Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

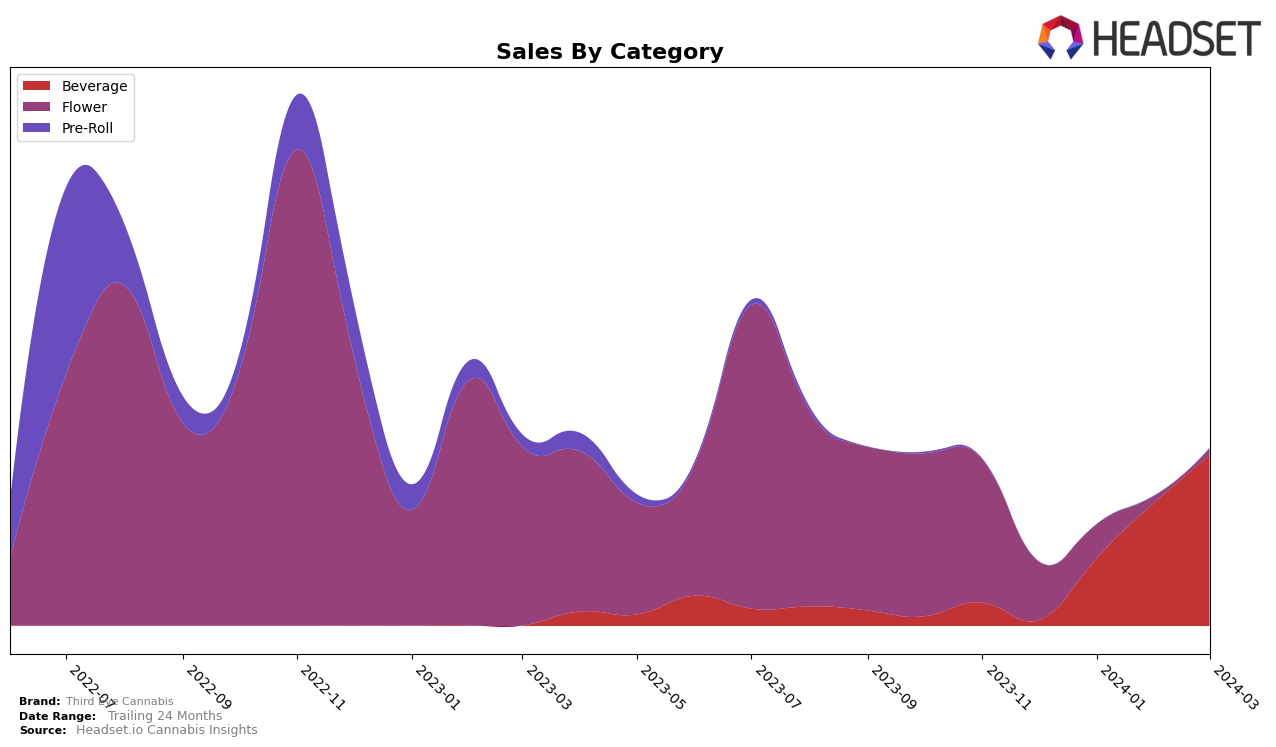

In the Beverage category, Third Eye Cannabis has shown a notable performance across different states, with particular emphasis on its presence in Oregon and Michigan. In Oregon, the brand made a significant leap from being ranked 28th in December 2023 to holding the 17th position consistently in February and March 2024. This upward trajectory is supported by a substantial increase in sales, starting from 128.0 in December 2023 and soaring to 3741.0 by March 2024. Meanwhile, in Michigan, Third Eye Cannabis entered the top 30 rankings in January 2024 at 25th, dipped slightly to 29th in February, but managed to climb back to 25th by March. This fluctuation in rankings, coupled with sales that ranged from 197.0 in January to 246.0 in March, indicates a growing but volatile market presence within the state.

Comparatively, the brand's performance in Oregon is notably stronger than in Michigan, evidenced by both its higher rankings and significantly larger sales volumes. The consistent improvement in rankings within the Oregon market suggests a robust consumer acceptance and a potentially expanding market share. However, the presence in Michigan, while still in the top 30, shows a level of inconsistency that may point to challenges in market penetration or consumer retention. The lack of data for December 2023 in Michigan implies that Third Eye Cannabis was not among the top 30 brands in that state and category during that month, marking January 2024 as a pivotal point for the brand's introduction or re-introduction to the Michigan market. This difference in market dynamics between Oregon and Michigan offers a rich area for further analysis, especially in understanding the factors driving the brand's success in Oregon and the challenges it faces in Michigan.

Competitive Landscape

In the competitive Oregon beverage market, Third Eye Cannabis has shown a notable upward trajectory in its rank and sales, despite not breaking into the top 20 until recently. Starting from a position outside the top 20 in December 2023, it has made a significant leap to 17th place by March 2024. This rise is indicative of a growing consumer interest and market share, with sales increasing consistently over the months. In comparison, competitors like Hush and Dirty Arm Farm have experienced fluctuations in their rankings, with Hush dropping out of the top 20 in January and Dirty Arm Farm falling to 19th by March. Meanwhile, Kottonmouth KMK and Happy Cabbage Farms have shown varied performance but neither has consistently outperformed Third Eye Cannabis in terms of upward mobility in rank. This trend suggests that Third Eye Cannabis is rapidly gaining ground, potentially positioning itself as a strong contender in the Oregon beverage category, challenging established brands through its recent market performance.

Notable Products

In March 2024, Third Eye Cannabis's top-selling product was Cherry Lime Elixir (100mg THC, 16oz) from the Beverage category, maintaining its number one position from January and February with a notable sales figure of 359 units. The second spot was secured by Runtz Muffin (3.5g), a Flower category product, which saw a consistent performance, moving from third to second place over the recent months. Pineapple Chunk2 (3.5g) also from the Flower category, experienced a significant ranking improvement, jumping to the second position in March after not being ranked in February. Blueberry OG (3.5g), another Flower category product, was the third top-performing product in March, despite a slight decline from its previous top position in December. These rankings highlight a strong preference for Flower category products, with a notable exception for the consistently popular Cherry Lime Elixir beverage.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.