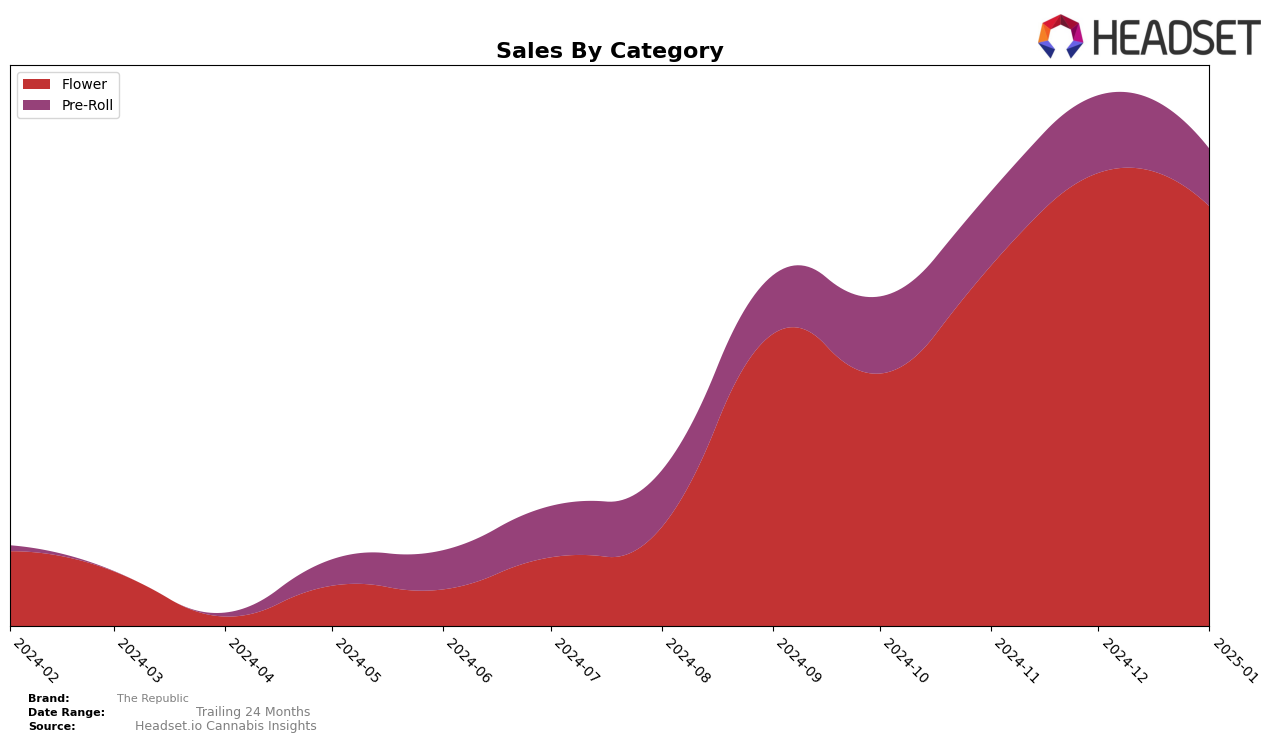

The Republic has shown varied performance across Canadian provinces, particularly in the Flower category. In Alberta, the brand experienced an upward trend, moving from rank 65 in October 2024 to 45 by January 2025. This steady climb suggests an increasing market presence, despite starting outside the top 30. Meanwhile, in Ontario, The Republic made significant strides, improving its rank from 79 in October 2024 to 38 in January 2025. The rapid ascent in Ontario indicates a strong consumer response and growing brand recognition in this competitive market.

In contrast, The Republic's performance in Saskatchewan remained relatively stable, maintaining a position within the top 30 throughout the observed period. However, the brand experienced a slight dip, returning to rank 27 in January 2025 after holding the 24th position in November and December 2024. This fluctuation might reflect a competitive landscape or seasonal variations in consumer preferences. While The Republic has not yet broken into the top 30 in Alberta and Ontario, its progress in these markets suggests potential for future growth and improved positioning.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, The Republic has shown a promising upward trajectory in its market rank, moving from a position outside the top 20 in October 2024 to 38th by January 2025. This improvement indicates a positive reception and growing consumer interest. In contrast, brands like San Rafael '71 and Fuego Cannabis (Canada) have experienced fluctuations, with ranks oscillating between the low 30s and 40s, suggesting a less stable market presence. Meanwhile, Color Cannabis has seen a decline, dropping from 29th to 40th, which could potentially benefit The Republic as it gains ground. The Republic's consistent sales growth over these months, despite the competitive pressures, positions it as a rising player in the Ontario Flower market, potentially poised to challenge more established brands.

Notable Products

In January 2025, Reserve 25%+ (28g) maintained its position as the top-performing product for The Republic, with sales reaching 3189 units. Reserve 25 Plus Pre-Roll 2-Pack (2g) held steady in the second spot, despite a decrease in sales from previous months. Republic Reserve Pre-Rolls 10-Pack (5g) consistently ranked third, showing a slight drop in sales. The Reserve 25%+ Milled (28g) remained in fourth place, experiencing a decline in sales compared to December 2024. Lastly, Reserve 25%+ Milled (14g) continued to rank fifth, with its sales figures also decreasing from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.