Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

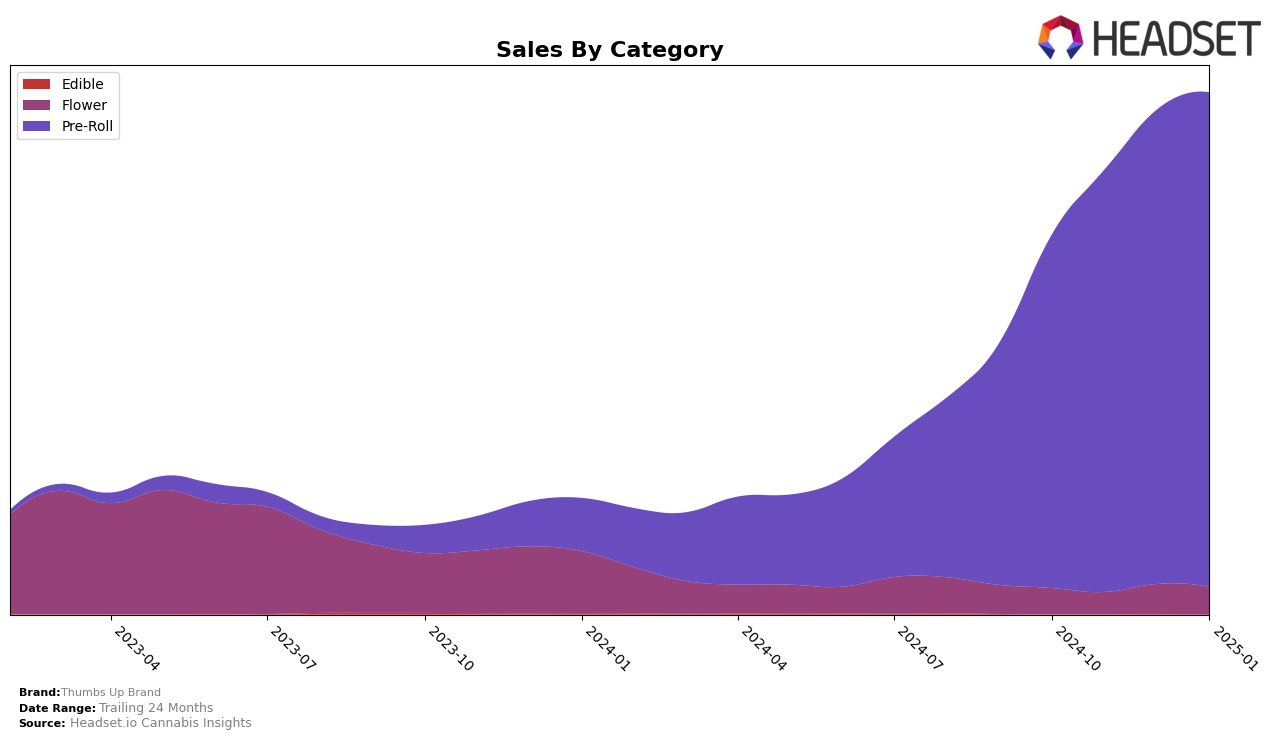

The performance of Thumbs Up Brand in the Pre-Roll category has been particularly notable across several Canadian provinces. In Alberta, the brand has shown a consistent upward trajectory, moving from the 26th position in October 2024 to the 14th position by January 2025. This upward movement is mirrored in British Columbia, where it climbed from 17th to 9th place over the same period, indicating a strong consumer preference and possibly effective marketing strategies. Meanwhile, in Ontario, Thumbs Up Brand has also improved its standing significantly in the Pre-Roll category, reaching the 9th position by January 2025. This consistent performance across multiple provinces suggests a robust presence in the Pre-Roll market, although the brand's absence from the top 30 in the Flower category in most regions indicates room for growth or a potential strategic focus on Pre-Rolls.

In terms of the Flower category, Thumbs Up Brand's performance appears to be less pronounced. While the brand managed to secure the 93rd position in Ontario in October 2024, it did not maintain a top 30 ranking in subsequent months, suggesting challenges in capturing market share or possibly a strategic deprioritization of this category. Similarly, in Alberta, the brand did not appear in the top 30 rankings, highlighting a potential area for development. The sales data from Alberta shows a decline from October to January, which could indicate a need for strategic adjustments. The brand's focus on Pre-Rolls might suggest a deliberate strategy to dominate this category, but the lack of presence in the Flower category across these regions could be seen as a missed opportunity or a calculated risk.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Thumbs Up Brand has shown a notable upward trajectory in terms of rank and sales. Starting from the 16th position in October 2024, Thumbs Up Brand climbed to the 9th position by January 2025, indicating a significant improvement in market presence. This ascent is particularly impressive when compared to competitors like Pure Sunfarms, which maintained a steady rank around the 10th position, and Shred, which experienced a decline from 5th to 7th place over the same period. Despite having lower sales figures than these competitors initially, Thumbs Up Brand's consistent sales growth suggests a strengthening brand appeal. Meanwhile, MTL Cannabis and PIFF have seen relatively stable rankings, with MTL Cannabis dropping slightly from 6th to 8th and PIFF improving from 13th to 11th. This competitive analysis highlights Thumbs Up Brand's strategic advancements in the Ontario Pre-Roll market, positioning it as a rising contender against established brands.

Notable Products

In January 2025, the top-performing product from Thumbs Up Brand was the Indica Pre-Roll 2-Pack (2g), maintaining its position at rank 1 for four consecutive months with sales reaching 125,690 units. Following closely, the Sativa Pre-Roll 2-Pack (2g) retained its second-place ranking, showing consistent popularity. The Indica Pre-Roll 10-Pack (3.5g) held steady at rank 3, indicating stable demand since December 2024. The Sativa Pre-Roll 10-Pack (3.5g) experienced a slight drop in rank from 3 to 4, while the Indica x Sativa Pre-Roll 2-Pack (2g) entered the rankings at 5 in December and maintained this position in January. These rankings suggest a strong preference for smaller pre-roll packs among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.