Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

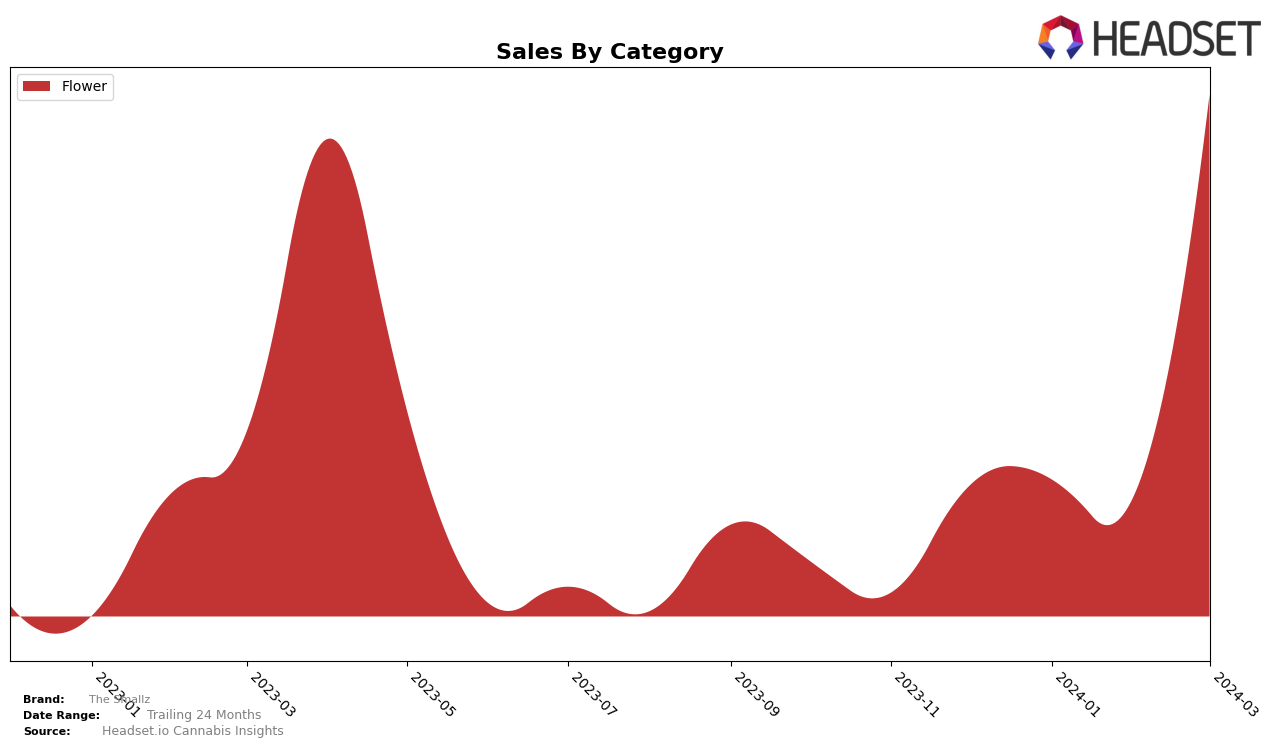

In Michigan, The Smallz has shown a remarkable journey in the Flower category, demonstrating significant movement in rankings over the recent months. Starting off the year without a spot in the top 30 for December 2023, the brand made a notable entrance in January 2024 at rank 92, followed by a slight dip to 99 in February. However, March 2024 marked a dramatic shift, as The Smallz catapulted to the 28th position. This leap is indicative of a strong upward trajectory in brand performance within the state's competitive cannabis market. The sales figures mirror this positive momentum, with a substantial increase from February's 220,553 to a remarkable 961,072 in March, underscoring the brand's growing consumer base and market penetration.

While the data for The Smallz in Michigan's Flower category is promising, it's important to note the initial absence from the top 30 rankings in December 2023. This gap signifies a period of either market entry challenges or strategic recalibration for the brand. However, the subsequent improvement in rankings and sales from January to March 2024 reflects a successful turnaround strategy, possibly driven by marketing efforts, product quality improvements, or both. The impressive sales jump in March not only highlights The Smallz's ability to capture market share but also suggests a growing consumer acceptance and preference for their products. This analysis provides a glimpse into the brand's performance dynamics, yet it's clear that The Smallz is on an upward trajectory in Michigan's cannabis market, making it a brand to watch in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in Michigan, The Smallz has shown a remarkable trajectory in terms of rank and sales, despite not being in the top 20 brands until January 2024. From a position outside the top 90 in December 2023, The Smallz surged to rank 28th by March 2024, indicating a significant increase in market acceptance and sales performance. This leap is particularly noteworthy when compared to competitors like Glacier Cannabis, which fluctuated in ranking but ended in a higher position in March, and Uplyfted Cannabis Co., which consistently ranked higher than The Smallz but showed a downward trend in rank from January to March. Other competitors, such as Fruit & Fuel and Fawn River, also experienced fluctuations in their rankings, but none demonstrated the dramatic rank improvement seen by The Smallz. This analysis underscores The Smallz's potential for growth and market penetration, positioning it as a brand to watch in the Michigan Flower market.

Notable Products

In March 2024, The Smallz saw Zkittle Mints (28g) leading their sales with a significant jump to the top position from previously being unranked, boasting sales figures of 2513 units. Following closely, Sunshine (28g) and Cherry Nerdz Smallz (28g) secured the second and third spots, respectively, both also not ranked in the previous months, indicating a notable shift in consumer preferences. Lemon Gravy Smallz (28g) improved its ranking from fifth to fourth, showing a steady increase in popularity with sales of 1034 units. Cap Junky (28g), despite a slight drop from third to fifth, remained in the top five, demonstrating consistent demand among The Smallz's offerings. These shifts highlight a dynamic change in top-selling products for The Smallz, with new entrants dominating the sales chart in March 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.