Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

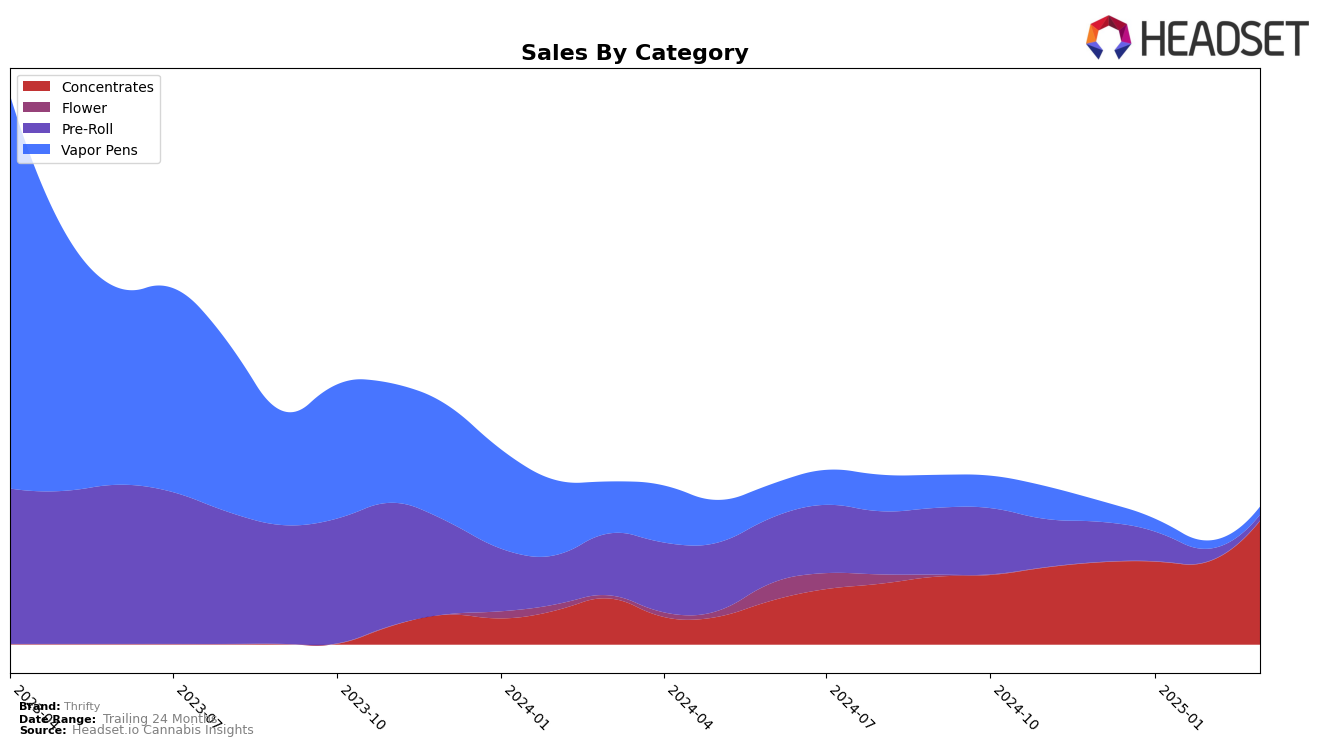

Thrifty has shown varied performance across different categories and regions. In the Alberta market, the brand's presence in the Concentrates category was not within the top 30 by March 2025, indicating potential challenges in maintaining competitive positioning. Conversely, in Ontario, Thrifty has consistently improved its ranking in the Concentrates category, climbing from 17th place in December 2024 to 10th by March 2025. This upward trend suggests a growing consumer preference or effective market strategies in Ontario, as evidenced by a notable increase in sales from January to March.

In British Columbia, Thrifty's performance in the Concentrates category saw a slight fluctuation, with rankings moving from 36th in January to 33rd by March 2025. This indicates a modest recovery but still highlights the competitive nature of the market. The Pre-Roll category in British Columbia, however, did not see Thrifty break into the top 30, suggesting potential areas for growth. Meanwhile, in Saskatchewan, the brand's appearance in the Vapor Pens category was short-lived, as it only ranked in December 2024, hinting at either a market exit or increased competition.

Competitive Landscape

In the Ontario concentrates market, Thrifty has demonstrated a notable upward trajectory in both rank and sales over the past few months. Starting from a rank of 17th in December 2024, Thrifty made a significant leap to 10th place by March 2025. This improvement is indicative of a strategic positioning that has allowed Thrifty to outperform several competitors. For instance, while Dab Bods maintained a relatively stable rank around 11th, Thrifty's ascent suggests a successful capture of market share. Similarly, Tribal, which fluctuated between 12th and 16th place, did not exhibit the same upward momentum as Thrifty. Meanwhile, Tremblant Cannabis and Roilty Concentrates remained consistently ahead in rank, but Thrifty's growth trajectory could pose a future challenge to these established brands. This competitive landscape highlights Thrifty's potential to continue its rise, driven by strategic initiatives that resonate with consumers in the Ontario concentrates category.

Notable Products

In March 2025, Thrifty's top-performing product was Big Steal Live Resin (1g) from the Concentrates category, maintaining its consistent number one rank with a notable sales figure of 7994 units. Stixx - Toasted Marshmallow Pre-Roll 10-Pack (5g) from the Pre-Roll category climbed to the second position, improving from its third-place rank in February. Peach OG Liquid Live Resin Cartridge (1g) saw a slight improvement, moving up to third place from its consistent fifth-place standing in previous months. Stixx - Waffle Cone Pre-Roll (1g) dropped to fourth place after peaking at second in February. Grab Bag Full Spectrum Distillate Cartridge (1g) entered the rankings in fifth place, marking its debut in the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.