Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

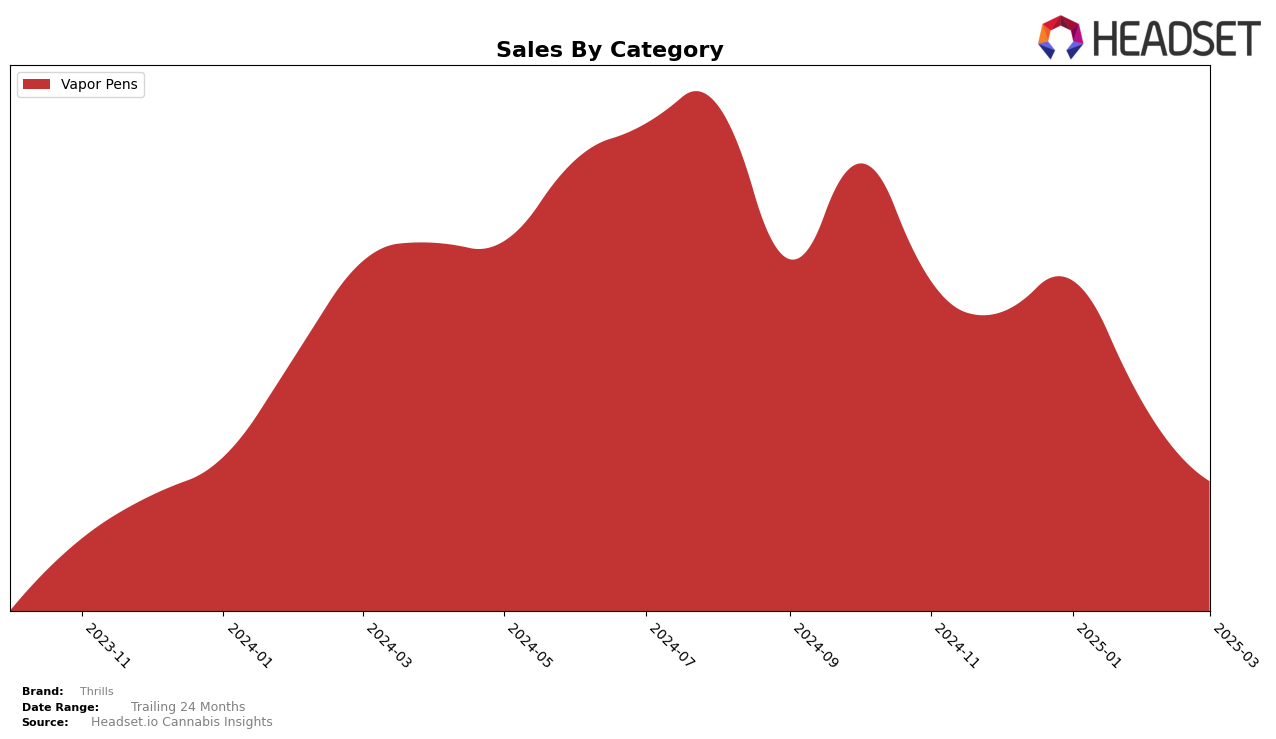

In the state of Washington, Thrills has experienced some fluctuations in the vapor pen category over the first quarter of 2025. Starting at rank 20 in December 2024, the brand saw a slight improvement in January 2025, moving up to rank 18, before dropping back to rank 20 in February. By March 2025, Thrills fell to rank 26, indicating a downward trend in its market position within this category. Despite these rank changes, the brand's sales figures reveal a more nuanced story, with a notable peak in January followed by a decline in the subsequent months.

The absence of Thrills from the top 30 rankings in any other state or category during this period suggests potential challenges in expanding its market presence beyond Washington or within other product categories. This lack of visibility could be a strategic focus for the brand moving forward, as they aim to diversify and strengthen their position across different markets. The performance in Washington, while experiencing some volatility, provides a critical insight into consumer preferences and competitive dynamics in the vapor pen segment, offering a foundation for Thrills to build upon in other regions or product lines.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Thrills experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked 20th in December 2024, Thrills improved to 18th in January 2025 but then saw a decline to 26th by March 2025. This drop in rank coincided with a decrease in sales, suggesting potential challenges in maintaining consumer interest or facing increased competition. Notably, Freddy's Fuego (WA) maintained a relatively stable position, ranking 24th in March 2025, indicating consistent performance despite fluctuations in sales. Meanwhile, Canna Organix and Treehaus Cannabis both improved their rankings significantly by March, suggesting they may be capturing market share from Thrills. The data highlights the dynamic nature of the vapor pen category in Washington, emphasizing the need for Thrills to strategize effectively to regain and sustain its competitive edge.

Notable Products

In March 2025, Blueberry Yum Yum Distillate Cartridge (1g) reclaimed the top spot among Thrills' products, leading the Vapor Pens category with sales of 1472 units. Black Cherry Soda Distillate Cartridge (1g) closely followed in second place, showing a consistent rise from fifth in December 2024 to second in March 2025. Mango Sherbet Distillate Cartridge (1g) maintained a strong presence, ranking third, despite a slight dip compared to earlier months. Durban Poison Distillate Cartridge (1g) saw a decrease in sales, dropping to fourth place from second in January 2025. Zkittles Distillate Cartridge (1g) remained steady at fifth place, indicating stable but lower sales performance compared to its competitors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.